-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

| 🏦 Min. Deposit | USD 20 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, SCB |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | Capital.com, MT4, TradingView |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices |

Last Updated On Mar 20, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Capital.com

With one of the industry’s lowest-cost trading environments and 3000+ CFDs to trade, Capital.com provides a welcoming environment for beginners and professional traders.

A well-regulated broker, Capital.com offers trading on an extensive range of tradable instruments, including over 120 Forex pairs, over 2700 share CFDs, 20 indices, 19 commodities, and over 100 cryptocurrencies – one of the largest sets in the industry.

Although Capital.com only offers one trading account, its trading costs are significantly lower than average. Spreads start at 0.60 pips on the EUR/USD and no commission. Additionally, no fees are charged for deposits, withdrawals, or inactive accounts.

Platforms supported are TradingView, MT4 and Capital.com’s award-winning proprietary web platform. Customer service is available 24/7 to help with any technical queries. Capital.com’s world-class educational and market analysis section is notable, providing exceptional value for beginner and experienced traders.

| 🏦 Min. Deposit | USD 20 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, SCB |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | Capital.com, MT4, TradingView |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Low minimum deposit

- Excellent education

Cons

- Limited account options

Capital.com’s Overall Rating

Capital.com offers a well-rounded trading experience with its web trading platform, MT4 and TradingView compatibility catering well to new and more experienced traders. Its standout features include a vast selection of tradable assets, with over 120 Forex pairs and 2700+ share CFDs available through a single trading account. This account has competitive spreads starting from 0.60 pips on EUR/USD and no commission. Furthermore, Capital.com’s commitment to education and customer support, available 24/7, significantly benefits traders at all levels. Capital.com ensures the safety of client funds through strict regulatory compliance and negative balance protection.

FxScouts gives Capital.com a high rating of 4.78 out of 5.

Is Capital.com safe?

Yes, Capital.com is a safe broker for Nigerians to trade with. It maintains regulation from the world’s top regulators, including the UK’s FCA, ASIC of Australia and CySEC in Cyprus. Nigerians will be trading with Capital.com’s subsidiary regulated by the SCB of the Bahamas.

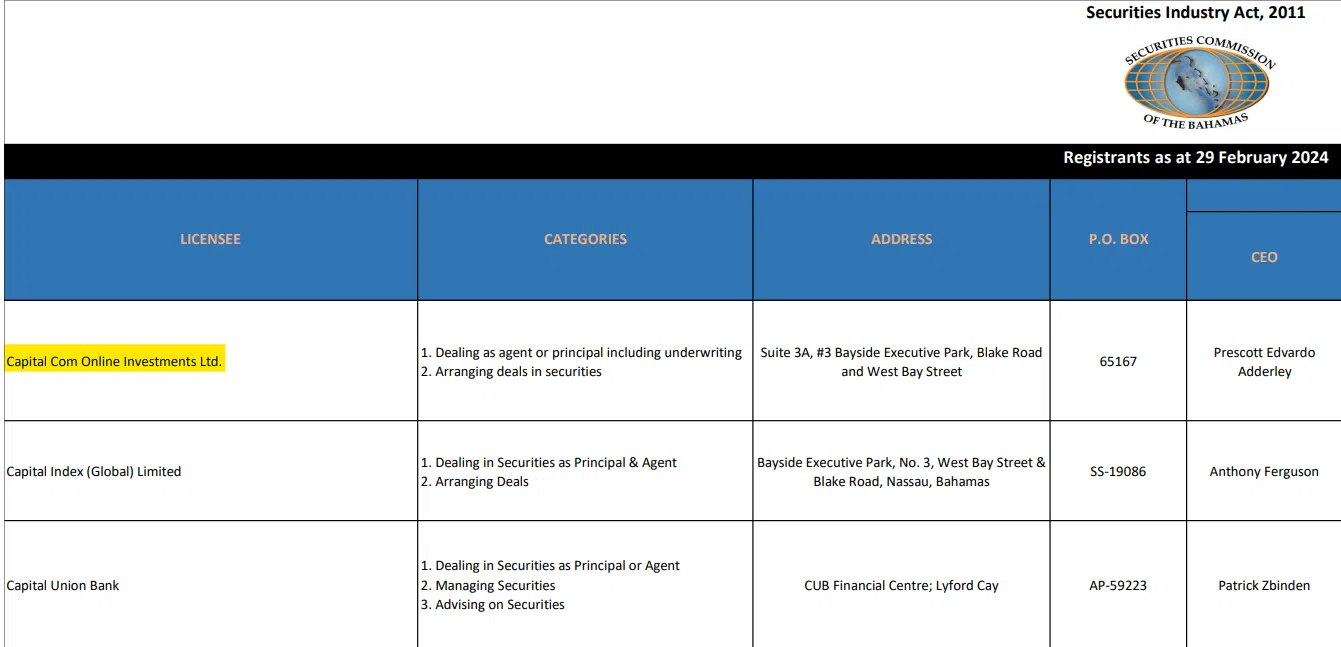

SCB Regulation: Nigerians will be trading under the subsidiary, Capital Com Online Investments Ltd, authorised and regulated by the Securities Commission of the Bahamas (SCB). See below for Capital.com’s SBC licence:

Trader Protections: A well-respected regulator, the SCB ensures that all Capital.com client funds are held in segregated accounts and that Capital.com offers its traders negative balance protection, ensuring that clients cannot lose more than is in their trading account. Additionally, under SCB regulation, leverage is capped at 200:1 on major currency pairs.

Trading Instruments

Capital.com’s range of tradeable assets is wider than most other brokers, with large numbers of share CFDs, Forex pairs, and cryptocurrencies rarely seen at other brokers.

Alongside Forex pairs, Capital.com offers cryptocurrencies, stocks, commodities, indices, and currency indices:

- Forex: Capital.com has 125 currency pairs available for trading, a much broader range than most other brokers. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/JPY, GBP/JPY, and USD/ZAR), and exotics.

- Share CFDs: Capital.com offers over 2700 share CFDs, more than most other large international brokers. The selection available includes some of the major US, UK, and European Exchanges.

- Indices: Capital.com offers 20 indices for trading, which is around the average available at similar brokers. The most popular indices combine the shares of some of the largest and most globally acknowledged companies.

- Commodities: Capital.com offers trading on 19 commodities, a broader range than is typically seen at other brokers. Most brokers offer between 5 and 10 commodities. Commodities include metals such as gold and silver, energies such as oil and natural gas, and softs such as sugar, cocoa, and cotton.

- Cryptocurrencies: With over 110 crypto pairs available for trading, Capital.com has one of the largest ranges of cryptocurrencies in the industry. The spreads vary significantly compared to other traditional Fiat currencies.

Overall, Capital.com offers a wide range of financial instruments, including shares, Forex pairs, and cryptocurrencies, that are not usually available at other brokers.

Accounts and Trading Fees

Capital.com offers only one account type, whereas most CFD brokers will provide at least two or three. However, its account is suited to both beginners and more experienced traders, and its trading fees are lower than those of similar brokers.

Tight Spreads: Capital.com offers one live commission-free account with competitive trading costs starting at 0.6 pips on the EUR/USD. Capital.com’s account has a low minimum deposit requirement of 20 USD, putting it within the reach of beginner traders.

Capital.com also allows hedging and scalping, but it does not have a copy trading option. Note that Capital.com does not offer Islamic Swap-free accounts.

Demo Account: Capital.com offers a free unlimited demo account where clients can test out trading strategies with virtual funds. The customer support team is available 24/7 to help with any account setup or technical difficulties.

Overall, although Capital.com only offers a single live account, its trading costs, low deposit requirements, and wide range of assets make it appealing to both beginners and experienced traders alike.

Deposits and Withdrawals

Capital.com offers an average range of deposit and withdrawal methods, and no extra fees are charged.

As a well-regulated broker, Capital.com ensures that all Anti-Money Laundering rules and regulations are followed. As such, all withdrawals are returned to the deposit source. Capital.com offers commission-free deposit and withdrawal options that can be performed on the broker’s trading platform.

Trading Account Currencies: Trading accounts can be denominated in six base currencies – EUR, USD, GBP, CHF, AED or MXN, which is average compared to other brokers. Be aware that if you make your deposit in another currency not listed here, it may be subject to currency conversion fees.

Minimum Deposit: The minimum deposit is 20 EUR, 20 USD, 20 GBP, 20 CHF, 80 AED or 400 MXN for all payment methods, except a wire transfer, which has a minimum of 250 EUR (or the equivalent in the currency of your trading account).

Deposit and Withdrawal Methods: The deposit and withdrawal methods offered include Debit cards, Credit cards, Bank Wire transfer and Applepay. Withdrawal requests are processed within 24 hours but can take between five business days for funds to reach client accounts. Wire transfers may take longer.

See below for details:

Trading Platforms

With its own intuitive web-based platform, MT4 and TradingView, Capital.com’s trading platform support is better than most other brokers.

Capital.com Web Platform

Capital.com has its own self-developed trading platform, available on web browser. The platform is easy to use, intuitive and simple to set up, which is great for beginner traders.

The bespoke platform offers an in-depth financial analysis with over 75 technical indicators, multiple trading chart types, and extensive drawing tools. It also enables users to effortlessly toggle in and out of up to six tabs while keeping an eye on all charts and instruments in the trading arsenal. One is also able to set up multiple watch lists to track selected markets. It also provides traders with smart risk management tools allowing traders to control their risk with various stop loss and take profit tools. One drawback of the platform is that it lacks support for automated trading solutions and third-party strategies.

Metatrader 4

Developed by MetaQuotes in 2002, MT4 is still one of the most popular CFD trading platform in the world. Although the platform’s interface is now dated, MT4 is still widely recognised for its fast execution speeds, wide range of charting tools, algorithmic trading, and customisability. Other features of MT4 include:

- Supports the creation, modification, and utilisation of automated trading strategies.

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

- Allows traders to develop their own custom indicators.

- Additional Smart Trader Tools, including 30 popular technical indicators and 24 analytical objects.

Trading View

Capital.com recently added TradingView to its arsenal of trading platforms. TradingView Basic is free of charge for traders who open a live account at Capital.com but be aware that Premium versions of TradingView have a monthly subscription cost.

TradingView is not only a trading platform with detailed information to help you make trading decisions: it also includes one of the biggest social trading communities, with plenty of EAs (Expert Advisors) that beginner traders, or those too busy to trade manually, will appreciate.

TradingView advantages include:

- Unmatched charting capabilities, suitable for beginners and advanced traders

- Large social trading community of more than 50 million users

- The ability to design your own indicators and strategies using TradingView’s Pine Script

programming language. - The option to validate trading ideas using TradingView’s bar-by-bar replay function.

- Wide selection of fundamental data

- Real-time global news coverage

The benefit of Capital.com offering third-party platforms such as MT4 and TradingView is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, thousands of plugins and tools are available for MT4 and TradingView.

Overall, Capital.com’s platform support is average compared to other similar brokerages, and it offers its own proprietary trading platform which is easier to use and set up than MT4.

Mobile Trading

Capital.com’s trading app is well-designed and intuitive, MT4 and TradingView are also available as mobile apps.

Capital.com’s trading platform is available on Android and iOS mobile devices and tablets. As with the web trading platform, traders can choose from multiple languages. Although the platform’s functionality is slightly limited compared to the desktop version, with reduced timeframes and fewer charting options, traders will still have access to analytics with technical indicators, graphical objects, and a full set of trading orders.

MT4 and TradingView Mobile Trading

Capital.com offers support for the MT4 and TradingView mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Opening an Account at Capital.com

The account opening experience at Capital.com is excellent: it is intuitive, quick, and easy, and accounts are generally approved within one business day.

Nigerian traders can open an account at Capital.com as long as they meet the minimum deposit requirement of 20 USD.

Traders can open a corporate account (in which case, clients need to contact customer support), or an individual account, which will be the focus of this review:

- Click “Sign Up” at the top right-hand corner of the website.

- Traders will be directed to fill in their details, including name, country of residence, employment status, and financial status, etc.

- The next step is to choose your preferred base currency (click here for more on Capital.com’s trading account currencies).

- Capital.com requires at least two documents to accept you as an individual client:

- Proof of Identification — Capital.com accepts all government-issued identification documents, such as Passports, national ID cards, driving licenses, and other government-issued IDs.

- Proof of Address — A proof of residence/address document must have been issued in the name of the Capital.com account holder within the last 6 months and must contain the trader’s full name, current residential address, issue date, and issuing authority.

After the application is approved, traders can log in and fund their accounts. we suggest you read Capital.com’s risk disclosure, customer agreement, and terms of business before you start trading.

Overall, Capital.com’s account-opening process is fully digital, intuitive, and hassle-free.

Trading Tools

Capital.com’s trading tools are severely limited compared to other similar brokers.

Capital.com offers access to its platform via API and support for TradingView in addition to a few risk management tools on its web platform, but otherwise, few trading tools are available.

Overall, Capital.com offers fewer trading tools than most other brokers.

Educational Material

Capital.com provides an extensive, well-organized selection of educational and market analysis materials, far exceeding that of other brokers. Notable is Capital.com TV, which stages numerous high-quality videos that covers a range of trading-related content. It also provides trading ideas related to current events.

Capital.com’s educational materials comprise the following:

- Demo account

- General educational videos

- Webinars

- Quality educational articles

- Glossary

- Learning courses (on different topics, ending with a quiz)

Capital.com’s excellent written educational materials help traders develop skills to improve trading performance. Seven guides have been compiled and cover topics ranging from basic trading strategies to financial markets and instruments. Capital.com also provides five video courses, providing an in-depth introduction to the most fundamental trading elements, and allows traders to explore various trading approaches.

Capital.com regularly hosts free webinars, which are available to subscribers of the broker’s official YouTube channel.

Market Analysis Materials

Like its educational materials, the market analysis available at Capital.com surpasses that of most other brokers.

The Financial News and Features section is filled with well-presented, up-to-date analytics and fundamental analyses. The overall quality of the content, the comprehensive analysis, and the research’s educational value far exceed its competitors. This research material correlates with videos presented on the Capital.com TV platform. An Economic Calendar is also available.

Customer Support

Available 24/7, Capital.com’s customer support is excellent compared to other brokers

Capital.com offers customer support 24/7 via phone, Facebook Messenger, Viber, WhatsApp, Telegram, online Live Chat, and email in English, Russian, German, Spanish, Arabic, French, Italian and Turkish.

For the purposes of this review, we found customer support responsive, polite, and very helpful. They answered most of our questions to our satisfaction.

Regulation and Industry Recognition

Founded in 2016 and headquartered in Cyprus, Capital.com is authorised and regulated by the UK’s Financial Conduct Authority (FCA), the Cyprus Security and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Securities Commission of the Bahamas (SCB). See the following list of Capital.com registered companies:

- Capital Com Online Investments Ltd is a Company registered in the Commonwealth of The Bahamas and authorised by the Securities Commission of the Bahamas with license number SIA-F245.

- Capital Com (UK) Limited is registered in England and Wales with company registration number 10506220 and authorised and regulated by the Financial Conduct Authority (FCA), under register number 793714.

- Capital Com SV Investments Limited is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 319/17. Capital Com SV Investments Limited, Company Registration Number: 354252, registered address: 28 Octovriou 237, Lophitis Business Center II, 6th floor, 3035, Limassol, Cyprus.

- Capital Com Australia Limited (ABN 47 625 601 489) is a company registered in Australia and regulated by the Australian Securities and Investments Commission (ASIC) under AFSL 513393.

Capital.com has won many awards over the last few years, further burnishing its credentials as a safe broker. Recent awards include:

- 2023 Best Trading App (Good Money Guide)

- 2023 Best CFD Provider (Online Money Awards)

- 2022 Overall Client Satisfaction (Investment Trends)

- 2022 Best Spread Betting Platform (ADVFN)

- 2021 Education Materials/Programmes (Investment Trends)

- 2021 Mobile App/Platform (Investment Trends)

Overall, because of its history of responsible behaviour, strong international regulation, and wide industry acclaim, we consider Capital.com a safe broker for Nigerians to trade with.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process, which includes a detailed breakdown of how we review Capital.com’s product offering. Central to that process is the evaluation of the broker’s reliability, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Capital.com’s Risk Warning

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Capital.com would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Transactions with non-deliverable over-the-counter instruments are a risky activity and can bring not only profit but also losses. The size of the potential loss is limited to the size of the deposit. Past profits do not guarantee future profits. Use the training services of our company to understand the risks before you start operations.

Overview

A CFD market maker, Capital.com is a trustworthy and well-regulated broker. It offers competitive, variable spreads on a wide range of assets and charges no commissions, inactivity, withdrawal, or deposit fees.

Capital.com’s extensive, well-organized selection of education and research materials makes it an excellent choice for beginner traders. Its proprietary platform is user-friendly and boasts a wide range of functionality. Overall Capital.com is an exceptional choice for traders looking for a low-cost trading environment on a large number of tradable assets.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Capital.com stacks up against other brokers.