-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Last Updated On Jul 9, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Octa

Octa is a good low-cost broker, but it has a few drawbacks. On the one hand, it has very low trading costs, charges no fees for deposits and withdrawals, and offers a great copy trading service — though this is not available on iOS mobile devices.

On the other hand, Octa onboard Nigerian traders through its Comoros Union-based entity, which has few regulatory protections. The range of instruments available to trade is also slightly limited compared to other brokers, with 52 Forex pairs, 5 commodities, 10 indices and 150 equities.

Looking past these issues, you will find an excellent low-cost broker: Octa offers three swap-free accounts with minimum deposits of 20 USD, a slick mobile app, and a good range of trading tools. It also heavily promotes its wide range of bonuses and can offer leverage of 1:1000 on Forex pairs.

| 🏦 Min. Deposit | USD 20 |

| 🛡️ Regulated By | CySEC, FSCA, MISA |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, OctaTrader |

| 💱 Instruments | Commodities, Forex, Indices, Metals, Stock CFDs |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Fast and free withdrawals

- Low minimum deposit

- Tight spreads

Cons

- Limited range of assets

- Poorly regulated

Is Octa Safe?

Octa is regulated by CySEC in the EU, which provides strict regulatory oversight, but Nigerian traders are onboarded through its entity based in the Comoros.

Regulation: Octa has a good reputation but is only regulated by a single tier-2 regulator: CySEC in Europe. However, Nigerian residents will be trading under the subsidiary, Octa Markets Ltd, which is registered in the Comoros Union, a comparatively weak regulator.

Still, Octa does have a good reputation, and its European operations are overseen by one of the better regulators in Cyprus.

Safety Features: Octa segregates all funds from the company’s operating capital and offers negative balance protection to all its clients. Comoros registration also means that Octa can offer higher leverage and bonuses to Nigerian traders.

Company Details:

![]()

![]()

Octa’s Trading Instruments

Octa offers most asset classes except cryptocurrencies, but the range of instruments in each class is slightly below the industry average.

High Leverage: Leverage is up to 1000:1 for Forex trading and is generally much higher than other brokers across all asset classes.

Full list of Instruments:

![]()

![]()

- Forex: Octa only has 52 currency pairs, fewer than some other brokers, but the leverage on Forex pairs is up to 1000:1.

- Indices: There are 10 indices available for trading at Octa. Leverage is up to 400:1 on indices.

- Commodities: Octa offers trading on 5 commodities: Gold, Silver, Natural Gas, Brent Crude, and WTI crude. Leverage is up to 400:1 on commodities.

- Equities: Octa offers trading on 150 equities at 40:1 leverage, a smaller range than other large international brokers.

Note that traders can only trade on 74 of Octa’s 230 instruments on the MT4 Account, but the full range of instruments is available on the MT5 Account.

Overall, Octa has fewer instruments for trading than most other brokers but offers all the major asset classes.

Accounts and Trading Fees

Octa has three trading accounts with very low costs, but we found the rules on leverage restrictive. Each account is linked to a different trading platform, and the number of instruments available on each account differs, too.

Trading Fees: All three of Octa’s accounts require a minimum deposit of only 20 USD, and each account is associated with a different trading platform (MT4, MT5, or OctaTrader). Trading fees are the same on all three accounts.

Account Trading Costs:

![]()

![]()

Trading costs at other brokers tend to be 9 USD per lot of EUR/USD, making Octa one of the lowest-cost brokers in the industry. We were also pleased to find that all accounts are swap-free.

MT4 Account: The MT4 Account requires a minimum deposit of 20 USD, and no commission is charged on trades. Spreads start at 0.6 pips (EUR/USD) and average at 0.7 pips, tighter than other similar brokers. Leverage is up to 1000:1 for Forex trading, and the margin call/stop out is 25%/15%. Energies, Forex and indices are available to trade, but not equities.

MT5 Account: The minimum deposit is also 20 USD on the MT5 Account. Spreads start at 0.6 pips and average at 0.7 pips on the EUR/USD, and no commissions are charged. The MT5 trading platform has some extra features, including depth of market, an integrated economic calendar, and full-size tick charts. Traders can access Octa’s full range of financial instruments on this account.

OctaTrader: The OctaTrader Account, available on OctaFx’s in-house trading platform, also requires a 20 USD minimum deposit. Its trading conditions almost exactly mirror those of the MT4 Account, but traders can trade on an extra 6 indices.

Deposits and Withdrawals

We were impressed to find that Octa offers a good range of funding methods, and deposits and withdrawals are free and fast.

Like most brokers, Octa does not allow funding to or from third parties. All withdrawal requests from a trading account must go to a funding source in the trader’s name.

Accepted Deposit Currencies: Nigerians will be disappointed that Octa only allows trading accounts to be denominated in EUR and USD. Always check the exchange rate when converting from NGN to other currencies, as hidden conversion fees can make trading expensive and affect profitability.

Funding Methods: Octa does not charge any deposit or withdrawal fees. See below for a list of methods:

- Local Bank Transfer: Traders can transfer funds via an ATM, at the bank, or via a mobile or desktop application.

- Neteller: The minimum deposit is 50 USD, and the minimum withdrawal is 5 USD. Deposits are processed instantly, and withdrawals are processed in 1 – 3 hours.

- Skrill: The minimum deposit is 50 USD, and the minimum withdrawal is 5 USD. Deposits are processed instantly, and withdrawals are processed within 1 – 3 hours.

- Bitcoin: Check Octa’s site for minimum deposits and withdrawals, as this is subject to change. Deposits are processed within 30 minutes, and withdrawals are processed within 1 – 3 hours.

- Other Cryptocurrency (ETH, LTC, DOGE, USDT): Check Octa’s site for minimum deposits and withdrawals, as this is subject to change. Deposits are processed within 30 mins, and withdrawals in 1 – 3 hours.

Octa Bonus

Octa runs several promotional schemes for Nigerian clients – some of which you don’t even have to spend any money to benefit from:

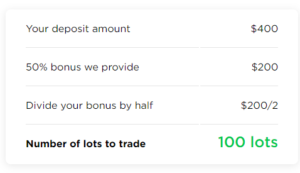

50% Deposit Bonus

Octa offers a deposit bonus scheme (up to 50% of your deposit) though withdrawing the bonus is conditional on trading activity, using the following formula:

Demo Contests

Octa runs demo account contests on the MT4 platform. The demo contest runs for four weeks, and the participant with the largest demo account balance at the end of the period will win 500 USD, with smaller prizes for the rest of the top five.

Trade & Win: Get Gadgets for Trading

The Trade & Win promotion gives traders free prizes and gadgets based on their trading volume. For instance, if you have traded 150 lots with Octa you would be eligible for an Android smartwatch. Other prizes include phones and even laptops.

Octa’s bonuses and contests are always changing so please refer to the website for new promotions.

Octa’s Mobile Trading Apps

Octa has its own easy-to-use trading app and supports both the MT4 and MT5 apps.

OctaTrader App

OctaTrader is a well-designed trading app with a slick and easy-to-use layout available on Android and iOS.

Easy to use: After downloading the app, we found it easy to open new real and demo accounts, manage our leverage, deposit and withdraw funds, and trade on the charts.

Trader Tools: The newly added Space tool is a customisable trading feed you can adjust to your trading style and interests. Space offers real-time market insight, pattern analysis and technical and fundamental analysis. Other useful tools include a feed of market news and trading ideas from reliable news sources, and a profit calculator. It also features a market monitor so we could keep tabs on our favourite trading instruments. None of these tools are ground-breaking, but they all worked as expected, and the profit calculator took into account the different swap rates on MT4 or MT5.

Customer Support: Support was available 24/5 from inside the app. We found the customer support team helpful and responsive.

The app also lets you manage any bonuses or contest accounts you have open with Octa. Overall, we liked how user-friendly the app is; its simple design will appeal to beginner traders.

MT4 and MT5 Mobile Trading

The MT4 and MT5 trading platforms are available on both Android and iOS mobile devices and tablets. There is some loss in functionality when compared to the desktop versions of these trading platforms, including reduced timeframes and fewer charting options.

Octa’s mobile trading support is good compared to other brokers, with the MT4 and MT5 mobile versions available, in addition to the Octa trading app. However, Octa’s trading app is only available on Android devices.

Other Trading Platforms

Octa recently discontinued its support for cTrader, one of our favourite trading platforms. But with MT4, MT5, and OctaTrader, Octa still has good platform options. Octa also has one of the best copy-trading platforms in the industry.

OctaTrader

After two years in development, Octa has launched its trading platform, OctaTrader, available in a web browser. With an intuitive layout and all the features you would expect from a modern trading platform, OctaTrader is particularly good for beginners. OctaTrader supports one-click trading, advanced order types, most of the popular indicators featured in the MetaTrader platforms, a multi-lingual user interface and nine timeframes. Customer support is available 24/7 in English from within the platform. OctaTrader also seamlessly integrates with the Octa Trading app for Android and iOS devices.

MT4 and MT5

The main benefit of using third-party platforms such as MT4 and MT5 is that traders can keep their own customised versions of the platforms should they choose to migrate to another broker. Both MT4 and MT5 are available for Windows, Android, iOS, and web browser.

Overall, Octa’s platform support is about average when compared to other brokers. Additionally, MT4 and MT5 are generally more difficult to set up and are less user-friendly than the web-based platforms available at some other brokers.

Octa Copy-trading

Octa also offers a copy trading platform free for all accounts, allowing beginners to copy the trades of more experienced, successful traders for a small fee per traded lot. Beginners simply find the Strategy Providers they want to follow and click “Copy.” Their positions will be copied automatically. The copy trading service is also user-friendly and well-designed. This function is also available through the mobile app.

The only downside to the copy-trading app is that it is only currently available on Android devices.

Platform Overview

Opening an Account at Octa

The account opening process at Octa is hassle-free and fully digital, and accounts are ready for trading immediately. Account verification is only required for withdrawals.

All Nigerian residents are eligible to open an account at Octa if they meet the minimum deposit requirements stipulated by their chosen deposit method.

Creating an account is straightforward, the process is fully digital, and accounts are available for trading immediately:

New traders must click on the “Open Account” button at the top of the page, where they will be directed to register an account.

- Octa’s intake form requires clients to register an account with an email address and a password.

- Next, new traders are directed to fill in their personal details (including name, country of residence, email address, and birth date).

- Traders then must select their preferred account type (MT4 or MT5), live or demo account, level of leverage, and account base currency.

- Once this step is complete, traders can make their first deposit via several payment channels and can start trading.

- Traders are only required to submit any verification documents to Octa when they want to withdraw funds. These include:

- Proof of Identification – Octa accepts all government-issued identification documents such as passports, national ID cards, driving licenses, or other government-issued IDs.

- Proof of Address – Proof of residence/address document must be issued in the name of the Octa’s account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

- We advise that you read Octa’s risk disclosure, customer agreement, and terms of business before you start trading.

Octa’s account-opening process is fully digital and hassle-free, and accounts are available for trading immediately.

Trading Tools

Octa has a greater range of useful trading tools than other similar brokers.

Alongside industry standards such as an Economic Calendar, Profit, and Trading Calculators, Octa also offers an Account Monitoring tool and Autochartist.

- Account Monitoring Tool: The Account Monitoring tool allows traders to monitor any other Octa trader’s account and sort by Balance, Gain, Trades, and Account Type. This tool also allows you to dig into the history of an account so you can learn how the account holder has managed their success. Accounts are only represented by numbers, so all holders remain anonymous.

- Autochartist: Octa also supports Autochartist, the industry-standard trading signals provider. Autochartist provides traders with automated alerts for opening and closing trades, a volatility analysis tool that allows you to better optimise take-profit and stop-loss levels, and integrated market reports. Autochartist is available on both MT4 and MT5 and requires a minimum balance of 500 USD in your Octa account.

Trading Tools Comparison:

![]()

![]()

Overall, Octa offers a good range of trading tools, including Autochartist, one of the best technical analysis tools in the industry.

Octa For Beginners

The educational material at Octa and its alternative website is good but focused on new traders; for more experienced traders, there is little in the way of educational support. Customer support is competitive but where Octa really shines is in the research and market analysis available.

Educational Material

The educational material at Octa and its alternative website is good but focused on new traders; for more experienced traders, there is little in the way of educational support. Customer support is competitive, but where Octa really shines is in the research and market analysis available.

Educational Material

The educational materials available at Octa are more comprehensive and in-depth than at other brokers, but it is more geared toward beginners than experienced traders.

YouTube: Octa offers numerous free resources to help you learn trading. Octa is very active on YouTube, with regular live trading sessions and webinars. In addition, a workshop for novice traders is held every Saturday in different languages, including Hindi and English. You can also watch the recordings of past webinars, as they are saved on YouTube and are always available.

Videos and Articles: The Octa website has an extensive education section with videos and articles for beginner and intermediate traders. The education section is anchored by a collection of articles collectively called Forex Basics. Article topics range from explainers on ECN trading and Risk Management to Technical Analysis and Trading Strategies and more advanced concepts such as Pair Correlations and Fibonacci Retracements. These articles are detailed and well-written and offer valuable advice for new and intermediate traders.

Tutorials: There is a short Tutorial section covering the MetaTrader platforms, CopyTrading, Autochartist, and CFDs, and a Video Tutorial section focused on getting started with MetaTrader. Finally, there is a FAQ section and a useful glossary of Forex trading terms. The education section also links the Manuals for the different platforms Octa supports.

Octa also offers a free Telegram channel with strategies, trading ideas and other exclusive materials from experts.

Finally, Octa offers Space where trading experts and analysts share daily market analytics and trading strategies to help you achieve your investment goals.

Overall, Octa’s educational materials are some of the best in the industry, but it could include more suitable content for advanced traders.

![]()

![]()

Analysis Material

Like its education section, the market analysis materials available at Octa are better than most other brokers.

Market Insights: Octa has an excellent Market Insights section which is updated frequently. Regular posts include a Daily Forecast, a Daily Review, and Weekly Review. These posts frequently offer predictions of future market movements – but be cautious and do your own research before acting on any predictions.

Octa YouTube Channel: The Market Insights section also has a daily video series, uploaded to the Octa YouTube channel, called Market in a Minute, which covers all the big news from the Forex markets for the preceding trading day. In addition to all these regular updates, there are irregular short pieces published in reaction to trading events with detailed technical insight.

Forex News: Octa also hosts a Forex News section, with short briefings on all the major news stories affecting the Forex markets. This section is updated over the weekend, and the articles are well-written and concise. These briefings are offered without suggesting how the events will affect the markets.

Octa Telegram Channel: Octa has a special analytics channel called Octa analytics that is aimed at helping traders stay on top of important market events and market trends. Users can check the most likely trading scenarios and discuss them within the community. Octa also posts messages dedicated to market insights and service updates.

Customer Support

Octa customer support is open 24/7 via live chat and 24/5 via phone, email, WhatsApp, and Telegram.

Additionally, the Finance Department is open from 06:00 – 22:00 (EET), and the customer verification department is open from 08:00 – 17:00 (EET) for account setup and troubleshooting queries.

We found the support team very responsive but uninformed.

Regulation and Industry Recognition

Regulation: Octa is regulated by the Cyprus Securities and Exchange Commission (CySEC) and registered with the Mwali International Services Authority, Comoros Union:

- Octa Markets Cyprus Ltd is an investment firm registered in Cyprus and regulated by the CySEC since 2018 (license 372/18). This enables users to trade with a broker under European regulatory oversight with enhanced levels of safeguards.

- Orinoco Capital (Pty) Ltd. holds a Financial Service Provider (FSP) licence number 51913 from the Financial Sector Conduct Authority (FSCA) in South Africa

- Octa Markets Incorporated, is a company registered in Saint Lucia with the registration number 2023-00092.

- Octa Markets Ltd., registration number: HY00623410, international brokerage and clearinghouse license number: T2023320, is authorised by the Mwali International Services Authority, Comoros Union.

The FCA (the UK’s Financial Conduct Authority) briefly regulated the company from 2015 to 2017 (ref: 679306), but Octa decided not to renew its licence after the Brexit referendum and instead kept its focus on the EU market.

Industry Recognition: Octa has received much industry recognition in recent years, winning Best Forex Broker 2023 (allforexrating.com), Most Transparent Broker 2023 (fxdailyinfo.com), Best Client Funds Security Indonesia 2023 (World Business Stars Magazine), Best Educational Broker 2023 (Global Forex Awards), Most Reliable Broker Asia 2023 (Global Forex Awards), and Best Forex Broker South Africa 2023 (Global Banking and Finance Review).

FxScouts has also given Octa the award for Best Forex Copy Trading Platform 2021 for its innovative approach to copy trading.

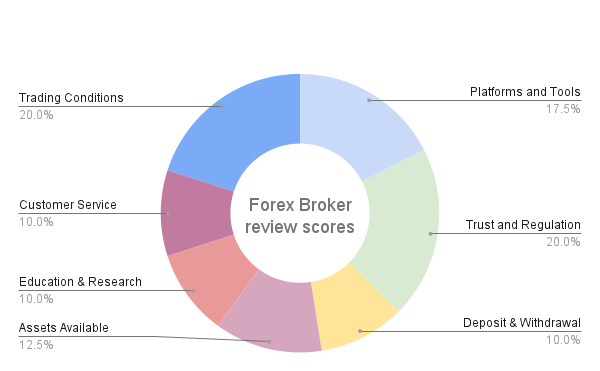

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker, the platform offering of the broker, and the trading conditions offered to clients, summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Octa Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Octa would like you to know that: Forex margin trading involves substantial risks. Forex margin trading exposes participants to risks including, but not limited to, changes in political conditions, economic factors, acts of nature and other factors, all of which may substantially affect the price or availability of one or more foreign currencies.

Overview

Octa is good or excellent across the most important areas. Octa’s trading costs are some of the lowest in the industry, and it has no swap fees. Its intuitive yet sophisticated copy-trading platform was the recipient of our Best Copy Trading Award for 2021. It has an excellent analytical section, a well-designed education section for beginners, world-class trading tools, and a range of exciting bonus options for Nigerian traders. Additionally, its customer support is available 24/7, which is exceptional in an industry where the norm is 24/5.

However, although Octa is a decent all-around broker, traders may be put off by the lack of decent regulation, which for many traders will mean an immediate end to their interest. Additionally, Octa has a limited range of financial instruments, although, in October 2022, it added a range of equities to its offering.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Octa stacks up against other brokers.