-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Last Updated On May 10, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on AvaTrade

AvaTrade is an internationally regulated beginner-friendly CFD broker offering trading on Forex, cryptocurrencies, commodities, indices, stocks, bonds, vanilla options, and ETFs. AvaTrade has received extensive industry recognition for AvatradeGO, one of the most popular mobile trading applications available globally and, unlike many European brokers, has a local Nigerian customer support team.

AvaTrade’s single commission-free account has a minimum deposit requirement of 100 USD and has average trading costs for a market maker broker, with spreads starting at 0.90 pips on the EUR/USD. In terms of trading platforms, AvaTrade offers a wider choice than most brokers, with support MT4, MT5, AvaOptions, and its proprietary web trader platform. The same is true for the trading tools available, with Avatrade offering Trading Central, Duplitrade, and AvaProtect, its own innovative risk management system. Furthermore, Avatrade does not charge any deposit or withdrawal fees and provides an excellent selection of educational materials to get new traders started.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | ASIC, CySEC, CBI, FRSA |

| 💵 Trading Cost | USD 9 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, Avatrade Social, AvaOptions |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices, Vanilla Options |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Top-tier regulation and security with licenses from ASIC and CBI among others

- Accessible trading with a low minimum deposit of 100 USD

- Award-winning mobile trading with the AvaTradeGO app with social trading features

- Wide range of assets including unique instruments like vanilla options

- Educational material to support trader development and strategy enhancement

Cons

- Market analysis could be more extensive

- Poor regulatory oversight outside of the UK and EU

- Avatrade is a Market Maker and operate a dealing desk which might not align with all trading preferences

Is AvaTrade Safe?

Although Avatrade holds licences from a large number of top regulators, Nigerian traders are onboarded through Avatrade’s British Virgin Islands (BVI) entity. This means that Nigerians have little recourse in the case of a dispute with Avatrade.

BVI Regulation: Although the BVI is not usually considered a strict regulator, it ensures that Avatrade segregates its client funds from its operational funds. It also means that Avatrade can offer its Nigerian clients higher leverage (up to 400:1).

Safety Features: Although the lack of oversight may be off-putting for some Nigerian traders, we still consider Avatrade a safe broker to trade with. Firstly, Avatrade holds licences from many top-tier regulators from around the world, ensuring that it treats its clients fairly. Secondly, it provides all clients with negative balance protection, which means that traders cannot lose more than their initial deposit. Finally, it has received a wealth of industry recognition, supporting its credentials as a safe broker.

We confirmed each of the licences and regulations on the regulator’s online register.

Avatrade’s Trading Instruments

While Avatrade’s range of tradable assets is around the industry average, it also offers specialty instruments such as vanilla options which are rarely found at other brokers.

Specialty Instruments: Avatrade offers several asset classes that aren’t found at other brokers. These include 53 vanilla options, traded exclusively on Avatrade’s AvaOptions platform, two bonds, 59 ETFs, and 20 cryptocurrencies, providing traders with excellent asset diversification.

- Forex: Avatrade’s range of currency pairs is around the industry average and includes majors, minors, and exotics.

- Share CFDs: Avatrade’s range of share CFDs is average compared to other large international brokers and includes popular US tech companies and multinational energy companies.

- Commodities: Avatrade’s range of commodities is excellent, as most brokers offer trading on between 5 – 10 commodities. Avatrade offers 25.

- Indices: Avatrade offers trading on a large number of indices, and unlike many other brokers, trading is available on the VIX index with maximum leverage at 400:1.

- Cryptocurrencies: Avatrade offers a similar range of cryptocurrencies as other brokers, but its leverage is higher.

- Bonds: Avatrade offers trading on two bonds, the EURO-BUND and the JAPAN GOVT BOND. This is around the industry average for bond trading.

- ETFs: Exchange Traded Funds have rapidly gained in popularity in recent years, and Avatrade’s range of ETFs is wide compared to similar brokers.

- Vanilla Options: Traders can trade on currency pairs and gold and silver on the AvaOptions platform. Vanilla options are seldom offered at other brokers, so Avatrade shines on this front.

Overall, Avatrade has a similar number of assets compared to other brokers, but it stands out for its specialty instruments, including vanilla options, ETFs, bonds, and cryptocurrencies.

Accounts and Trading Fees

Avatrade offers one commission-free trading account, and both its initial and ongoing costs are around the industry average.

Trading Fees: Avatrade’s account requires a minimum deposit of 100 USD, making it accessible to most traders. No commissions are charged for Forex trading, and traders will find spreads of 0.9 pips (EUR/USD), which is around the industry average.

We opened and tested Avatrade’s Standard account.

Standard Account: In order to open an account, traders will have to make a minimum deposit of 100 USD. The account is available on MT4, MT5, and Avatrade’s proprietary platform. We were pleased to see that spreads on the platform are 0.9 pips on the EUR/USD, as advertised on Avatrade’s website, and there are no commissions for Forex trading:

Nigerian clients who deposit 2,000 USD or more will gain free access to Duplitrade, a popular third-party copy trading platform.

Deposits and Withdrawals

Avatrade offers a decent range of funding methods, and we were pleased that both deposits and withdrawals are free. However, we found that withdrawal times are slow compared to other brokers.

A well-regulated broker, Avatrade ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all non-profit withdrawals are returned to the deposit source. Traders can only withdraw up to 100% of the original deposit to a credit or debit card. After this, funds may be withdrawn by another method in the trader’s name.

Accepted Deposit Currencies: When we opened our account, we noticed that the Avatrade client portal allows traders to choose between six base currencies, including USD, GBP, EUR, AUD, AED, and CHF. However, the main currency used is USD.

While this may not affect occasional traders, high-volume traders (who trade more than 10 lots a month) should consider opening an account denominated in USD because a conversion fee will be charged for every trade made on a USD-quoted currency pair. This can be done by opening a multi-currency bank account at a digital bank.

Funding Methods: We were pleased to find that Avatrade offers a good range of payment methods, and it does not charge fees for deposits or withdrawals.

Overall, while withdrawals and deposits are free, we were disappointed by Avatrade’s processing times on both its deposits and withdrawals.

See below for a complete list of payment options and withdrawal times:

Avatrade’s Mobile Trading Platforms

With support for four mobile trading apps, including its award-winning AvatradeGO, we found that Avatrade provides a superior mobile trading experience.

AvatradeGO Trading App

We quickly realised that the AvatradeGO app is not a trading platform but more of a portal that allows traders to manage their Metatrader 4 platform from a mobile device or tablet. It’s available on both Android and iOS and integrates with Avatrade’s social trading application.

AvatradeGO Features: We enjoyed how easy it is to use the AvatradeGO app. It has a sophisticated dashboard and intuitive home screen that allows you to view educational videos, and market analysis materials and contact customer support from within the app. It also has excellent search functionality, and it’s simple to place orders, set price alerts, create watchlists, and view live prices and charts.

Trading Tools: The mobile app also features AvaProtect, Avatrade’s risk management system. This unique trading tool allows clients to purchase protection against losing trades for a specified time, and if a trade is closed during that period.

Overall, the AvatradeGO mobile app provides a smooth trading experience with an intuitive dashboard. We also enjoyed the step-by-step onboarding tutorial on how to use the app.

MetaTrader 4 and MetaTrader 5

Avatrade offers MT4 and MT5 available for both Android and iOS. Although there is slightly limited functionality compared to the desktop versions of the platforms, with reduced timeframes and fewer charting options, traders will still have access to analytics with technical indicators, graphical objects, and a full set of trading orders.

AvaOptions Mobile Application

Unlike most other brokers, Avatrade offers trading on vanilla options. It has also created its own options mobile trading platform. Traders can choose between more than 55 currency pairs and gold and silver. The platform gives you total control over your portfolio, letting you balance risk and reward to match your market view.

Overall, Avatrade’s mobile trading support is excellent compared to other brokers, with the MT4 and MT5 mobile versions available and the AvatradeGO and AvaOptions trading apps.

Other Trading Platforms

Avatrade offers a wider range of trading platforms than other brokers, including MT4, MT5, and its own proprietary platforms – Avatrade Webtrader and AvaOptions.

For the purposes of this review, we tested Avatrade’s web trader platform. When you log in to your account, you are immediately redirected to the platform.

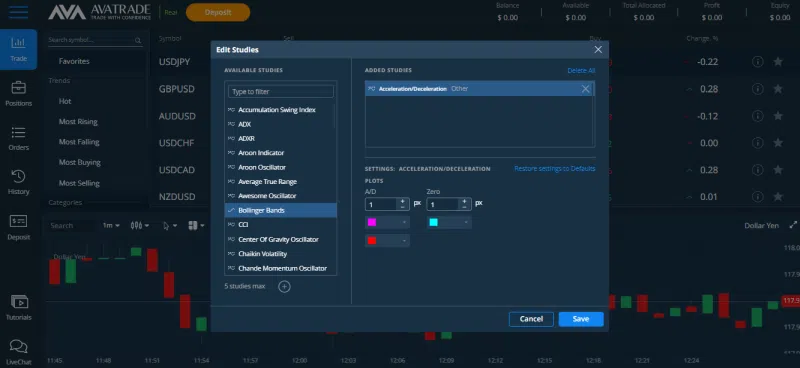

Avatrade Webtrader

The web trader platform requires no downloads or installation and is available for all devices. We found that the web trader has a clean user interface and intuitive design and is easy to navigate and search for various instruments, making it a great option for beginner traders. There are three chart types, including Line, Bar, and Candlestick charts, and you can also access a wide selection of indicators in multiple timeframes. See below:

One drawback is that the platform is not customisable, and traders can’t change the size and position of the tabs. The platform also does not allow traders to set price alerts and notifications. More advanced traders may prefer MT4 or MT5, both available at Avatrade, which allows traders to customise their indicators, has many more chart types, and algorithmic (or automated) trading.

We were pleased to note that Trading Central, one of the most popular third-party trading tools on the market, is fully integrated into the platform and provides technical insight and instant pattern recognition.

Metatrader 4 (MT4)

We found that, like most brokers, the Avatrade MT4 platform is the standard version with 24 graphical objects and 30 built-in indicators. Unlike Avatrade’s proprietary web trader, algorithmic trading is available, and MT4 is fully customisable.

As you can see below, only the basic orders are available, being Market, Limit, Stop, and Trailing Stop.

Metatrader 5 (MT5)

MT5, the newer version of MT4, is also available at Avatrade. The difference between the two platforms is that MT4 is a Forex-only platform, while MT5 allows trading on all the assets available at Avatrade. We recommend using MT5 if you are looking for a more powerful and faster trading platform when it comes to back-testing functionality for automated trading algorithms. Additionally, traders prefer MT5 for its depth of market display, additional technical indicators, and analytical tools.

AvaOptions

AvaTrade allows trading on vanilla options. Options trading provides traders with opportunities to benefit from more than just the 2-dimensional nature of Forex trading. Vanilla options are available on more than 50 currency pairs, gold and silver. Trading options can be complex, but the AvaOptions platform simplifies the process.

Opening an Account at AvaTrade

We found Avatrade’s account opening process fast and hassle-free compared to most other brokers.

It took us about 5 minutes to open an account at AvaTrade, and once our documentation had been submitted, our accounts were ready for trading immediately. We were also pleasantly surprised to receive a phone call from customer service to assist with troubleshooting issues.

As a Nigerian trader, you are eligible to open an account at Avatrade as long as you meet the minimum deposit requirement of 100 USD.

Creating an account is fast and fully digital, and accounts are usually ready for trading in a matter of minutes.

How to open an account at Avatrade:

- After clicking on the “Register now” button at the top of Avatrade’s main page, we were given a choice to open either a Real or a Demo account. We selected the Real Account option.

- We were then directed to Avatrade’s intake form, which required us to fill in our name, and email address and choose either an individual or joint account.

- Next, we were asked to complete a short form to help Avatrade assess the state of our finances and trading knowledge. Many brokers omit this step in the account-opening process, but it is a responsible move in an industry that is often accused of not protecting customers.

- Lastly, Avatrade needed at least two documents to accept us as an individual client; these are:

- Proof of Identification – current (not expired) coloured scanned copy (in PDF or JPG format) of a passport. If no valid passport is available, a similar identification document bearing a photo such as an ID card or driving licence will work.

- Proof of Address – a Bank Statement or Utility Bill. Please ensure, however, that the documents provided are not older than 6 months and that the trading name and physical address are clearly displayed. Documents can be scanned or sent through as a high-quality digital camera picture.

Once all documents had been received, our account was ready for trading within a matter of minutes.

Avatrade’s account opening process is fast, hassle-free, and fully digital compared to other similar brokers.

Avatrade’s Research and Trading Tools

Avatrade’s market research is average compared to other similar brokers, and most of the research is curated by third-party providers. It also offers the services of Trading Central, a world leader in technical and fundamental analysis.

Research is available through the web trading platform, the MetaTrader platform, the AvaOptions trading platform, and on Avatrade’s website:

- Trading Central: Trading Central is a third-party company that provides Avatrade’s clients with market insight and trade analysis. These products are available through Avatrade’s proprietary interfaces (WebTrader and AvaTradeGO) and via notifications (SMS/email/push). The market insight provided by Trading Central helps inform traders’ strategies and trading plans and is created by expert analysts.

The tool helps merge these experts’ views with automated algorithms and offers pattern recognition to trigger trading ideas. Trading Central also delivers a daily strategy newsletter, combining technical and fundamental research directly to your inbox. Trading Central also provides an updated news feed for each asset, which also comes with a sentiment score for that asset. An additional feature of Trading Central is the Trend Analysis, which predicts whether assets will rise and fall and by what percentage.

- Economic Calendar: Avatrade’s Economic Calendar provides a good selection of fundamental data. It also offers a feature that allows traders to gauge historical volatility and trends, including an “impact” button to see how various prices were affected by certain news updates. Note that traders will have to sign up for an account to view this premium content.

- Trading Calculator: Like many brokers, Avatrade offers a trading calculator to help traders calculate the potential profits, losses, and trading costs. The calculation outcome will help traders decide if or when to open a position, what margin is required, and the cost of trading.

- AvaProtect: This unique trading tool allows clients to purchase protection against losing trades for a specified time. Any losses will be fully refunded if a trade is closed during that period. While the AvaProtect feature is active, traders can still benefit from any gains on a position. The cost of AvaProtect changes according to the market and size of the trade. AvaProtect is also available on the AvaTradeGO App. Note that this feature is not available on limit orders, only on market orders.

Overall, while Avatrade’s in-house team does not provide as much market analysis as is available at other large international brokers, it provides a good set of third-party tools to help its clients make trading decisions.

Social Trading

We found that AvaTrade offers an excellent and varied social trading experience compared to other brokers.

We were pleasantly surprised to find that Avatrade offers two copy trading platforms and its own social trading platform:

- Duplitrade, a third-party copy trading platform

- Zulutrade, also a third-party copy trading platform

- AvaSocial, Avatrade’s proprietary social trading platform

Duplitrade: Duplitrade is a popular copy trading platform that can link to the MT4 trading platform. DupliTrade allows traders to automatically duplicate the actions of expert traders (with proven histories) directly into their AvaTrade trading account. However, traders will have to deposit a minimum amount of 2,000 USD to access Duplitrade, way above the required minimum deposit. We thought this offering was expensive compared to other similar brokers.

Zulutrade: Another firm favourite is Zulutrade, a popular auto trading platform. ZuluTrade converts experienced traders’ recommendations and automatically executes the trades in your AvaTrade account.

We also like the fact that although Zulutrade offers automated trading, copy traders can monitor all open positions in real-time and have full control over their funds. Copy traders can choose from a large set of experienced and high-ranking traders with many followers. In order to open a copy trading account, you should click on “New Account” and select Zulutrade as the trading platform.

AvaSocial: AvaTrade clients can also download the broker’s social and copy trading platform – AvaSocial. Available on iOS and Android devices, the mobile app allows clients to replicate the trades of successful investors. You can opt to trade on market signals manually or to follow a fully automated service.

Users can interact with other traders via community channels, ask questions on specific strategies, find out more about crypto markets, or seek a trading mentor, making it a great tool for beginner traders.

Overall, Avatrade offers a comprehensive social and copy trading experience compared to other brokers.

AvaTrade’s Educational Material

Avatrade provides an excellent selection of educational materials compared to other similar brokers. The education section caters to both beginner and more experienced traders alike.

We found that Avatrade’s library of educational materials is world-class and on par with some of the best brokers in the world. Education comprises trading videos, a trading for beginners section,, and a free trading e-book. These materials are in-depth and well-structured and cater to beginner and experienced traders. Avatrade also offers a demo account for traders to practice their trading:

- Trading for beginners – The Trading for beginners section gives you all the information you need to tackle Forex and CFD instruments confidently. In this section, traders can learn about many trading topics, including ‘What is Forex,’ ‘What is a pip,’ ‘What is Metatrader?’, ‘MACD trading strategies,’ ‘How to read a Forex chart,’ ‘Technical analysis,’ and more.

- Trading Platforms – How to use the platforms available, such as MT4 and MT5, to trade successfully and achieve your goals.

- Online Trading Strategies – This section covers various online trading strategies, including day trading, swing trading, and financial instruments.

- Trading Rules: These guides educate traders on how to trade efficiently, master the basics, and progress to more advanced trading techniques and strategies.

- Economic Indicators: These articles outline the types of economic indicators and their importance during trading.

- Demo Account: AvaTrade’s free demo account is a handy tool to practice trading, test an expert advisor, or acquaint yourself with Forex trading. With 100,000 USD in virtual funds, the demo account accurately simulates AvaTrade’s real account but expires after 21 days.

AvaTrade’s Customer Service

We found that Avatrade’s customer service is excellent compared to other similar brokers.

Customer service is available Monday through Friday between 05:00AM – 09:00PM GMT in the English desk.

Avatrade has Service Representatives native in additional languages (Spanish, French, Italian, Arabic, Russian, Portuguese and German) who are on call between 06:00AM – 03:00PM GMT. You can reach out through Chat, Phone and Email.

For the purposes of the review, we tested the live chat service and email. Our email was answered within a couple of hours, and the answer was relevant and to the point. We found the live chat agents were polite and responsive, and they were able to answer all our questions. After logging into the live chat, we were connected to an agent who replied to our message within 30 seconds, as shown below:

Safety and Industry Recognition

Regulation: Avatrade has a corporate structure composed of multiple regulated entities that operate in different regions across the world, including South Africa, Australia, Cyprus, Japan, Abu Dhabi, and the British Virgin Islands. See below for more details:

- Ava Capital Markets Australia Pty Ltd is regulated by the ASIC (No.406684).

- DT Direct Investment Hub Ltd. is regulated by the Cyprus Securities and Exchange Commission (No. 347/17).

- ATrade Ltd is regulated in Israel by the Israel Securities Authority (No. 514666577).

- Ava Trade Middle East Ltd is regulated by the Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) (No.190018).

- Ava Trade Japan K.K. is licensed and regulated in Japan by the Financial Services Agency (License No.: 1662), the Financial Futures Association of Japan (License No.: 1574).

- Ava Capital Markets Pty is authorised and regulated by the South African FSCA (licence number No.45984).

- Ava Trade Ltd is regulated by the British Virgin Islands FSC No. SIBA/L/13/1049.

- AVA Trade EU Ltd is compliant with MiFID and is regulated by the Central Bank of Ireland, Reference No.C53877.

Industry Recognition: In addition to being regulated by several national authorities, AvaTrade has received widespread industry recognition for its excellent trading conditions and innovations. Recent awards include:

- Most Trusted Trading Platform Europe 2022 (International Business Magazine)

- Best Mobile Trading Platform 2022 (Investingoal)

- Best Overall Broker 2022 (Daytrading)

- Best Broker UK 2022 (World Economic Magazine)

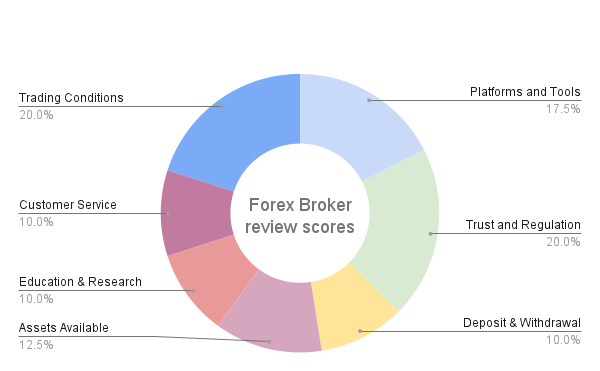

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is evaluating the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, summarised in this review. Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

AvaTrade Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. AvaTrade would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Final Word

AvaTrade is one of the best, largest, and most reputable brokers in the world, and for good reason. It offers a wide range of trading platforms, including its award-winning mobile trading app, AvatradeGO. It also offers world-class trading tools, including Trading Central, and excellent analytical and education sections.

Although Avatrade’s trading costs are not the lowest in the industry, traders will find them acceptable. Spreads start at 0.9 pips on the EUR/USD in exchange for a minimum deposit of only 100 USD. One major drawback for Nigerian traders considering Avatrade is that they are onboarded through Avatrade’s BVI-regulated entity, which means that they are not as well protected as their international counterparts.

FAQ

Is AvaTrade Safe?

Yes. AvaTrade is an internationally regulated Forex CFD broker.

What is the AvaTrade minimum deposit?

Clients can open a live AvaTrade account for 100 USD.

How do I fund my Avatrade account?

Clients can fund accounts using Skrill, Webmoney, Neteller, ETF, and credit cards. Payments will reflect in your trading account between 1-5 days, depending on the deposit method.

How can I withdraw money from Avatrade?

Clients can only make withdrawals via payment methods used to fund your account, with the only exception made for clients who are withdrawing earnings and have already made a withdrawal via the original funding method. Withdrawals are typically processed and sent within 1 to 2 business days.

Does AvaTrade have a demo account?

The free AvaTrade demo account has 100,000 USD virtual funds. The account will expire after 21 days but can be reopened by the support team.