-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

HFM (HotForex) Broker Review

Last Updated On Jun 26, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on HFM

HFM (formerly known as HotForex) is a well-known international broker with a strong presence in Nigeria. It has local customer support, and unlike many other international brokers, it offers NGN trading accounts. It also offers fast and free deposits and withdrawals from local banks.

HFM offers four standard accounts and one specialised copy trading account. Three of its four standard accounts have no minimum deposit requirements and have extremely competitive trading fees. All accounts are available as Islamic accounts. We were also pleased to find that HFM has recently reintroduced cryptocurrency trading, no doubt because of the popularity of the asset. This is alongside an excellent range of trading instruments, including 950 international stocks.

HFM supports the MT4 and MT5 platforms in addition to its own mobile HF App, which allows clients to trade from charts and make deposits and withdrawals. It also has several excellent trading tools to assist traders further. Unfortunately, access to tools such as Autochartist, which other brokers offer as a free service, requires an account balance of 100 USD.

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | CySEC, FCA, DFSA, FSC |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, HFM Trading App |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, ETFs, Forex, Indices, Metals, Stock DMAs |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Low minimum deposit

- Tight spreads

- Well regulated

- Good range of accounts

Cons

- Limited base currencies

Is HFM (formerly known as HotForex) Safe?

Although Nigerian traders are onboarded through HFM’s Saint Vincent and the Grenadines-based entity, which offers very little protection, we consider HFM a trustworthy broker.

Regulation: Although HFM has an excellent reputation in the Forex trading community, Nigerian traders will be onboarded through its subsidiary registered with Saint Vincent and the Grenadines FSA. The SVG FSA is not a regulator and does not supervise trading or protect traders.

On the other hand, HFM does have a good reputation, and its other operations are overseen by some of the better regulators in Europe, including the UK’s FCA and CySEC of Cyprus. But Nigerian clients must rely solely on the reputation of HFM as no additional measures exist to ensure client protection.

Safety Features: In a show of good faith, HFM segregates all funds from the company’s operating capital and offers negative balance protection to all its clients. No regulatory oversight also means that HFM can offer higher leverage and bonuses to Nigerian traders, which may be attractive to some.

Company Details:

![]()

![]()

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of HFM’s SVG registered entity:

HFM’s (formerly known as HotForex) Trading Assets

We were pleased to find that HFM has recently reintroduced cryptocurrencies to its offering, a good move considering how popular this asset class has become. It also offers trading on a wide range of stocks.

Cryptocurrencies: HFM recently (at the end of 2021) reintroduced its range of cryptocurrencies. Its range includes favourites such as Bitcoin, Ethereum, Dashcoin, and Litcoin. All cryptos are crossed with the USD or EUR, and leverage is up to 50:1 on pairs such as the BTC/USD, a higher level of leverage than is typically offered on cryptos by other brokers.

Stocks: Nigerian traders will be pleased to see that HFM offers 950 DMA (Direct Market Access) stocks, allowing clients to trade directly on stock exchanges from around the world, but this product line is only available on MT5.

Full List of Instruments and Leverage:

![]()

![]()

- Forex pairs: HFM offers 53 Forex pairs to trade, including majors, minors, and exotics such as USD/ZAR and ZAR/JPY. While this is a substantial number, other brokers will offer 60+ pairs to trade. Maximum leverage is 1:1000.

- Metals: HFM offers silver and gold crosses with both the EUR and USD and palladium and platinum futures. This is an average selection of metals compared to other brokers. Maximum leverage is 1:200 on gold but falls to 1:20 on palladium futures.

- Energies: HFM offers spot and futures contracts on both Brent and WTI oil. The maximum leverage is 1:66.

- Indices: HFM offers spot and futures contracts on a range of international indices, including the NASDAQ, S&P500, FTSE100, DAX30, and the Nikkei. This is a broad range of indices compared to other brokers. The maximum leverage is 1:200.

- Shares: HFM offers 71 share CFDs to trade, including popular US tech companies and multinational energy companies. While this may seem like a smaller range of share CFDs than offered by other brokers, HFM also offers 950 DMA stocks. The maximum leverage is 1:14.

- Commodities: HFM offers five of the most common commodity futures to trade, such as coffee and sugar. Maximum leverage is 1:66

- Bonds: HFM offers CFD trading on the three most popular bonds in the world – UK Gilts, Euro Bunds, and the US 10-year. The maximum leverage is 1:50.

- Cryptocurrencies: HFM offers 19 crypto pairs to trade, including Bitcoin, Ethereum, Dash, and Litecoin, among others. Leverage is up to 50:1 on cryptos, but traders should be aware of trading with high leverage on such a volatile asset.

- ETFs: Exchange Traded Funds have rapidly gained in popularity in recent years, and HFM offers spot contracts on 34 of the most traded ETFs in the world. The maximum leverage is 1:50.

Overall, we were pleased with the range and depth of financial assets available at HFM. The reintroduction of cryptocurrencies will be a major drawcard for the broker.

HFM (formerly known as HotForex) Accounts and Trading Fees

HFM offers four account types, which is more than most other brokers. In May 2023, HFM restructured its accounts, removing the minimum deposits on three of its four accounts and increasing leverage from 1:1000 to 1:2000.

Trading Fees: Despite the variation, overall trading costs are lower than average across all four accounts, and the accounts offer different benefits in terms of trading strategies and minimum deposits.

Account Trading Costs

![]()

![]()

Cent Account

The Cent Account is good for beginner traders who want to keep risk as low as possible while learning. With no minimum deposit requirement and trades denominated in USD cents (USC) rather than USD, trading costs are very low on this account, though potential profits are low too. Variable spreads start from 1.2 pips on major pairs, leverage is up to 1:2000, and traders can open a maximum of 150 positions simultaneously. Because this is a Cent Account, it is only denominated in USC.

Premium Account

The Premium Account is a good entry-level account for beginner traders, with no minimum deposit requirement. Variable spreads start from 1.2 pips on major pairs, which is tight for an account with no minimum deposit requirement, and no commissions are charged. Leverage is up to 1:2000, traders can open a maximum of 500 positions simultaneously, and this account is denominated in both NGN and USD.

ZERO Account

This is a market execution account with spreads starting at 0 pips on the EUR/USD. Where previously there was a minimum deposit requirement of 200 USD to open the ZERO Account, there is now no minimum deposit requirement. As with all raw spread accounts, you will be charged a commission – in this case, the charge is 3 USD per lot (6 USD total round turn) on major forex pairs. These are some of the lowest trading costs in the industry.

Pro Account

With ultra-low spreads, leverage up to 1:2000 and no commissions; the Pro account caters to more experienced traders who want to take their trading to the next level. Spreads start at 0.5 pips (EUR/USD), which is much tighter than other brokers, and the account has a reasonable minimum deposit requirement of 100 USD/50,000 NGN.

HFcopy Account

The HFcopy Account is available to both Strategy Providers (SPs) and Followers who have joined HFcopy. SPs can open an HFcopy Account to build their inventory of Followers and trade in exchange for a Performance Fee, as high as 50%. Only available on the MT4 platform, the spread starts at 1 pip, and trading instruments offered on this account are limited to Forex, Indices, and Gold. The minimum deposit is 300 USD for SPs and 100 USD for Followers, and accounts are only denominated in USD.

HFM (formerly known as HotForex) Deposit & Withdrawal

HFM charges no fees for deposits and withdrawals, but withdrawals via credit and debit cards take up to 10 days to be processed, which is painfully slow compared to other brokers.

As a regulated broker, HFM ensures that all Anti-Money Laundering rules and regulations are followed. As such, all non-profit funds are returned to the original deposit source.

Accepted Currencies: When we opened our account at HFM, we were given the choice of four base currencies: USD, EUR, NGN or JPY. The Pro, Premium, and Zero Accounts can all be denominated in Nigerian Naira.

Local bank transfers: We were pleased that HFM offers free online bank funding for clients with online bank accounts. This is a much faster method of depositing and withdrawing funds than a standard bank wire, with deposits reflecting almost instantly and withdrawals received within 2 business days.

Traditional deposits are handled on weekdays and conditions apply to each deposit option.

- Bank Wire – HFM will cover the fees for transfers over the minimum amount of 100 USD. The funds will be added to your trading account within one business day of the funds reflecting in HFM’s account.

- Visa/Mastercard and Skrill – A minimum deposit of 5 USD is required and will take approximately 10 minutes to reflect in your trading account. There are no fees for this deposit method.

Traditional withdrawals are processed within 24 hours (weekdays only) of receiving them, but different conditions apply to each payment method.

- Bank Wire – No fees and a minimum withdrawal of 100 USD. Bank wire withdrawals can take 2-10 days to receive, depending on your bank.

- Visa/Mastercard and Skrill – No fees and minimum withdrawal of 5 USD. Card withdrawals can take 2-10 business days, depending on your bank, but Skrill withdrawals are almost instant.

HFM’s (formerly known as HotForex) Mobile Trading Platforms

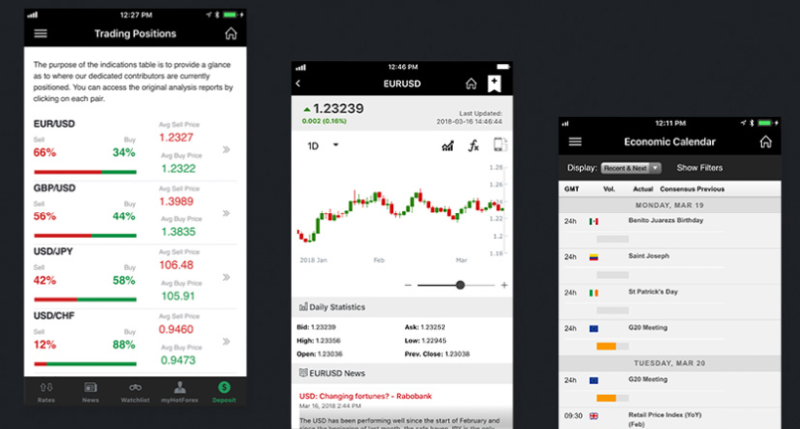

HFM offers a mobile app that looks great and is easy to use. It also offers MT4 and MT5 mobile apps, all available on both Android and iOS.

HF App

The HF App has a sleek design and intuitive interface. The HF App allows traders to easily transfer, withdraw, deposit funds, search for instruments, and create watchlists. It also has an integrated economic calendar, and traders can access HFM’s educational materials on the app:

MT4/MT5 Mobile Apps

We found that the HFM MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. We were able to close and modify existing orders and calculate profit/loss in real-time. We also find it easier to search for instruments than on the web trader versions of the platforms.

Other Trading Platforms

Like many other brokers, HFM offers MT4 and MT5 but does not offer its own desktop trading platform.

While MT4 and MT5 are both excellent trading platforms, many other CFD brokers also offer their own web-based platforms, which tend to be easier to use for beginner traders. On the other hand, the benefit of HFM offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker.

For the purposes of this review, we tested both of HFM’s web trader platforms.

![]()

![]()

Metatrader 4 (MT4)

Our review found that HFM offers the standard version of MT4, which has 24 graphical objects and 30 built-in indicators. However, it also offers Premium Trader tools, available to clients who deposit more than 200 USD, which plug directly into the MT4 platform, enhancing its functionality (click here for more on Premium trader tools).

We found that the platform’s interface is dated, but it is fully customisable. There are three chart types, including Line, Bar, and Candlestick charts and you can access a wide selection of indicators in multiple timeframes:

HFM also offers support for MT4 MultiTerminal, providing a convenient method of managing multiple accounts simultaneously from a single interface.

Metatrader 5 (MT5)

MT5, the newer version of its predecessor, MT4, is also available at HFM. We recommend using MT5 if you are looking for a more powerful and faster trading platform when it comes to back-testing functionality for automated trading algorithms. Additionally, traders prefer MT5 for its depth of market display, additional technical indicators (38 as opposed to 30 on MT4), and analytical tools.

In our review of MT5 web trader, we noted that it has a great depth of market display:

Both MT4 and MT5 are available as downloads, browser-based, and on iOS and Android devices. Mobile access is 24/7, and mobile apps employ the latest SSL encryption technology for security.

Overall, we found that HFM provides a good selection of third-party platforms but lacks its own in-house trading platform, which is usually more user-friendly.

HFM’s (formerly known as HotForex) Bonuses and Promotions

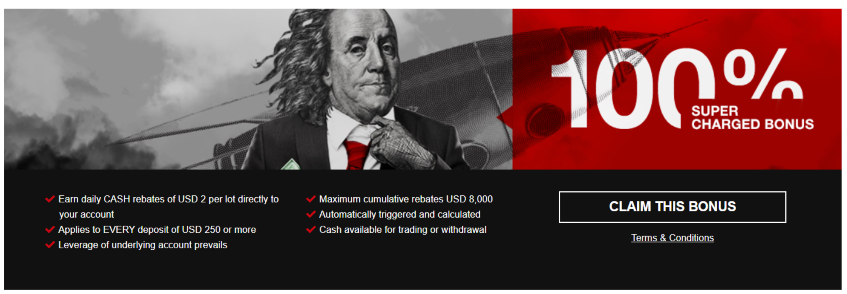

We were impressed that HFM offers multiple bonuses, trading contests, and promotions for Nigerian traders. At the time of writing, the following bonuses are available:

- On deposit bonus: With this bonus, traders earn daily cash rebates of 2 USD per lot directly to their account. It applies to every deposit of 250 USD or more and increases account leverage.

- Rescue Bonus: Applies to deposits over 50 USD, and traders can access greater leverage. It also protects traders from periods of drawdown.

For all the current HFM Bonus information, please refer to its website.

Opening an Account at HFM (formerly known as HotForex)

Opening an account at HFM is a quick and hassle-free process. However, it took two days for our accounts to be verified, which is longer than other similar brokers.

It took us about 3 minutes to open an account at HFM. We could immediately deposit funds into our accounts, but our accounts were only ready for trading after two days.

As a Nigerian trader, you can open an account at HFM, but will need to meet all the minimum deposit amounts to do so; these are:

- Cent Account: o USD

- Premium Account: 0 USD

- Pro Account: 100 USD/50,000 NGN

- Zero: 0 USD

- HFcopy Account: 100 USD

We found that opening a live account at HFM is easy and takes less than 3 minutes. While HFM also offers Corporate Accounts and Joint Accounts, we will focus on opening an Individual Account:

- Initially, we were required to provide our full name, phone number, email address, and date of birth. We also had to choose whether we wanted the base currency of our account to be USD or EUR.

- Once this step was complete, we accessed our MyHF dashboard. This is the administrative hub for demo accounts, live accounts, and finances.

- From the MyHF hub, we chose our account type and submitted our Know Your Customer (KYC) documentation. HFM needed at least two documents to accept us as an individual client:

- Proof of Identification – current (not expired) coloured scanned copy (in PDF or JPG format) of your passport. If no valid passport is available, a similar identification document bearing a photo such as an ID card or driving licence will work.

- Proof of Address – a Bank Statement or Utility Bill. The documents provided should not be older than 6 months and your name and physical address should be clearly displayed.

- Important Note: The name on the Proof of Identification document must match the name on the Proof of Address document.

- We were able to upload our documents directly from the myHF area; but you can also scan them and send them via email.

- We were also asked to complete a short form to help HFM assess the state of our finances and trading knowledge. While most brokers omit this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- Once this step was complete, we were required to make at least the minimum required deposit for our chosen account via one of HFM’s deposit methods.

Our documents were checked by the verifications department and were approved in around 48 hours, which is longer than other similar brokers. Note that any deposits will be credited to the account only after your documents have been approved and the myHF area is fully activated.

We advise you to read HFM’s risk disclosure, customer agreement, and terms of business before you start trading.

HFM’s (formerly known as HotForex) Research and Trading Tools

Our review found that HFM has a competent in-house research team that produces high-quality and useful market analysis materials. It has also partnered with several third-party analysis companies to enhance its offering further.

Research

HFM’s research and market analysis is divided into three main sections, each of which provides a specialised benefit for traders looking for market insight and trading opportunities.

Forex News – In partnership with FXSTREET, a respected market news aggregator and publisher, HFM provides a constant stream of news that impacts the markets. While the main focus is on geopolitical events and macroeconomic movements, we found that there is some reporting on technical analysis – mainly from large banks and other financial institutions. With new stories every few minutes, 24/5, this is an excellent resource for traders using all types of strategies.

HFAnalysis – This is the hub for HFM’s own market research content. The focus is a market news blog, split between fundamental and technical analysis, and trader education. From here, we were able to access monthly and quarterly outlooks, video analysis, special reports, and intraday charts. We were also able to access the HFM podcast; generally published mid-week, this is a detailed look at recent market movements and a look ahead to potential market-impacting events. Overall, we found that the analysis provided by HFM’s experts is detailed and accurate and is on par with the in-house research provided by other large international Forex brokers.

Advanced Insights – This plugin for MT4 and MT5 provides sentiment and volatility analysis from an insight engine that applies big data AI to millions of news articles and live trading positions. The plugin also provides a timeline of the upcoming events and presents detailed infographics on HFM’s full range of assets. While this tool is free, traders must have deposited at least 100 USD and made closed trades worth 10 lots or more in the previous two months.

Trading Tools

We found that HFM offers an excellent range of trading tools, including Autochartist, a free VPS service, and a set of Premium Trading Tools. While all these tools are provided free, we were disappointed that traders are required to make a substantial deposit before access is provided.

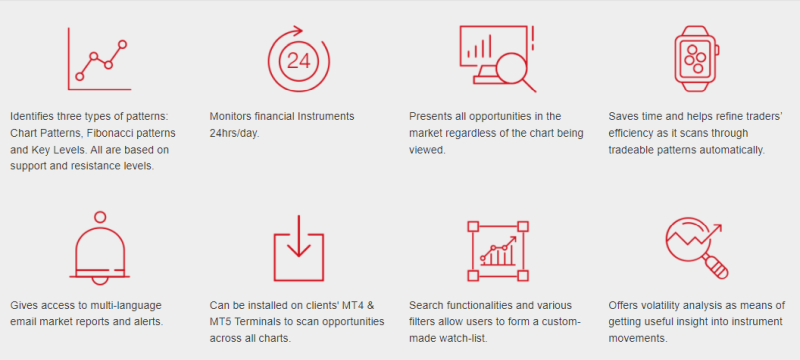

Autochartist

Available for all HFM clients with a minimum deposit of 100 USD, Autochartist is an award-winning automated technical analysis tool that plugs into MT4 and MT5 and scans all available CFD markets for trading opportunities. It is one of the best technical analysis tools on the market and we were pleased to see that HFM subscribes to its services.

Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

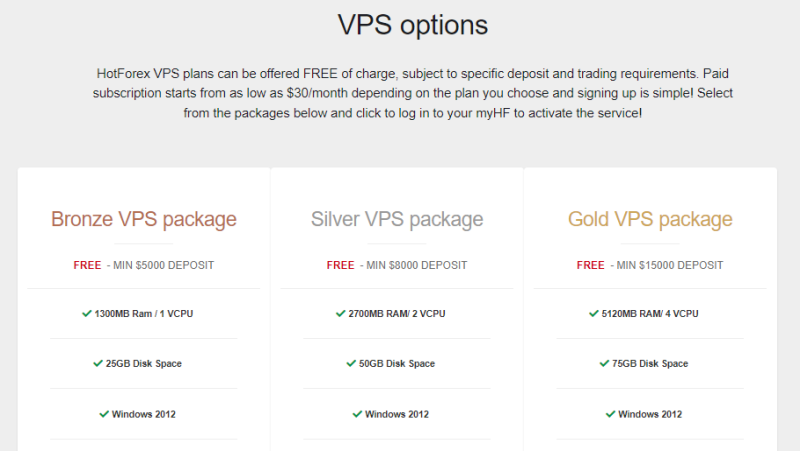

VPS

HFM clients with a minimum deposit of 5000 USD can also subscribe to a free VPS hosting service provided by external third-party providers. VPS services ensure trades are never disrupted by technological or connectivity issues, such as load-shedding or internet service failure. The VPS service is only available to traders using the MT4 platform. See below for more details:

Premium Trader Tools

Premium Trader Tools provide all HFM clients with a minimum deposit of 200 USD, allowing traders access to institutional quality technology, including advanced trading tools, user-configurable news and information, and trade analysis. It also includes an array of sophisticated alarms and messaging systems and live sentiment and correlation tracking. A few of the tools in the package include:

- Trade Terminal: A feature-rich professional trade execution and analysis tool, providing several trading features and order controls that are not included in MT4 or MT5.

- Mini Terminal: The mini-terminal facilitates trade management by making commonly-used trading features more accessible than in the native version of the software.

- Connect: A customisable news feed aggregator and interactive economic calendar

- Correlation Matrix and Correlation Trader: These tools work together to show correlations between pairs of trading symbols. It functions with any symbols available in the trading platform, allowing a calculation of the correlation between multiple asset classes against Forex. The Correlation Trader will then allow for a detailed inspection of the correlation between any two instruments.

Other trading tools available at HFM include a range of trading calculators, which can be used to calculate pip value, swap fees, risk percentages, and support and resistance levels.

Between the analytical tools and the sheer scale of market research on offer – in audio, text, and video format – from both in-house and third-party experts, we think HFM’s market analysis is considerably more useful than most other brokers – though about equal when compared with other international brokers with large research and analysis budgets.

Market Research Comparison:

![]()

![]()

HFM’s (formerly known as HotForex) Education

Our review found that much like the market analysis at HFM, the educational content available is multi-format, of very high quality, and more useful for beginners than what is available at most other brokers. It also offers a free demo account that does not expire.

Because we opened a live account, we had access to the HFM e-Course. We found that the course is well-structured and includes the basics of Forex theory and Forex trading, reading and interpreting charts, trading strategies, trading psychology, and technical analysis.

Video tutorials are available without registration; these cover introductory concepts, Metatrader tutorials, trading strategies, and lessons in economic theory.

We enjoyed HFM’s webinars. These cover current events, advanced trading strategy, and risk and money management and are run every few days. The webinars do not require an account at HFM, but you will need to register.

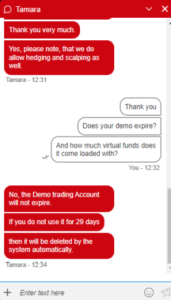

HFM’s (formerly known as HotForex) Demo Account

We opened a demo account and found that it does not expire, which is helpful for beginner traders. We were provided with a virtual starting balance of 100,000 USD, which can be topped up on request. We could view charts, news, and analysis, get access to the full-featured MT4 and MT5 platforms, and experience real-time prices and real forex market volatility.

Education Comparison:

![]()

![]()

HFM’s (formerly known as HotForex) Customer Support

We found that HFM’s customer support is better than most other brokers.

Award-winning customer service and a client-focused approach to business mean that beginner traders at HFM can rely on excellent support.

Support is available 24/5 in over 27 languages via email, live chat, and telephone. Toll-free local phone numbers and email addresses give clients direct, free access to quality customer service in their language.

For the review, we tested the live chat and telephone services. Our call was received immediately, and we were transferred to the correct department, which answered all our questions to our satisfaction. The live chat agents were also responsive and highly knowledgeable:

Safety and Industry Recognition

Regulation: HFM is the global brand name of HF Markets Group. Entities within the group are regulated by the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), the Financial Sector Conduct Authority of South Africa (FSCA), and the Financial Services Authority of Seychelles. See below for HFM listed companies:

- HF Markets SA (PTY) Ltd – authorized by FSCA (South Africa) registration no. 46632

- HF Markets (Europe) Ltd – authorized by CySEC (Cyprus) registration no. 183/12.

- HF Markets (UK) Limited – authorized by FCA (UK) registration no. 801701.

- HF Markets (DIFC) Ltd – authorized DFSA (Dubai) registration no. F004885.

- HF Markets (SV) Ltd – authorized by FSA (St. Vincent and the Grenadines) registration no. 22747 IBC 2015.

- HF Markets (Seychelles) Ltd – authorized by FSA (Seychelles)registration no. SD015.

Awards:

HFM has won numerous awards for its services and offerings over the years, recent awards include:

- Most Transparent Broker 2020 (The European – Global Banking & Finance Review Awards),

- Best Client Services – Global 2020 (Capital Finance International Magazine),

- Best Broker in Africa 2020 (AtoZ Forex),

- Best Trading Experience South East Asia 2020 (International Finance Awards),

- Best Partners Program Global 2020 (International Investor Awards),

- Excellence in Customer Service Global 2020 (International Investor Awards),

- Best Global Copy Trading Platform (Global Forex Awards 2019) for the HFcopy trading service.

With many years of responsible operation, regulation from some of the strictest authorities in the world, and a long list of awards for customer satisfaction, HFM is considered a reliable and safe Forex broker.

Evaluation Method

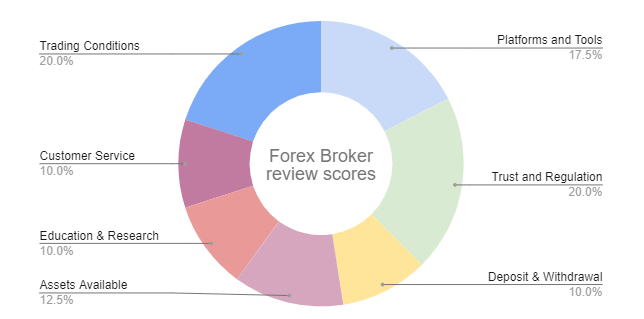

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, platform offering, and the trading conditions offered to clients, summarised in this review.

Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

HFM’s (formerly known as HotForex) Risk Statement and Disclaimer

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. HFM would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.90% of retail investor accounts lose money when trading CFDs with HFM. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

A trustworthy broker, HFM focuses on providing an optimal trading environment for its Nigerian clientele. It supports local bank transfers with instant deposits and two-day withdrawals. It also has an excellent customer support team that is responsive and knowledgeable.

Another attractive feature for Nigerian traders is that HFM offers trading on a range of DMA shares and has recently reintroduced cryptocurrencies to its books. One drawback is that Nigerian traders will be onboarded through HFM’s SVG FSA-regulated entity, which means that they will have little recourse in case of a dispute with the broker.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how HFM stacks up against other brokers.