-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

| 🏦 Min. Deposit | USD 50 |

| 🛡️ Regulated By | CySEC, FCA, ASIC, FSCA |

| 💵 Trading Cost | USD 22 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Stock CFDs, Forex, Futures, Indices, Metals |

Last Updated On Apr 28, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on IronFX

With oversight from some of the top international regulators, strong international regulation, and a wide range of flexible account choices, IronFX appeals to Nigerian traders looking for a well-regulated MT4 broker with a low-deposit Cent Account and a large number of Forex pairs.

Trading is offered on multiple assets, including commodities, indices, metals, futures, shares, and over 80 Forex pairs, a larger range than is typically seen at other brokers. Traders can choose between nine live flexible accounts, including a low-deposit Cent Account that appeals to beginners who prefer to make smaller trades measured in micro-lots.

Some drawbacks for traders considering IronFX are that platform support is limited to MT4, and there are few educational and market analysis materials available, forcing traders to self-educate with other third-party platforms.

| 🏦 Min. Deposit | USD 50 |

| 🛡️ Regulated By | CySEC, FCA, ASIC, FSCA |

| 💵 Trading Cost | USD 22 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Stock CFDs, Forex, Futures, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Wide range of assets

Cons

- Expensive withdrawals

Is IronFX Safe?

With a long history of responsible behaviour, and some of the strongest international regulation, we consider IronFX to be a safe broker to trade with.

BMA Regulation: Founded in 2010 and headquartered in Limassol, Cyprus, IronFX is the trading name of Notesco Financial Services. Nigerian traders are onboarded through Notesco Limited, registered in Bermuda under the Bermuda Monetary Authority (BMA).

Safety Features: The BMA’s rules for forex brokers are not as strict as those of the EU or the UK. For example, the BMA does not require brokers to offer negative balance protection, comply with leverage restrictions, or force brokers to participate in compensation schemes. Additionally, the BMA allows brokers to offer bonuses and promotions. However, in addition to segregating client funds from its operating capital, IronFX provides Nigerians with negative balance protection, but it does not participate in any compensation schemes.

Company Details:

Overall, because of its strong regulation, a long history of responsible behaviour, and wide industry acclaim, IronFX is considered a safe broker to trade with.

Trading Instruments

IronFX’s range of financial instruments to trade is limited compared to most other brokers, but it offers over 80 Forex pairs.

IronFX offers tradable assets across six categories, including Forex, commodities, metals, indices, shares, and futures:

- Forex: IronFX offers 83 forex pairs for trading, an extraordinary range compared to most other brokers. These include majors, minors, and exotics. Leverage is up to 1:1000 on the standard accounts and 1:200 on the ECN accounts for major pairs.

- Commodities: IronFX only offers trading on nine commodities, which is slightly limited compared to most brokers. Commodities include energies such as oil, brent crude, and natural gas. Leverage is up to 1:50 on commodities.

- Indices: IronFX offers trading on 16 indices, which is a combination of the shares of some of the largest and globally acknowledged companies. These include EU50Cash, JPY335Cash, Aus200Cash, and the US100Cash, among others. Leverage is up to 1:100 on indices.

- Share CFDs: IronFX only offers trading on 145 share CFDs, which is much fewer than most other brokers. The selection available includes some of the major US, French, South African, and Spanish shares on the market. Leverage on share CFDs is up to 1:10

- Future CFDs: IronFX has an impressive range of futures, with 26 available for trading. Traders can choose between currencies, commodities, and energies, Leverage is up to 1:100 on futures.

- Metals: IronFX offers trading on 6 energies, which is average compared to most other brokers. These include silver, gold, palladium, and platinum. Leverage is up to 1:50 on metals.

Besides the wide selection of Forex pairs, IronFX has a disappointing CFD range. This is mostly down to the limitations of the MT4 platform.

Accounts and Trading Fees

IronFX’s trading fees are significantly higher than most other brokers, and it has a complicated account structure.

Trading Fees: Unlike most other Forex brokers that offer trading on up to three account types with tighter spreads linked to higher minimum deposits, IronFX offers trading on seven different accounts that have a very complicated account structure. IronFX offers four instant execution accounts and three market execution accounts with various spread/commission combinations. To make matters more complicated, traders can choose between fixed or floating spreads on the instant execution accounts.

Additionally, the overall trading costs are higher than average across all seven accounts, though the accounts offer more benefits tied to higher minimum deposits.

For some unknown reason, IronFX does not publish the minimum deposits associated with each account, and it was very difficult to extract this information from customer service.

Account Trading Costs:

As you can see from the table above, in most cases, IronFx’s trading costs are built into the spread – though the Zero Fixed Account and ECN Zero Spread Accounts carry an 18 USD commission in exchange for spreads of 0 pips on the EUR/USD. Trading costs on all account options at IronFX are significantly higher than average – between 11 and 22 USD per lot traded. The average trading costs at most other brokers tend to be 9 USD or lower.

See below for account details:

- The Live Floating/Live Fixed Accounts: These are instant execution commission-free accounts with Standard, Premium, and VIP tiers. Leverage is up to 1000:1 and traders can choose between floating or fixed spreads:

- Standard Account: Fixed spreads start at 2.2 pips on the EUR/USD or 1.8 pips on the floating-spread option, which is much wider than other similar brokers. Accounts are denominated in USD, EUR, GBP, AUD, JPY, BTC, PLN, and CZK. Note the Standard Account is available as a Micro Account with a minimum deposit of only 50 USD.

- Premium Account: Fixed spreads start at 1.8 pips on the EUR/USD and start at 1.6 pips if one chooses the floating spread option. Again, these spreads are wider than other similar brokers. Accounts are denominated in USD, EUR, GBP, AUD, JPY, BTC, PLN, and CZK.

- VIP account: Fixed spreads start at 1.6 pips on the EUR/USD and start at 1.4 pips if one chooses the floating spread option. Accounts are only denominated in USD. Even with the high minimum deposit, traders will be disappointed with these wide spreads.

- The Live Zero Fixed Spread Account also uses instant execution, but spreads are fixed at 0 pips for the EUR/USD, and a commission of 18 USD round turn/lot is charged for major FX pairs and 23 USD round turn/lot on minor pairs. These commissions are some of the highest in the industry. Accounts are denominated in USD and EUR.

STP/ECN Accounts:

These accounts are market-execution accounts with a leverage of up to 200:1:

- The STP/ECN No Commission Account is a market execution account. No commission is charged, and fees are included in the spreads, which start at 1.7 pips on the EUR/USD. Again, even though traders have direct market access, these spreads are unusually wide, and the minimum deposit requirement is high. Accounts are denominated in EUR, USD, JPY, and BTC.

- The STP/ECN Zero Spread Account offers spreads as low as 0 pips on the EUR/USD, and a commission is charged per lot traded. The commission is 18 USD per lot on major pairs, and 23 USD per lot on minors. Again, the commissions on this account make it unpalatable for most traders. Accounts are denominated in USD, EUR, and JPY.

- The STP/ECN Absolute Zero Account is a fully customisable market execution account, where 1.1 pip average spreads on the EUR/USD are offered with no commission. Accounts are only denominated in USD, EUR, and JPY. This account offers the lowest ongoing trading costs of all the accounts at IronFX, but with a spread of 1.1 pips on the EUR/USD, is still wider than those found at other brokers.

Demo Accounts

IronFX offers demo accounts so traders can test the platform and practice strategies. There are four demo accounts available:

- Demo Floating Spread

- Demo STP/ECN Zero Spread

- Demo STP/ECN Absolute Zero

- Demo STP/ECN No Commission

Each demo account imitates actual trading conditions and comes loaded with 100,000 of the base currency of your choosing. Demo accounts expire after three weeks of inactivity and cannot be reactivated. Most other brokers have demo accounts that don’t expire, so this is an unusual move on the part of the broker.

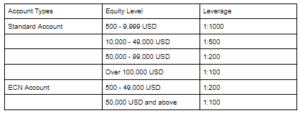

Note that leverage decreases with increasing equity, see the table below:

Overall, the ongoing and initial costs on all of IronFX’s account types are higher than other similar brokers, making it difficult to find any advantages for either beginners or more experienced traders.

Deposits and Withdrawals

IronFX offers a wide range of deposit and withdrawal methods, and while no fees are charged for most methods, withdrawals by bank wire transfer are expensive. Additionally, IronFX does not publish any details about deposits or withdrawals on its website.

In line with Anti-Money Laundering rules, IronFX does not process payments to third-party accounts. All withdrawal requests from a trading account will be funded to a bank account or source in the trader’s name.

Trading Account Currencies: Accounts can be denominated in the following base currencies: EUR, GBP, USD, JPY, PLN, AUD, BTC, IRX, ADA, PMA, CZK, ETH, and CHF. IronFX does not offer accounts denominated in NGN, which means that Nigerians will have to pay currency conversion fees. However, because IronFX offers such a range of trading account currencies, Nigerians can open multiple trading accounts with different base currencies to avoid paying fees on every trade.

Deposits and Withdrawals: IronFX offers a range of account funding and deposit methods, including local bank transfers, debit cards/credit cards, Bitcoin payments, and various eWallets. Deposits are free on all funding methods and are processed within 24 hours, which is around the industry average. However, it takes 48 hours on average for IronFX to process withdrawals, which is longer than most other brokers.

IronFX charges admin fees on some withdrawal methods and a fee of 50 USD for bank transfers under 300 USD.

Traders should note that IronFX does not publish the list of deposit and withdrawal methods it supports – one has to register an account to find this information. This is unusual and not consumer-friendly, as most brokers publish their withdrawal and deposit fees on their websites.

IronFX supports the following payment methods:

- Credit cards

- Debit cards

- Bank Transfer

- Skrill

- Neteller

- Digital Assets

- Bit Wallet

- Fasapay

- Perfect Money

Overall, IronFX offers a wide range of deposit and withdrawal methods, but it charges a fee of 50 USD for bank transfers under 300 USD, which is relatively expensive. Additionally, it is not transparent about its deposit or withdrawal fees.

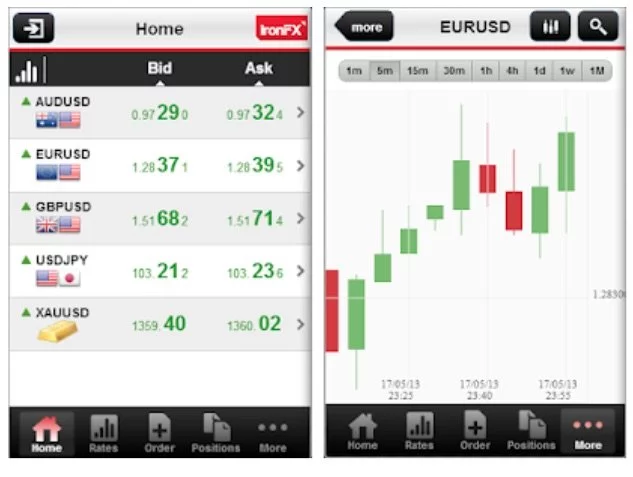

Mobile Trading Platforms

IronFX offers the MT4 mobile trading app and its own in-house web trader app, which is average compared to other brokers.

Webtrader App

The webtrader mobile app is a portal for MT4 that links seamlessly with the web trader desktop version. It is simple to set up and use, and traders can trade from the charts, deposit and withdraw funds, and can access IronFX’s educational and market analysis materials.

MT4

MT4 is available for both Android and iOS. Although there is slightly limited functionality compared to the desktop version of the platform, with reduced timeframes and fewer charting options, traders will still have access to analytics with technical indicators, graphical objects, and a full set of trading orders.

Additionally, spotty mobile connections can lead to a poor overall trading experience. Generally, it is better to be at your desktop to conduct day-to-day trading and use a mobile device to keep an eye on the markets or close open positions.

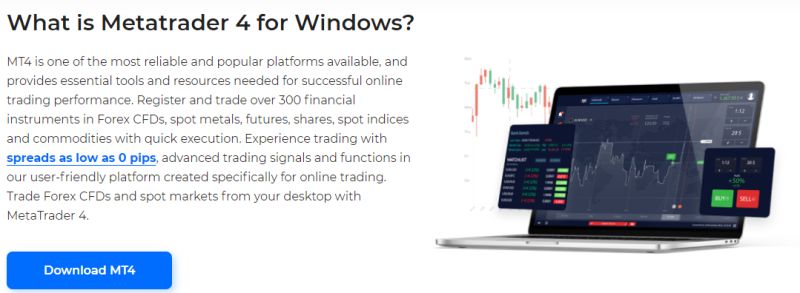

Other Trading Platforms

With support for Metatrader 4 only, IronFX’s trading platform choice is severely limited compared to most other brokers, but it offers the MT4 Advanced.

IronFX offers the standard out-of-the-box MT4 platform and an upgraded package labeled MT4 Advanced. The added functionality transforms MT4 into a state-of-the-art trading platform, allowing access to the industry’s latest trading features, such as permitted automated strategies and built-in ability to use EAs (Expert Advisors). A multi-page PDF is available to explain the added functionality.

As a trading platform, MT4 remains one of the most popular for its wide community support, trade execution speeds, charting tools, and customisability. Additionally, traders can take their own customised version of the platform with them should they decide to migrate to another broker.

Trading Platforms Overview:

Opening an Account at IronFX

The account opening process at IronFX is fast and hassle-free.

All Nigerian traders can open an account at IronFX if they meet the minimum deposit requirements.

The four-step account opening process is fully digital, and accounts are generally ready for trading in one day. IronFX offers individual, joint, and corporate accounts, but we will focus on opening an individual account.

How to open an account at IronFX:

- Click on the ‘Register’ button and register your email address and password. Additionally, traders need to select the account type, base currency, bonus, and level of leverage.

- Next, traders are will have to wait for the IronFX personnel to confirm the account.

- The third step requires depositing money through the client portal.

- The last step is to confirm your identity in order to make withdrawals. IronFX will need two documents from you:

- A photo ID (passport, driver’s license, or national ID card) and;

- A secondary ID (a bank or utility statement with your full name and address dated in the last three months).

We suggest you read IronFX’s risk disclosure, customer agreement, and terms of business before you start trading.

Compared to other similar brokers, IronFX’s account opening process is fast, generally hassle-free, and fully digital.

Trading Tools

IronFX’s trading tools are average compared to what’s available at other brokers.

IronFX offers a VPS service, Trading Central, TradeCopier, various trading calculators, and PMAM accounts:

VPS: IronFX offers VPS hosting through third-party providers free of charge for accounts above 5,000 USD. For those accounts which do not meet that threshold, a 30 USD monthly fee will apply. VPS enables you to upload and run your MT4 Expert Advisors and cAlgo Robots 24 hours a day without needing to keep your trading terminal running. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

PMAM: A Personal Multi-Account Manager (PMAM) is available, an in-house version of the MT4 Multi Account Manager (MAM) and the Percentage Allocation Management Module (PAMM), usually seen at other brokers. PMAM accounts are those on which a manager trades on the behalf of investors.

Trading Central: Trading Central is available to clients who register a live account. A third-party tool, Trading Central’s professional analysts use the most advanced technical analysis tools in the industry to curate relevant information. This tool essentially supports traders without the technical know-how to make trading decisions. Trading Central is one of the most popular trading tools available and provides excellent market analysis, and IC Markets does well to offer this service to its clients.

TradeCopier: TradeCopier is a platform developed by IronFX. It allows you to connect a part of your portfolio with the portfolio of a trader of your choosing. Once you copy a trader, all of their opened trades are copied to your account. All of their actions in the future are automatically copied to your account, as well. When you first register, you can select only one Strategy Provider, but later on, you can follow more Strategy Providers through the TradeCopier platform. Copy trading is a great option for traders who lack the experience or time to follow the markets.

IronFX also offers a range of trading calculators, including a currency converter, a pip calcultor, a margin calculator, and a profit calculator.

Overall, IronFX offers a good range of trading tools, but its VPS service requires a high minimum deposit.

Trading Tools Overview:

Educational Material

IronFX’s educational materials are limited compared to other large international brokers.

On the whole, besides the video material, blog content, and one downloadable e-book, IronFX’s educational materials lack depth and provide only a sweeping overview of the basics of forex trading.

Videos: The video materials highlight IronFX’s market experts and analysts as they explain the basics of forex trading and the fundamentals to risk management and advanced trading strategies. They also cover concepts that interest more advanced traders. Some of the video material is only available for traders who open a live trading account and make a deposit. However, the video material, while more comprehensive than other aspects of IronFX’s education section, is disorganized, and it’s difficult to find what you’re looking for.

IronFX’s blog content is curated by IronFx’s in-house analysts and is updated frequently. The blog content is a mixture of educational materials, explaining concepts such as technical and fundamental analysis, and also provides an overview of the markets. The blog content is updated every two to three days.

IronFX used to offer webinars and seminars, but unfortunately, these are no longer available.

Overall, although IronFX offers a wide range of informative video content, the materials generally lack substance and are not well-structured.

Education Overview

Research and Analysis

IronFX’s research and analysis materials are more comprehensive than its education section, but compared to other large international brokers, they are still lacking.

A duo of in-house analysts provides market commentary on breaking news insights. The presentation and depth of these materials are acceptable but fall short of what is on offer at other large brokers. Additional market news can be found in the video section mentioned above.

Live economic news, current rates, analysis, and economic calendar data are delivered directly to your trading platform to help you plan your trading day and uncover the most profitable opportunities.

Overall, while the market research is updated frequently, the breadth of the material trail many of IronFX’s competitors.

Customer Support

Customer support is available 24/5, in 30 different languages, to support clients from over 180 countries in Europe, Asia, the Middle East, Africa, and Latin America.

IronFX can be contacted on local toll-free phone numbers, live chat, and email.

For the purposes of this review, we found customer support responsive but uninformed. They were unable to answer many of our questions and seemed generally confused.

Safety and Industry Recognition

Regulation: IronFX has oversight from every major regulator in the world, including the Financial Conduct Authority(FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC). It is also regulated by the Financial Services Commission Authority (FSCA) of South Africa and is registered in Bermuda. See below for details:

- Notesco Ltd (UK) is authorised and regulated by the FCA in the United Kingdom, license 585561.

- Notesco Financial Services Limited is authorised and regulated by CySEC in Cyprus, license 125/10.

- Notesco SA (Pty) Limited is authorised and regulated by the Financial Sector Conduct Authority (FSP no. 45276).

- Notesco Pty Limited is authorised and regulated by ASIC in Australia, AFSL no. 417482.

- Notesco Limited is registered in Bermuda under the Bermuda Monetary authority (BMA) with registration number 51491.

Awards

IronFX has excellent credibility within the industry, having won over 40 awards since its inception. Awards include:

- Best Online FOREX Trading Platform 2021 (Global Business Insights)

- International – Online Currency Trading Platform of The Year, Ironfx 2021 (Gamechangers Global Awards)

- Most Outstanding Online Trading Partners Program (AI Global)

Overall, because of its strong regulation with some of the best international, a long history of responsible behaviour, and wide industry acclaim, IronFX is considered a safe broker to trade with.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process, which includes a detailed breakdown of the IronFX offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Warning

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. IronFX would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66.22% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

IronFX is a globally-recognised, remarkably well-regulated Forex broker with a range of assets on offer, including over 80 Forex pairs, which is more than other brokers. Trading conditions are poor across most account types, but IronFX allows traders to choose from a wide range of options, including the execution method that suits their trading strategy. IronFX only offers support for the MT4 platform, including the MT4 Advanced package for a superior trading experience, but educational and market analysis materials are lacking, forcing traders to self-educate elsewhere.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how IronFX stacks up against other brokers.