For over a decade, FxScouts Nigeria has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and African markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

- Pepperstone - ECN Broker with no Minimum Deposit

- FXTM - ECN Broker with High Leverage and Low Fees

- IC Markets - Best ECN Broker for Beginners

- FP Markets - Best ECN Broker for Scalping

- Axi - Best ECN broker on MT4

- FBS - ECN Account with Lowest Spreads

- Vantage - Best ECN Broker for Pro Traders

- ThinkMarkets - Best ECN Account for Crypto Trading

These are the best ECN Brokers for 2024

How to compare ECN brokers

ECN brokers use high-speed networks to find the best pricing available and execute trade orders as quickly as possible. Where a ECN broker gets its market pricing and how fast it executes trades should always be considered alongside other more standard broker metrics. When comparing ECN brokers, always consider:

Trading cost: Traders seek out ECNs brokers because of their low trading costs. Trading costs on ECN accounts are a combination of the spread and a commission. Trading costs for one lot of EUR/USD at ECN brokers will range from 6 USD to 18 USD, depending on the broker’s trading conditions.

Execution quality: A combined metric used to discuss execution speed, slippage and rejection rate, execution quality describes the connection between the broker and the market and will directly impact the level of control a trader has over their positions. A high-grade ECN broker will have fast execution speeds, which leads to less slippage in pricing between when the order is executed and when it is opened, and less order rejection due to unavailable counterparties. Better execution quality will produce fewer unintentional losses.

Execution venues: ECN brokers are never counterparty to client trades. Instead, it uses its network to place trades with third parties. These third parties are called execution venues. The more execution venues an ECN broker has, the more competition there will be for its client’s trades, leading to lower spreads and lower overall trading costs for traders.

Tradable Assets: A good ECN broker will offer clients a larger number of FX Pairs and other CFD assets to trade. Having a limited set of trading assets can negatively affect the traders, as they would miss out on trading opportunities.

Regulation: Regulators monitor the activities of the broker and the trading desk. Unregulated ECN brokers are dangerous as there is no way of telling if they are ECN brokers without making a deposit and opening a trade. Brokers regulated by the FCA (UK), ASIC (Australia) or MAS (Singapore) have better reputations for enforcement and thus ensure their member ECN brokers strictly follow protocols designed to protect clients and their trades.

Trading tools: Leading ECN brokers will offer traders a free Virtual Private Server (VPS) service, guaranteeing high-quality execution around the clock. Other trading tools offered by the best ECN brokers include indicator packages to assist with automated trading and in-platform market analysis tools such as Trading Central or Autochartist.

Pepperstone – ECN Broker with no Minimum Deposit

Who Pepperstone is for: Traders looking for a low-cost ECN broker with no minimum deposit and a choice of trading platforms.

Why we like Pepperstone: Pepperstone’s low-cost ECN trading service, fast trade execution, and range of third-party trading platforms has made it popular amongst experienced traders and serious beginners around the world. Pepperstone’s Standard Account has no commission and spreads starting at 1.00 pips on the EUR/USD, making it one of the lowest-cost trading accounts available. For traders who prefer raw spreads, the Razor Account has spreads down to 0 pips on the EUR/USD and a commission of 7 USD per trade. With average execution speed below 30ms, both accounts are suitable for scalpers and other traders who rely on bots for automated trading. Pepperstone supports all three major trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which is easier to learn but still has the sophisticated automation tools found in MT4 and MT5. Serious beginners looking for an ECN broker should take note that Pepperstone has scrapped its minimum deposit requirement, though it still recommends starting with at least 200 USD.

Pepperstone drawbacks: Pepperstone does not offer its own easy-to-use trading platform so beginners will have to learn how to use MT4, MT5 or cTrader. Beginners who decide to open a Razor Account will also need to calculate commission costs. Both issues can be reduced by using the cTrader trading platform, which has a flat commission structure and is easier to learn than MT4 or MT5.

FXTM – ECN Broker with High Leverage and Low Fees

Who FXTM is for: Traders who don’t mind paying a higher minimum deposit for low trading fees and higher leverage.

Why we like FXTM: Traders looking for an ECN account with high leverage will be immediately drawn to FXTM’s Advantage Account. Maximum leverage here is 2000:1, a level rarely seen at ECN brokers. This high leverage is combined with low trading fees, with spreads starting at 0 pips on the EUR/USD and commission of 4 USD round-turn, lower than most other ECN brokers. Available on both the MT4 and MT5 trading platforms, the Advantage Account requires a minimum deposit of 500 USD. For traders who prefer commission-free trading, the Advantage Plus Account offers a wider average spread of 1.5 pips (EUR/USD) and no commission. Both the Advantage and Advantage Plus accounts offer trading on 48 currency pairs, 3 spot metals, 14 spot CFDs on the MT4 platform, and trading on 33 currency pairs, and 2 spot metals on the MT5 platform. FXTM also provides FXTM Invest, a powerful copy-trading.

FXTM drawbacks: The obvious drawback here is the high minimum deposit of 500 USD. This will put FXTM’s ECN accounts out of reach for most beginners. Beginners should also beware of leverage this high, trading with 2000:1 leverage requires careful risk management. Without a carefully designed trading strategy high leverage can easily wipe out a trading account. Another minor gripe is that traders cannot use the cTrader trading platform at FXTM.

IC Markets – Best ECN Broker for Beginners

Who IC Markets is for: IC Markets is for beginner traders looking for an ECN broker with low fees, great educational content and 24/7 customer support.

Why we like IC Markets: IC Markets provides one of the most welcoming environments for beginner traders looking for an ECN broker. It’s not just the low trading fees, IC Markets also offers an archive of structured course material and expert-led webinars. Beginners can also take advantage of IC Markets excellent 24/7 technical support. Trading fees are lowest on IC Markets two Raw Spread Accounts, both with variable spreads averaging 0.1 pips on the EUR/USD. Being Raw Spread accounts, they both have a small commission per trade. IC Markets also has a Standard Account with no commission, but spreads start at 1 pip, meaning trading costs are near the industry average. Another major selling point for IC Markets is the range of trading platforms, with MT4, MT5 and cTrader all supported. IC Markets pricing relies on 25 different liquidity providers, ensuring that trading fees remain low.

IC Markets drawbacks: While beginners will enjoy the low trading costs, IC Markets’ minimum deposit is higher than some other ECN brokers at 200 USD. And while the educational content here is of fantastic quality, traders will find better market analysis elsewhere.

FP Markets – Best ECN Broker for Scalping

Who FP Markets is for: Scalpers looking for raw spreads and fast execution on the MT4, MT5 and cTrader trading platforms

Why we like FP Markets: FP Markets supports the MT4 and MT5, as well as the newly added cTrader trading platforms with 60+ FX pairs, shares, metals, indices, commodities, and cryptocurrencies to trade. With average spreads for EUR/USD at 0.1 pips, GBP/USD at 0.2 pips and USD/JPY at 0.1 pips, FP Markets’ pricing is comparable with Pepperstone and other industry-leading ECN brokers. And with an Equinix server cluster, most trades are executed in under 40 milliseconds, much faster than other ECN brokers. This makes FP Markets an excellent broker for scalping and EA trading on the Metatrader trading platforms. The commission is also low at 6 USD per lot round turn, and the minimum deposit is only 100 AUD (or currency equivalent).

FP Markets’ drawbacks: FP Markets provides ECN pricing but is not a true ECN broker; it streams its pricing directly from its liquidity providers. It does have a trading desk to manage risk but follows a no-dealing-desk intervention model. Traders should also be aware that FP Markets charges fees on most withdrawal methods.

Axi – Best ECN broker on MT4

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Who is Axi for: Traders who only use the MT4 trading platform and want an ECN broker with great trading tools and aren’t too bothered about trading shares.

Why we like Axi: Axi, formerly AxiTrader, stands out for three reasons: First off, it’s an MT4-only broker, so if you want to use any other trading platform you can look away now. Secondly, it’s an ECN broker with low fees, no minimum deposit requirement, and two simple accounts: One with commission and one without. Finally, it has a fantastic collection of trading tools that it offers for free to its clients. These include Axi’s MT4 NexGen plugin which includes an advanced sentiment indicator, a correlation trader, and an automated trade journal. Other free trading tools include Autochartist, MyFxbook, and PsyQuation. Autochartist is a tool that automatically identifies trading opportunities, MyFxBook is one of the world’s most popular copy-trading platforms and PsyQuation is an AI trade diagnostic that helps traders learn from their mistakes. And while the fees on its trading accounts aren’t the lowest available, they are below the industry average. The Pro Account is good value, with spreads averaging 0.1 pips on the EUR/USD and a 7USD commission.

Axi drawbacks: The obvious drawback here is Axi’s insistence on only providing support for the MT4 trading platform. Apart from putting some traders off, this also results in a smaller range of trading assets. Axi only recently added a handful of share CFDs to its product line-up. That said, Axi does have a good range of cryptocurrencies to trade.

FBS – ECN Account with Lowest Spreads

Who FBS is for: Forex-only traders looking for the lowest possible spreads, high leverage, and don’t mind a higher minimum deposit

Why we like FBS: FBS only offers a single ECN trading account, but the trading conditions are ultra-competitive. The FBS ECN Account is the only ECN account to achieve a negative spread, down to -0.1 pips on the EUR/USD at times but averaging 0 pips. Commissions are also lower than the industry average at 6 USD round turn. Professional traders will also appreciate the 500:1 leverage available and the unlimited number of orders that can be open or pending at one time.

FBS Drawbacks: There are several limitations to the FBS ECN Account. It’s only available on the MT4 trading platform and the minimum deposit is high at 1000 USD. The most difficult limitation for many traders will be the severely restricted range of assets to trade, with only 24 Forex pairs available. No multi-asset CFD trading here.

Vantage FX – Best ECN Broker for Pro Traders

Who Vantage FX is for: Experienced and professional traders who value low fees and aren’t concerned by high minimum deposits. Users of the ZuluTrade social trading platform will also find a home here.

Why we like Vantage FX: For Nigerian traders looking for a professional-grade ECN/STP broker, Vantage FX ticks many boxes: Supports for both the MT4 and MT5 trading platforms, STP execution to prevent slippage, and a wide range of markets to trade, including FX pairs, indices, commodities, and share CFDs. Vantage FX offers three account types, Standard STP, Raw ECN and Pro ECN. Professional traders will be interested in the Pro ECN account, which has a minimum deposit of 20,000 USD, spreads starting from 0.0 pips, and a very low 4 USD round turn commission. The Raw ECN is a good deal too, with spreads starting 0 pips but a slightly higher commission of 6 USD round turn. Vantage FX also offers support for the ZuluTrade social trading platform, which provides access to a vast pool of professional traders and profitable trading systems. ZuluTrade enables users to locate successful traders that are ranked by ZuluRank, a proprietary performance evaluation algorithm, and follow their trades which are translated into real trades in their own trading accounts.

Vantage FX drawbacks: The high minimum deposits at VantageFX will put most beginners off, with the Raw ECN account requiring 500 USD and the Pro ECN Account an eye-watering 20,000 USD. But for those that aren’t put off by these amounts, the advantage is low ongoing trading fees. Prospective clients should also note that Vantage FX does charge withdrawal fees on some funding methods too.

ThinkMarkets – Best ECN Account for Crypto Trading

Who ThinkMarkets is for: Traders who want low fees on their Forex trades but would also like to trade cryptocurrencies

Why we like ThinkMarkets: The ThinkMarkets ThinkZero Account is a popular account with ECN-pricing on the MT4 and MT5 trading platforms. Trading costs and conditions are standard compared to other brokers on this list, with spreads down to 0 pips on the EUR/USD and a 7 USD round-turn commission. ThinkZero Account holders do get a personal account manager though, and access to leverage of 1:500. The greater attraction here is access to ThinkMarkets’ stable of cryptocurrencies, with 20 to trade, including DASH, Monero and Shiba Inu. Cryptocurrency traders will also have 24/7 customer support, so weekend crypto trading won’t have to be halted due to technical issues.

ThinkMarkets drawbacks: Once again, the main drawback here is that the ThinkZero Account is not a pure ECN account but instead a market-execution STP account with ECN-pricing. Additionally, the cost of entry is relatively high, with a minimum account balance of 500 USD needed to open this account.

What is an ECN Broker?

An ECN broker connects traders to a network of liquidity providers, unlike a Market Maker broker which takes trades on to its own books.

ECN stands for Electronic Communication Network. An ECN broker sits at the centre of this communication network, like a spider in a web. The other members of the network are liquidity providers (like banks, hedge funds and other brokers).

ECN stands for Electronic Communication Network

Every time a client places a trade with an ECN broker it collects prices from the members of this network and presents the trader with the tightest spread it could find.

Because the liquidity providers in this network are competing for your trade, ECN brokers have very tight spreads – often down to 0 pips at times of high volatility.

ECN Brokers have very tight spreads

Traditional brokers (Market Makers) have wider spreads because they charge a fee in the spread. But ECN brokers do not make any money from the spread. Instead, they will charge a commission, this is their fee for playing matchmaker and finding a counter-party to your trade.

ECN brokers charge a commission per trade

Some traders prefer to trade with ECN brokers because they have no conflict of interest. Most market maker brokers will trade against their clients, which means that they make money when their traders lose.

Because ECN brokers only act as an intermediary for a trade, they do not make money when traders lose. In fact, the reverse is true. Over time, a successful trader pays more in commission to an ECN broker, so ECN brokers want their clients to be profitable.

ECN brokers make more money when traders profit

AND

Market Maker brokers make more money when traders lose

One common issue with ECN brokers is slippage and requotes. Because ECN brokers rely on external liquidity to match client’s trades, they are not always posted instantly. This can be a problem at times of high volatility – usually after a large event or data release – or at times of low liquidity – such as when most of the markets are closed. This also means that the market can move past your stop-loss orders, and your losses may exceed your expectations.

ECN Brokers have a higher risk of slippage and requotes

The last thing to be aware of with ECN brokers is that they generally require a larger minimum deposit – setting up and maintaining an ECN brokerage is an expensive business and traders will be charged more as a result.

ECN Brokers require higher minimum deposits

Which is the Best ECN Broker?

Axi is the best ECN broker. With competitive pricing on raw spreads, high liquidity, and fast execution Axi won our Award for Best ECN Broker of 2020.

Other highlights include a detailed and well-structured course for beginners and leading market analysis for all clients. Axi combines exceptional ECN trading conditions with world-class regulatory oversight. Read our full Axi review here.

What is the difference between an ECN Broker and a Market Maker Broker?

When you place a trade with an ECN broker, the counterparty to your trade will be a liquidity provider from the broker’s network. When you place a trade with a market maker broker, the broker themselves will be the counterparty to your trade. Market Makers create an artificial market for their clients – hence the name.

Market Makers always act as counterparty to your trade

Market Makers are also known as dealing desk brokers, as all trades will be filled at the rates set by the broker’s internal dealing desk. This business model, which means a market maker will always profit from their clients’ losses, generates an inherent conflict of interest which many traders are cautious of.

Currently, most well-regulated market makers are well regarded in the industry, despite the conflict of interest, and they go to great lengths to ensure their clients are not being unfairly treated.

But, Market Maker brokers are not a common choice for experienced Forex traders. Traders are limited to trading with one counterparty who is always trading against you and never on the open market with dynamic spreads.

That said, if you do want instant execution of your trades and you don’t want to pay a commission, a trusted market maker is a good idea.

How to Identify an ECN Broker?

There are a few ways to check: ECN brokers will describe their execution model in their legal documents, ECN brokers will always have variable spreads, ECN brokers will not have any trading restrictions (trade size, stop-loss limits, scalping or hedging bans), and traders with an ECN broker will experience both negative and positive slippage.

Read the Broker Agreement

All regulated brokers are required by law to publish a Client Agreement and Order Execution Policy stipulating their execution methods. Some ECN brokers will also act as Market Maker in certain circumstances, so this is not an always foolproof method of determining a broker type. See below for an extract from Pepperstone’s execution policy showing that they are an ECN broker.

Check that Spreads are Variable

ECN’s offer tight spreads and charge a commission per trade, and the spreads will also be variable. Fixed spreads are only offered by Market Makers, as they are not taken from a live and dynamic market. Below you can see that Axi publishes its live spreads on its website, these are variable and are taken from their network of liquidity providers.

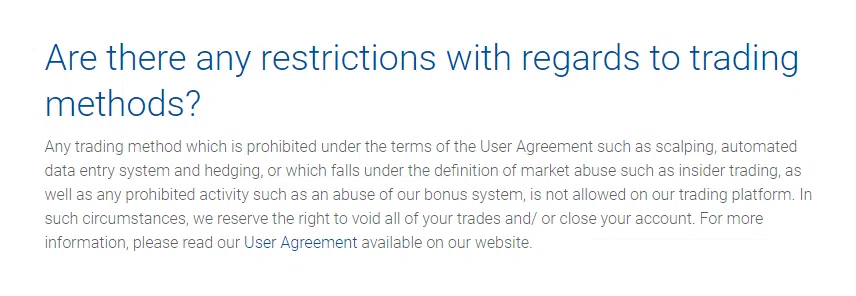

Look for Trading Restrictions

ECN brokers will never restrict your trading methods or trade size. This means that all automated trading, scalping, hedging and large order sizes (anything of 5 lots or over) will all be allowed. If a broker restricts any of these then it is not an ECN broker.

A good example of a broker with these restrictions is Plus500, a well-known market maker:

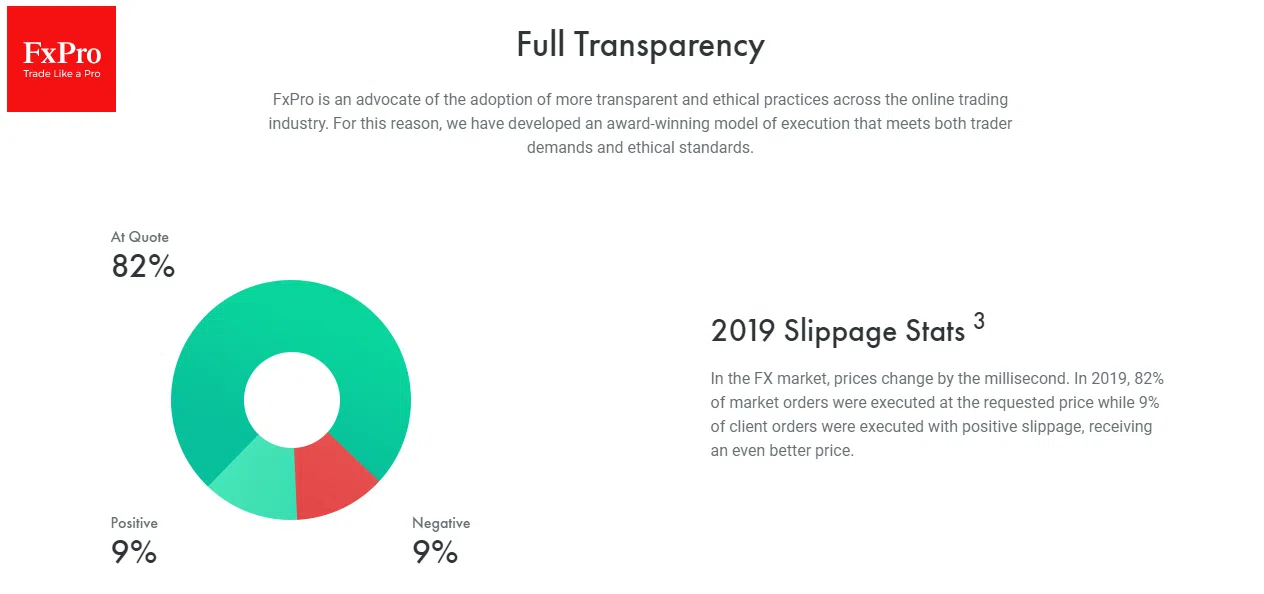

Slippage will be Positive and Negative

Slippage is the difference between the execution price and the order price at the time the order is submitted for execution. Slippage is a normal aspect of trading with ECN brokers, particularly for orders of a larger size and during times of thin liquidity and/or volatile market conditions.

Slippage can both positively and negatively impact your trading position. If you find that you are only experiencing negative slippage, then your broker is not using an ECN execution method. Another well known ECN broker is FxPro, which is dedicated to full transparency and always publishes its slippage statistics, see below for its 2019 figures:

Summary

So, while ECN brokers do not have the inherent conflict of interest present with market makers, commission will always be charged on your trades. ECN accounts will also require a higher minimum deposit – putting them out of reach for many beginner traders.

Are ECN brokers objectively better than market maker? This is not necessarily the case. All brokers we work with are trustworthy and well-regulated and broker choice is always down to personal preference. Whether you go with an ECN broker or a market maker, if you choose one from our list of the best in South Africa you will be in good hands. Interested in knowing more – here is our article on how to compare Forex brokers overall.

FAQs

What is the difference between an ECN Account and a Standard Account?

ECN Accounts will have tighter spreads than a Standard Account, but you will have to pay a commission per trade. Standard Accounts will not have any commission, but spreads will be wider.

How do ECN Brokers Make Money?

ECN Brokers make money by charging traders a commission per trade. Because they pass pricing on directly from their liquidity providers, they do not charge a fee in the spread.

Which is better, ECN Brokers or ECN/STP Brokers?

ECN/STP brokers are better because they will have less slippage and a faster execution speed than a pure ECN broker.

STP (Straight Through Processing) is the method of the transaction – with STP your order is sent directly to the counterparty through the Financial Information Exchange (FIX) protocol. The FIX protocol decreases trade execution time, reduces slippage, and ensures that traders get the best available pricing.

The STP protocol can be used by market-maker brokers as well as ECN brokers, and some brokers use a hybrid formula, where they will sometimes be the counterparty, and other times use an external liquidity provider. While this does lead to less slippage, it does mean that some trades will have a conflict of interest.

In most cases choosing a hybrid broker is the best way to go, as they will give you the most options.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our State of the Market Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.