-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | ASIC, BaFin, DFSA, CFTC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

Last Updated On Sep 8, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on IG

One of the most popular brokers in Nigeria and the largest CFD broker in the world by revenue, IG Markets has two low-cost trading accounts – one of which provides direct market access. With possibly the widest range of CFDs in the world, IG Markets offers trading on over 17,000 instruments, including Forex, indices, share CFDs, commodities, cryptocurrencies, digital 100s, options, ETFs, bonds, and interest rates.

On both accounts – the OTC Account and the DMA Account – IG Market’s trading costs are low compared to other similar brokers, with no minimum deposit requirements and tight spreads, averaging 0.86 pips on the EUR/USD. IG Markets offers trading on its own award-winning platform, as well as MT4 and L2 Dealer – a DMA specific platform for experienced traders. In addition to a wide range of trading tools, IG Markets also provides a world-class selection of educational and market analysis materials to get new traders started.

Overall, both beginner and experienced Forex traders won’t find a much better broker than IG Markets, and it is one of our highest-rated brokers for good reason. Combined with regulation from the FCA and ASIC, a long history of satisfied clients, and vast industry recognition, IG Markets is hard to beat.

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | ASIC, BaFin, DFSA, CFTC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Great platform choice

- Excellent education

- Excellent market analysis

Cons

- High minimum deposit

Is IG Markets Safe?

IG Markets is regulated by 17 national authorities and is publicly listed on the London Stock Exchange, but Nigerian clients will be trading through the Bermuda-regulated subsidiary which has less regulatory supervision than IG Markets’ companies based in the UK and Australia.

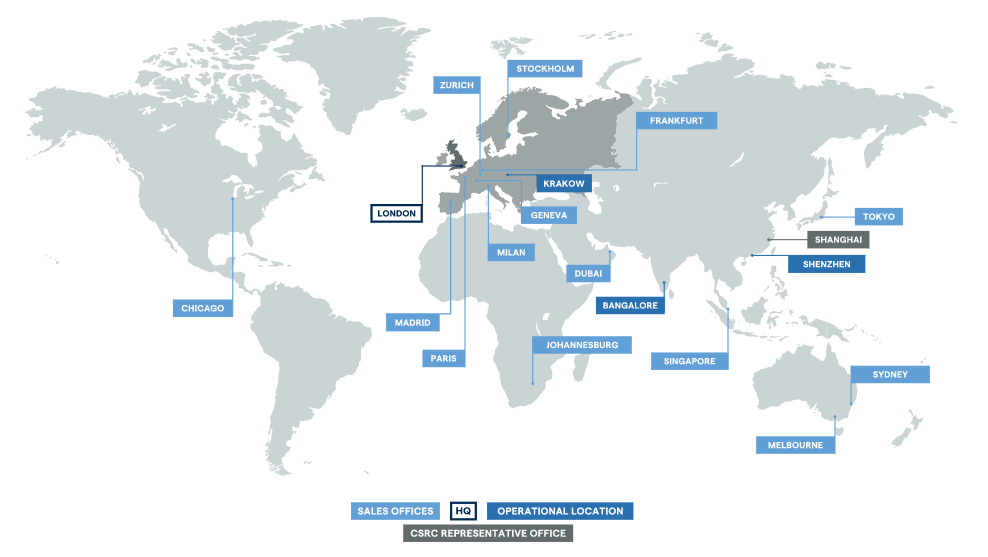

Founded in 1974 and headquartered in the United Kingdom, IG Markets is the largest Forex and CFD broker by revenue (as of June 2020) with 240,000 clients worldwide. IG Markets has 19 offices across the world and is regulated by 17 national authorities, including the Bermuda Monetary Authority (BMA), the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA) and the New Zealand Financial Markets Authority (FMA).

IG Markets’ holding company, the IG Group, is also listed on the London Stock Exchange and is a constituent of the FTSE 250 Index, adding a further level of regulatory scrutiny. See below for more details:

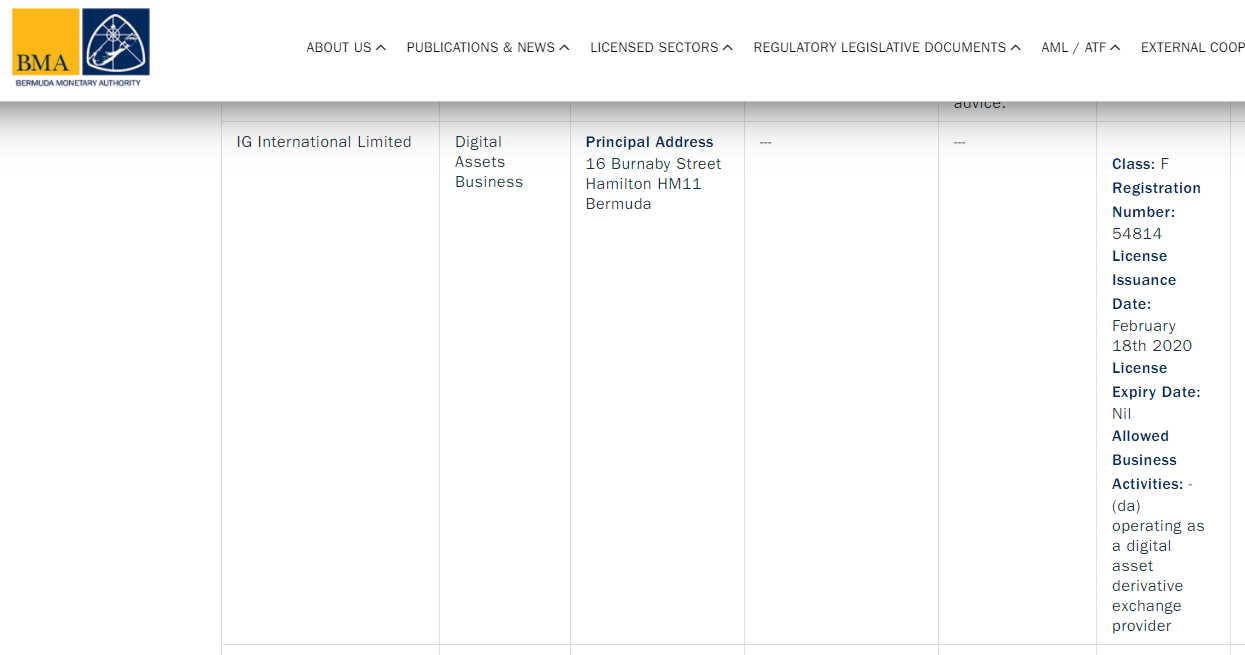

- IG International Ltd is licenced and regulated by the BMA (Registration number 54814)

- IG Market Ltd is authorised and regulated by ASIC (license 22044) and the FMA (FSP No. 18923)

- IG Australia Pty Ltd is authorised and regulated by ASIC, license 515106

- IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority, license 195355.

In Nigeria, clients of IG Markets will be trading with IG International Ltd, which has been licenced by the BMA since February 2020. IG International Ltd was created in 2020 to focus on IG Markets’ clients in Africa, South America and Asia.

The Bermuda Monetary Authority (BMA) has become a popular location for Forex brokers in recent years to avoid the restrictions placed on them by the regulators in Europe and Australia. While this means that Nigerian traders will have access to increased leverage and cash rebates for high-volume trading, the BMA is not considered a strong regulator and Nigerian traders will not have negative balance protection or access to any kind of compensation or official conflict resolution in the event of any dispute with IG Markets.

It is worth pointing out that IG Markets has a long history as a trusted Forex broker and all client money is held in segregated accounts and ring-fenced from creditors, in case of broker bankruptcy.

In addition to its broad regulatory supervision and long track record of responsible operation, IG Markets continues to receive industry from across the world.

- Number 1 in Australia by primary relationships, CFDs & FX (Investment Trends December 2020 Leveraged Trading Report)

- Best Finance App 2020 (ADVFN International Financial Awards)

- Best Multi-Platform Provider 2020 (ADVFN International Financial Awards)

- Overall Personal Wealth Provider 2020 (Online Personal Wealth Awards)

- Best CFD Provider 2020 (Online Personal Wealth Awards)

- Winner of Best Forex Trader 2019 (Investopedia Online Brokers Awards)

Because of the active internal client protection policies and processes, strong regulation, and acclaim from the industry, we consider IG Markets a safe and trustworthy broker.

IG Markets Trading Costs

IG Markets’ trading fees are low compared to other Forex brokers.

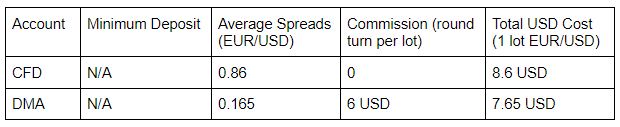

Unlike other brokers that offer a range of account types with lower spreads linked to higher minimum deposits, IG Markets only offers two accounts. The most popular account is IG Markets’ commission-free CFD trading account which is available on all supported trading platforms. For more on IG Markets’ trading platforms, click here.

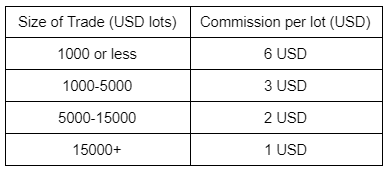

IG Markets also offers a Direct Market Access (DMA) Account on the L2 Dealer platform. This account is limited to Shares and Forex trading and provides tighter spreads in return for a commission that decreases depending on trading volume. It’s important to note that IG Markets recommends DMA trading on the L2 Dealer platform for more experienced traders only. For more on IG Markets account types, click here.

IG’s fee structure is transparent, and it publishes all trading fees. IG Markets’ accounts were assessed to compare the costs to those of other Forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads:

Trading Cost Formula: Spread x Trade Size + Commission = Total Cost in Secondary Currency (USD)

As you can see, the CFD account’s fees are built into its spreads, so there are no extra costs, except for the interest fees charged on positions held overnight. It’s worth noting that while the average spread on the EUR/USD is 0.86 pips for the CFD Account, spreads are variable at IG Markets and the EUR/USD can sometimes be as low as 0.6 pips.

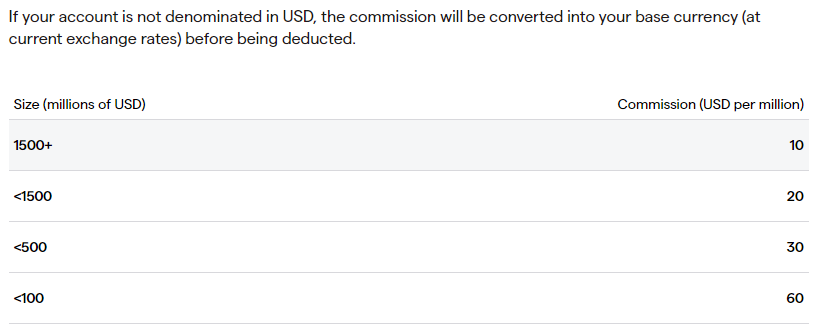

The DMA account does offer much tighter spreads but there is a commission per lot traded. While the 6 USD round-turn commission is slightly lower than average compared to other brokers, this can be reduced even further with high volume trading:

Average trading costs for one lot of EUR/USD amongst IG Markets’ competitors are about 9 USD. So, whichever account you decide to trade with, IG Markets’ ongoing trading costs are lower than the industry average. High volume traders will find trading costs much lower than average with the reduced commission.

While IG Markets does not publish its overnight financing rates (swap rates), these can be viewed via the trading platform. For Forex trading, IG Markets charge the swap fee based on the current tom-next rate. Tom-next shows, in points, the difference between the interest paid to borrow the currency that is being notionally sold, and the interest received from holding the currency. Once the tom-next rate has been calculated for a trading position, IG Markets will add an admin fee of 0.8%.

Compared to other market makers, IG Markets’ trading costs are low. In addition, neither of IG Markets’ accounts have a required minimum deposit, making it a good choice for both beginner traders.

IG Markets Non-trading costs

IG Markets has higher than average non-trading costs than other brokers

While there is normally no fee for IG accounts, inactive CFD accounts are charged an 18 USD fee on the first of every month if no dealing activity has occurred for two years or more. This fee is only charged if you still have funds in your account. This fee is lower than average than most other brokers, and most brokers will charge you after a 6 month inactivity period.

Traders may be dissatisfied with IG Markets when it comes to the higher than average deposit costs, but withdrawals are generally free of charge. For more on IG Markets’ deposit and withdrawal fees, click here.

Another cost to be aware of is a currency conversion fee of 0.5% when trading CFDs denominated in a currency other than your account’s base currency. This can be problematic considering the difficulty of switching base currencies at IG Markets, for more on this click here.

It’s worth pointing out that IG Markets is completely transparent about its deposit costs, even if these are higher than other similar brokers.

Opening an Account with IG Markets

The account opening process at IG Markets is slower than at other brokers and requires detailed information regarding the state of your finances and your trading knowledge.

All Nigerian traders are eligible to open an account at IG Markets, and with no minimum deposit required new traders don’t have to worry about funding the account right away.

The account-opening process at IG is relatively easy but identity verification can take up to two days. Until your identity has been verified, you will not be able to use your trading account. IG Markets offers joint and individual accounts, but we will focus on opening an individual account:

- New traders will have to click on the “Create Live Account” button at the top of the page, where they will be directed to register an account with a country of residence, full name and email address. You will also have to create a username and password.

- Once this step is completed you will be asked to complete a short form that will help IG Markets understand the state of your finances and your trading knowledge.

- While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- Once this form is completed, traders will have to submit the Know Your Customer (KYC) documentation:

- IG Markets requires proof of identification (such as current passport, ID card, or driver’s licence)

- Proof of address such as a utility bill or bank statement that is less than six months old.

- The account will be ready for trading once documentation has been verified, which can take two, or sometimes three days.

We advise you to read IG Markets’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, IG Markets’ account opening process is relatively hassle-free and all documents can be uploaded digitally. But identity verification does take longer than other brokers – most other brokers will be able to verify your identity within a matter of hours rather than days.

IG Markets Account Types

IG Markets offers two account types, which is average for large brokers, and the main CFD trading account is suitable for both beginners and more experienced traders.

IG Market offers two main account types for Forex and CFD trading with over 17,000 instruments available to trade, including over 90 Forex pairs, indices, share CFDs, IPO trading, commodities, cryptocurrencies, digital 100s, options, ETFs, bonds, and interest rates. For more on IG Markets trading instruments click here.

A corporate account option is also available if you wish to trade as a corporate entity rather than an individual. In addition, IG Markets offers leverage of up to 30:1 for major currency pairs, and average spreads on the EUR/USD are 0.86 pips, which is very competitive for a market maker broker.

CFD Trading Account

No minimum deposit is required to open a CFD trading account. Traders can choose to trade on either the MT4 platform, in which case spreads will average at 0.75 pips on the EUR/USD, or they can trade on the IG platform, where spreads average at 0.86 pips on the EUR/USD. However, there are marked differences between using the MT4 and IG proprietary platforms. Click here for more on IG Markets trading platforms.

DMA (Direct Market Access) Account

Spreads average at 0.165 pips on the EUR/USD, and commissions are based on the trading volume (see below for more details). Traders can only use the L2 Dealer platform when choosing the DMA account option.

Additional Accounts

IG has Share dealing and IG Investments Smart Portfolios accounts. These are non-leverage account types that let you trade stocks and shares.

IG Markets Deposits and Withdrawals

IG Markets charges no deposit or withdrawal fees for bank wires, but credit card deposit fees are higher than with other brokers.

In line with Anti-Money Laundering policies, IG Markets returns all non-profit funds to the original deposit source. No matter your deposit method, the withdrawal of all profits must be made by bank transfer to a bank account in your name. However, IG Markets can consider special cases where this is not an option.

Deposits

Traders can deposit funds via debit/credit card (Visa and Mastercard), bank wire transfers (also available on BPAY), and PayPal.

- Bank Wire: Deposits by bank wire are free of charge and take up to three business days to reflect. There is no minimum deposit requirement for bank wires.

- Credit and Debit Cards: While deposits made with a debit card are free of charge, IG Markets charges a fee of 1% on deposits made by Visa credit cards and 0.5% fee on deposits made by MasterCard credit cards. Deposits will reflect instantly for both debit and credit cards. The minimum deposit requirement is 300 USD on credit cards, and the maximum deposit per day is 50,000 USD.

Withdrawals

IG Markets does not charge a fee for withdrawals but the minimum withdrawal amount is 200 USD. Withdrawals are processed on the same day but may take two to five days to reflect.

While withdrawal costs are low and withdrawal times are average for the industry, IG Markets does charge fees on deposits via credit card. This is unnecessary and not common amongst other brokers.

IG Markets Base Currencies

Opening an account in a different base currency to USD with IG Markets – or switching base currencies – is a hassle compared with other brokers.

While IG Markets does allow traders to select different base currencies other than USD, new accounts are always denominated in USD by default. This can only be changed by emailing IG Markets support team with your name, date of birth and address, and the account number you would like to change.

This obviously takes some time and is a serious hassle for traders who trade exclusively in AUD CFDs and want to avoid the 0.5% conversion fee. In addition, IG Markets does not publish the list of base currencies it supports – so traders will have to email customer support to find out whether their chosen base currency is available.

Overall, this is strange behaviour from one of the most respected CFD brokers in the world. Most CFD brokers have no problem with letting new customers open their trading account in a range of currencies, and switching base currencies is usually an easy process. Why this is quite so difficult for IG Markets is an open question – but it does make fee-free trading in EUR or AUD denominated CFDs a hassle.

IG Markets Trading Platforms

IG Markets supports three trading platforms across mobile and desktop devices, including its own web-based platform and MT4. It also offers the L2 Dealer platform for DMA trading, which is unavailable at other brokers.

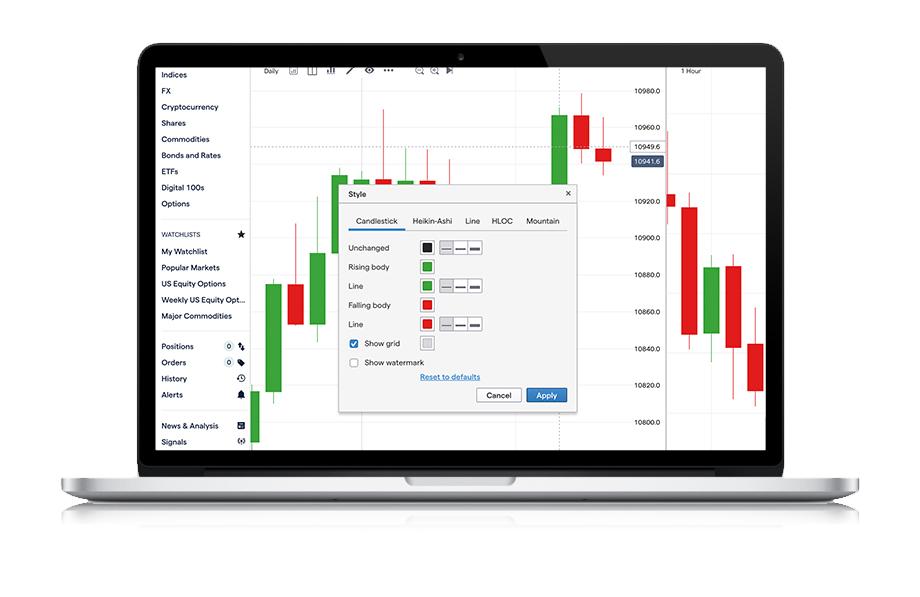

IG Markets offers clients a suite of trading platforms for beginner and advanced traders. Platforms available include the IG Markets web-based platform, MT4 and L2 Dealer – an advanced platform for DMA trading. This platform lineup won IG Markets the award for Best Multi-Platform Provider from 2016-2020 at the ADVFN International Financial Awards.

Web Trading Platform

Many similar brokers to IG Markets offer their own trading platforms, but IG Markets’ web-based platform is unusually customisable and functional when compared to other brokers’ own platforms. Some highlights include:

- 0.014 seconds average execution speed

- Compare up to four timeframes on a single chart

- 28 indicators (including MACD, RSI and Bollinger Bands) and 19 drawings

- Optional one-click trading, direct from charts – open, close and edit positions.

- Integrated access to ProRealTime, a web-based charting package for advanced traders. For more on IG Markets’ trading tools, click here.

- Free signals from both Autochartist and PIAfirst, providing a feed of trading opportunities based on technical analysis and market expertise

- Integrated news feed from Reuters and IG Markets analysts

All of IG Markets CFDs are available to trade through the IG Markets platform, no software download is required, and it’s suitable for traders of all experience levels.

The two downsides to IG Markets’ trading platform are the lack of automation and customisability available on MT4, and that traders will not be able to take the platform with them if they decide to switch brokers.

MetaTrader 4

Developed by MetaQuotes in 2002, MT4 is still the most popular CFD trading platform in the world. Although the platform’s interface is now dated, MT4 is still widely recognised for its fast execution speeds, a wide range of charting tools, algorithmic trading, and customisability. Other features of MT4 include:

- Supports the creation, modification, and utilisation of automated trading strategies.

- Supports MQL4 programming language.

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor (EA).

- Allows traders to develop their own custom indicators.

- Superior charting tools in nine timeframes

- 24 graphical objects

- 30 built-in indicators

- Four pending order types, including buy stop, sell stop, buy limit, and sell limit.

MetaTrader4 is intended for Forex specialists and is an ideal platform for trading CFDs and spread betting. Advanced MT4 charts, chart trading features, and market orders, including limits, stops, stop-loss and take-profit features are available free of charge.

Unique advantages of the MT4 platform include the automated trading functionality achieved through the use of EAs, the 18 customer apps created by IG, and the free Autochartist plugin. Note that MT4 users do not have access to Reuters News, Bloomberg, or FIX API.

L2 Dealer

L2 Dealer, a specialist platform designed by IG Markets, offers direct market access (DMA) free of charge as long as clients maintain a balance of 2000 USD. This platform is not recommended for beginner traders as the complexity of trading the DMA market is only suitable for traders who understand the terminology and risks involved.

The primary advantage of the L2 Dealer software is trading Forex at market prices, with liquidity from major providers. This improved liquidity from dark pools, separate brokers, and other market makers use smart order-routing, which seeks out and executes trades at the best price from various trading venues automatically.

The L2 Dealer platform also functions as a specialist share trading platform and provides market depth from a range of exchanges (including full market depth from the LSE) and an ‘Iceberg’ facility, which break large shares orders into smaller tranches. Like IG Markets’ web-trading platform, the L2 Dealer platform also has integrated access to ProRealTime, a web-based charting package for advanced traders.

Mobile Trading Apps

Both MT4 and IG Markets’ own trading platform are available on mobile devices. iPhone and iPad users will be disappointed that IG Markets’ platform is not available as an app but instead runs in the device’s browser with reduced functionality compared to the Android app. L2 Dealer is only available on desktop, but considering the complexity of L2 Dealer, this is not a downside.

IG Markets’ Mobile App

IG Markets own platform is available as a mobile app on Android devices. For iOS users, IG Markets has developed a Progressive Web App (PWA) which runs in mobile browsers.

iPhone and iPad users will be disappointed that IG Markets does not have an iOS app; the assumption is that IG Markets has concluded that Apple’s infamous terms of service are too restrictive and has decided to bypass the app store entirely.

IG Markets’ Android app features include:

- Access to 17,000 trading instruments including Forex, shares, indices, cryptocurrencies and commodities

- Advanced dealing with partial fills, points through current and tailored orders

- 28 technical indicators, such as Bollinger Bands, Fibonacci retracements and MACD

- News and analysis from IG’s in-house team and the Reuters live feed

- Trading directly from interactive price charts, featuring pinch to zoom and swipe to scroll

The PWA for iOS devices has reduced functionality compared to the Android app but still provides access to 17,000 trading instruments. While the PWA allows trading directly from charts, fewer technical indicators are available compared to the Android app. In addition, advanced dealing options, alerts and funding options are absent. Overall, iPhone users will be disappointed by the mobile trading experience at IG Markets.

MT4 Mobile App

IG Markets offers MT4 on a mobile trading platform, available for both Android and iOS. Although there is slightly limited functionality compared to the desktop version of the platform, with reduced timeframes and fewer charting options, traders will still have access to analytics with technical indicators, graphical objects and a full set of trading orders.

L2 Dealer is not available on mobile devices, due to the complexity of the platform.

Overall, all users of MT4 – and users of the IG Markets platform with Android devices – will be satisfied with the mobile trading experience at IG Markets. Owners of iOS devices will find a lower-quality service unless they are using MT4. This is a poor service compared to other brokers and is surprising coming from such a large and well-respected broker like IG.

IG Markets Trading Tools

IG Markets has a wide range of unique and useful trading tools, but they are exclusive to particular trading platforms. Most other brokers offer trading tools that function whatever platform a trader is using.

ProRealTime (IG Markets Platform and L2 Dealer only)

Only available on L2 Dealer and IG Market’s own platform, ProRealTime is a downloadable advanced charting package with advanced analytical features and monitoring tools. Intended for technical chart traders, ProRealTime allows clients to automate their trading and features a fully customisable interface. ProRealTime is free of charge for clients that trade at least four times per calendar month; otherwise, a fee of 40 AUD per month will be charged to use the tool.

Autochartist (MT4 only)

Free for all IG clients, Autochartist is an award-winning automated technical analysis tool that plugs into MT4 and scans all available CFD markets for trading opportunities.

Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

The market scanner provides statistically significant market movements and identifies important price levels that are catalysts for market movements.

IG’s Trading Signals (IG Markets platform only)

IG has partnered with Autochartist and PIAfirst to provide users of IG Markets’ own web-based platform with free trading signals. Autochartist is an automated technical analysis tool that scans the markets and analyses data across multiple timeframes to provide users with trading opportunities. PIAfirst is a trading strategy service provided by market professionals that delivers award-winning analysis and easy-to-implement trading strategies to users.

Trading signals from both Autochartist and PIAfirst are easy to access from the drop-down Signals menu in IG Market’s trading platform. Each signal also provides the accompanying analysis, allowing beginner traders to learn how both technical and fundamental analysis can be used to spot trading opportunities.

MT4 Indicators (MT4 only)

Like most brokers who offer MT4, IG Markets offers a package of indicators to all users of the platform. When you download MT4 from IG, you get six of the most popular indicators on the MT4 platform for free. You’ll also receive more than 12 add-ons when you download MT4 from IG. These enable you to customise the platform to your own preferences and trading needs. Add-ons include:

- Mini terminal: Allows traders to adapt MT4’s deal tickets and charts to their preferences with a host of highly configurable new features.

- Trade terminal: Control all trades from a single, powerful window.

- Stealth orders: Let’s traders keep their trades anonymous.

- Correlation matrix: Enables traders to see how correlated their watched markets are, and limit risk accordingly.

- Sentiment trader: Let’s traders analyse market sentiment or view a historic price vs sentiment chart.

Partial Fills and Points Through Current (IG Markets platform only)

For high-volume traders, IG Markets offers two trading tools to reduce the change of trade rejection.

Partial Fills

IG Markets now offers clients partial fills on their online trades. If you are a high volume trader you will be able to accept a partial fill to increase your chance of successful execution.

If you choose to use this feature, IG will only ever partially fill your order as an alternative to outright rejection. IG will never partially fill your order as an alternative to filling it in its entirety. So if you trade in a size so large that we cannot fill your entire order rather than reject your entire order IG will be able to fill you in the maximum size possible.

Point Through Current

Points through current will give traders even more control of their execution by allowing them to trade through the current IG price. This feature will reduce your chance of a price rejection in volatile market conditions, and increase the likelihood of successful execution when trading in large sizes.

While IG will still fill an order at the best possible price, the chance of a successful execution is increased when using ‘points through current.

API (Custom-built trading platforms only)

API stands for Application Programming Interface. It is a program that connects two applications – for example, your IG trading account and your custom-built platform. Trading with APIs enables you to gain direct access to IG’s ecosystem, providing you with faster order execution and more control, enhancing your trading experience.

IG Markets Trading Instruments

IG Markets’ has one of the widest (if not the widest) range of financial instruments to trade in the CFD industry, with over 13,000 share CFDs and instruments that are hard to find at similar brokers, such as ETFs, Options and Digital100s. In addition, IG Markets offers weekend trading on select Forex pairs – a unique product.

Alongside Forex pairs, IG Markets offers cryptocurrencies, share CFDs, commodities, indices, options, bonds, interest rates, ETFs, sectors and Digital 100s. IG Markets range of CFDs is one of the largest in the industry.

Forex: IG Markets offers 80+ currency pairs for trading, including majors (AUD/USD, EUR/GBP, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics (NOK/JPY, CHF/HUF and EUR/MXN). IG Markets has more pairs to trade than most other Forex brokers, but maximum leverage is 200:1.

In a first for any broker, IG Markets also offers weekend trading on GBP/USD, USD/JPY and EUR/USD. Spreads are higher over the weekend (averaging 6 pips on the EUR/USD) and are fixed.

Share CFDs: IG Markets offers 13,000+ share CFDs from across the world, which is much higher than most other brokers. The selection available includes popular stocks from the NASDAQ and NYSE as well as UK, German and Australian shares. Note that share CFDs are not available on the MT4 platform. Leverage on share CFDs is up to 10:1 and a small commission is charged both when a trade is opened and closed.

Share CFDs DMA: IG Markets also offers direct market access when trading share CFDs. With this method of trading share CFDs, clients get execution into multiple liquidity venues, including broker and MTF dark pools, dedicated market makers, exchange and MTF-lit trading venues. This is only available on the L2 Dealer platform and other fees from exchanges and stock borrowing may also apply.

Commodities: IG Markets offers 35 commodities, whereas most brokers only offer trading on between 5 – 10 commodities. These include gold, silver, iron ore, Brent and US crude, natural gas and softs such as coffee, sugar and live cattle. Maximum leverage on commodities is 200:1.

Indices: IG Markets offers trading on over 80 indices, which is much more when compared to other similar brokers, and includes the likes of the NASDAQ, FTSE100, DAX30 and Hang Seng. IG Markets also offers bespoke indices such as a Cannabis Index and an Emerging Markets Index. Major indices can also be traded over the weekend. Leverage is up to 200:1 on indices.

Cryptocurrencies: With 10 crypto pairs and the Crypto 10 Index (an index of the ten largest coins) available for trading, IG Markets offers a wider range than is available at most other brokers. Leverage on cryptocurrency trading is limited to 20:1, but crypto trading is available 7 days a week, unlike most other asset classes.

Options: IG Markets offers a range of daily, weekly, future, stock index and share options. Options give you the right, but not the obligation, to buy or sell an asset before a certain date. Options traders are generally trading volatility in the markets or hedging another trade.

Bonds: IG Markets offers 12 Bonds from Germany, UK, the US, France, Italy and Japan. Leverage is 20:1 and both spot and futures are available.

ETFs: At IG Markets there is a range of ETFs available to trade, such as stock index ETFs, that track an index or basket of stocks, and currency ETFs that track multiple currencies. Like share trading, ETFs can be both bought via IG Market’s stock brokerage service or speculated upon using leverage. In the case of CFD ETFs, leverage is limited to 10:1.

Interest Rates: IG Markets also offers 6 interest rate CFDs to speculate on. Interest rate CFDs are generally used to hedge other trades that will be affected by interest rate changes. Leverage is 50:1 on most rates.

Sectors: Another unique product offered by IG Markets, sectors are industry-specific CFDs. IG offers 44 UK and Australian sectors such as Fixed Line Telecoms, Beverages, Financials and Tobacco. Leverage on these products is limited to 10:1.

Digital 100s: Digital 100s are binary options that have recently been banned by ASIC and the FCA for all retail clients, but are available in Nigeria. Binary options are very high risk and clients should get in touch with IG Markets directly to understand more about the product lineup.

The sheer volume of tradable instruments available at IG Markets is staggering. Not only does IG offer one of the widest selections of shares to trade in the industry, but there are also two different methods of trading them. In addition, innovative CFDs such as Sectors, the Crypto Index and weekend Forex pairs are impossible to find at other brokers. Overall, it is easy to see why IG Markets are market leaders in the CFD industry with this product lineup.

IG Markets Research and Analysis

IG Markets research and analysis is comparable with most other large international brokers, with a constant feed of news and thoughts from the in-house trading team.

News and trade ideas, trading strategy education, and analysis of upcoming financial events are frequently published at IG Markets. The analysis is written by the IG Markets Global team of analysts who have professional backgrounds in trading at some of the major investment banks.

IG Markets sends free Morning Call and The Week Ahead reports daily and weekly, respectively. Each promises to deliver an analysis of major economic events and corporate news before the opening of the markets.

IG Markets Educational Content

IG Markets’ educational section is more detailed and better-structured than most other brokers and is suited to both beginners and more experienced traders.

Awarded Best Forex Educators 2018 (UK Forex Awards), IG Markets has plenty of current and accessible educational material for beginner traders. Reports and daily analysis are emailed to anyone who signs up, and 24-hour support is available.

IG Markets has a wide variety of educational materials to get traders started. These include the IG Academy, a section on Managing Your Risk, a Trading Strategy section, Webinars and Seminars, and a glossary of terms. See below for details:

- IG Academy: Online trading courses covering topics for beginner, intermediate and advanced traders. Live, structured classroom-style lessons are run daily and offer traders the opportunity to get personal feedback and interact with market analysts.

- Managing your risk: IG Markets provides several materials outlining how traders can reduce their risk. It also includes information on the various risk management tools offered at IG Markets.

- Trading Strategy: This section teaches traders how to look at the markets, use trading tools, and understand technical trading language.

- Webinars and seminars: IG Market’s webinars and seminars help build trader’s confidence and cover topics ranging from platform walk-throughs to upcoming trading opportunities.

- Glossary: The glossary provides comprehensive definitions and explanations of various financial terms.

Customer Support

IG Markets customer support is knowledgeable, responsive and available 24 hours a day.

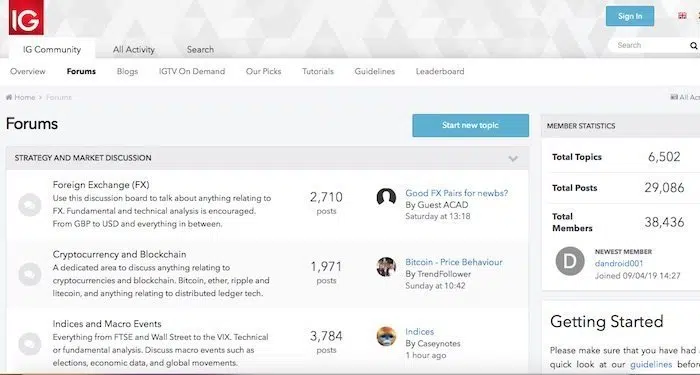

Clients support is available by phone, email, Twitter, and live chat, 24hrs a day from 8 am Saturday to 10 pm Friday (GMT). In addition, the peer support platform offers assistance from other traders and IG staff in a forum discussion, which is an ideal additional resource for beginner traders who have questions about the platforms, analysis, and trading ideas.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the IG Markets offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

IG Markets Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. IG Markets would like you to know that: Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Overview

Founded in 1974 and the largest broker in the world by revenue, IG Markets is the clear global leader in the CFD trading market. The sheer number of CFDs available to trade could be overwhelming for new traders, especially considering the range of trading platforms and trading methods.

IG Markets’ spreads on Forex are generally tighter than other large brokers and commissions are low on the DMA account. With a variety of trading platforms, including MT4 and the L2 Dealer platform for experienced traders, along with a catalogue of education, analysis, and webinars, IG Markets is a good choice for traders of all experience levels.

A publicly listed company with regulation from ASIC, FCA and the FMA – and constant industry acclaim – IG Markets is possibly the safest and most secure broker in the world.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how IG stacks up against other brokers.