-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Last Updated On Mar 20, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on XM

A popular global broker with a large customer base and a good reputation, XM is a good option for most Nigerian traders. It has some of the lowest fees in the industry, provides excellent research and education, and has a beginner-friendly trading app. It has an outstanding range of trading tools and offers traders generous bonuses and incentives. It also has one of the best copy trading services in the industry.

XM offers four trading accounts, three of which have a minimum deposit of 5 USD and have no commissions for Forex trading. The highlight is the commission-free Ultra Low Account with spreads that start at 0.6 pips (EUR/USD).

The main drawback is that XM’s Nigerian clients will be trading through XM’s company in Belize, which has poor regulatory oversight. However, Nigerian traders still have negative balance protection and can rest assured that their funds are kept in segregated accounts.

| 🏦 Min. Deposit | USD 5 |

| 🛡️ Regulated By | CySEC, ASIC, DFSA, FSCA |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals, Shares |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Excellent education

- Free deposits and withdrawals

Cons

- Limited platform choice

Is XM Group Safe?

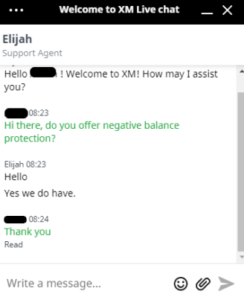

While XM is regulated by some of the world’s top authorities, Nigerian traders are not as well protected as their international counterparts.

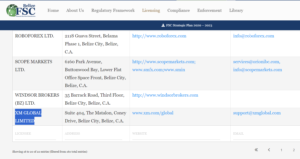

Belize FSC regulation: XM is regulated by CySEC in the European Union and ASIC in Australia. But XM’s Nigerian clients will be trading through its company XM Global Ltd, which is regulated by the Belize FSC and is generally considered a weak regulator. XM Global does not provide traders with compensation should the company be liquidated.

Safety Features: Although not required by the Belize FSC, we were pleased to find that XM Global protects traders by:

- Segregating its client funds from company funds in top-tier banks

- Providing traders with automatic negative balance protection. This means traders cannot lose more than their initial deposit.

Company Details:

![]()

![]()

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of XM’s FSC-regulated entity:

XM’s Trading Instruments

We were impressed with XM’s range of trading instruments, including over 57 Forex pairs, and pleased that it has added cryptocurrencies to its offering.

High Leverage: XM has 60 crypto pairs to trade at 500:1 leverage. This is a large selection of crypto pairs and a much higher level of leverage. Leverage is also up to 1000:1 on Forex pairs, but traders should be aware of trading with such high leverage as while it can increase profits, it can also significantly increase losses.

Full List of Instruments and Leverage:

![]()

![]()

- Forex: XM’s range of Forex pairs is around the industry average and includes majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics (SGD/JPY).

- Stock CFDs: The number of stock CFDs available at XM is much more than most other brokers. The selection available includes some of the major US companies, including Apple, Amazon, Facebook, Bayer, and Google, among others. In August 2023, XM also introduced 7 Turbo Stocks. Turbo Stocks are CFD stock products with leverage of up to 1:200 (which is much more than the leverage of 10:1 on ordinary stock CFDs). Another difference is that the trading of Turbo Stocks begins at the start of the trading day of the underlying asset and ends at the end of the same day.

- Commodities: XM’s range of commodities is average. These include gold and silver and softs such as coffee, corn, soybeans, and wheat.

- Cryptocurrencies: XM has recently added an average range of cryptocurrencies, a good move considering how popular this asset has become.

- Equity Indices: XM’s range of indices is slightly limited compared to other similar brokers and includes the likes of the US30Cash, UK100Cash, US500Cash, and the EU50Cash.

- Energies: XM’s range of energies is average and includes Brent, Natural Gas, and Oil.

- Shares: XM’s share offering is limited compared to other brokers.

XM’s Accounts and Trading Fees

XM offers five live accounts, which is more than other brokers, and it has average trading fees.

Trading Fees: All of XM’s accounts, except its shares account, have a minimum deposit of 5 USD, making them accessible to beginners. No commissions are charged for Forex trading on three of its five accounts, and traders will find spreads of between 0.8 pips and 1.7 pips (EUR/USD), depending on the account.

Account Trading Costs:

![]()

![]()

See below for account details:

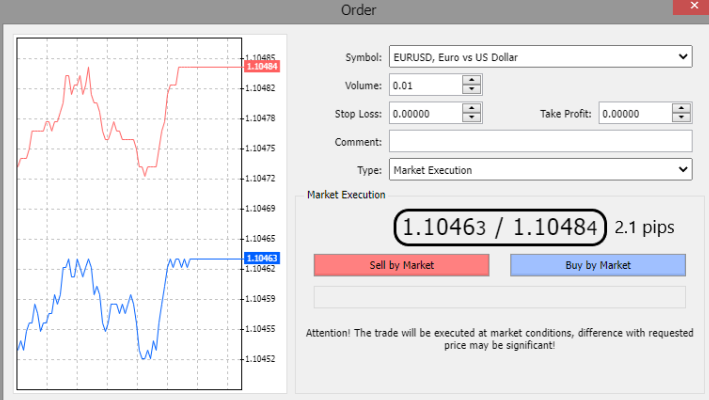

Micro Account: XM’s entry-level account, minimum deposits start at 5 USD on the Micro Account, and minimum spreads at 1.0 pips on the EUR/USD, which is similar to other brokers. However, we found that average spreads were closer to 2.1 pips on the EUR/USD, which is higher than similar brokers:

- Standard Account: Like the Micro Account, the minimum deposit requirement is 5 USD, and spreads average at 1.7 pips on the EUR/USD, which is wider than other similar-sized market makers.

- XM Ultra-Low Account: This account also has a 5 USD minimum deposit but spreads average at 0.8 pips on the EUR/USD, which is comparable to other similar-sized market makers. Trading Bonuses are not available on this account.

- Share Account: Due to the nature of this account, traders are not offered leverage. Contract sizes are one share, minimum trade volume is one lot, and the spread on this account is as per the underlying exchange. This account is only denominated in USD.

- Islamic Account: XM offers Islamic accounts for traders of the Muslim faith. We were pleased to note that XM does not apply any extra charges for Islamic accounts. This is unusual as most other brokers apply an admin fee to Islamic accounts in lieu of the swaps.

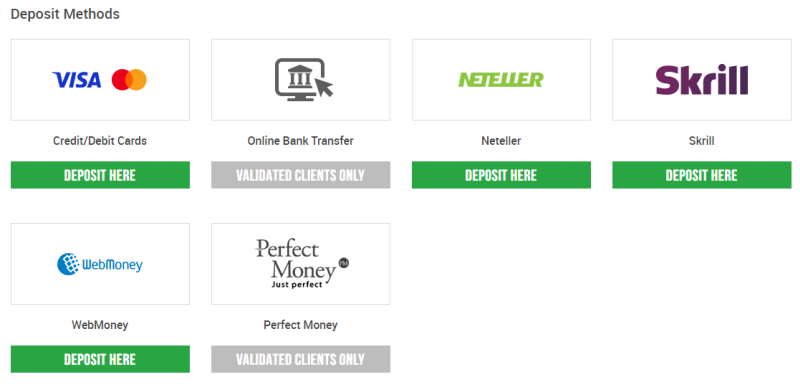

XM’s Deposits and Withdrawals

We were pleased to find that all deposits and withdrawals over 200 USD are free. Deposits took less than an hour to reach our trading account, and withdrawals took two days to reach our bank account.

In line with Anti-Money Laundering policies, XM operates a “return to source policy,” meaning that withdrawals can only be returned to the original funding source.

Base Currencies: When we opened our account, we noticed that the client portal allows traders to deposit funds in 11 base currencies, including EUR, USD, GBP, AUD, CHF, JPY, RUB, HUF, PLN, ZAR, and SGD. Unfortunately, XM does not offer accounts denominated in NGN, which means that traders will have to pay a conversion fee on every trade. While this may not affect occasional traders, high-volume traders (who trade more than 10 lots a month) should consider opening an account denominated in USD because a conversion fee will be charged for every trade made on a USD-quoted currency pair. This can be done by opening a multi-currency bank account at a digital bank.

Fees: The account funding process is open 24 hours a day and is fully automated. We were very pleased to note that XM covers all transfer fees and does not include any hidden fees or commissions on deposits or withdrawals. However, fees are charged on deposits and withdrawals made by wire transfer under 200 USD, or currency equivalent. See below for more details:

- Bank Transfer: Deposits and withdrawals are free; however, withdrawals under 200 USD incur a cost of 15 USD. Deposits and withdrawals take a few days to be processed.

- Credit card/Debit card: Deposits are instant and free, but withdrawals, while free, take up to two business days to be processed.

- eWallets (Skrill, Neteller, WebMoney, Perfect Money): Deposits and withdrawals are instant and free.

Once your account has been verified by customer service, you can deposit funds through the client portal:

We tested deposits via credit card and found that our payment was processed within an hour, and it took two days for our withdrawal to arrive in our account. These times are about average for the industry.

XM’s Mobile Trading Platforms

Our review found that XM offers three mobile trading platforms, which is more than other brokers, including MT4, MT5, and the XM App. All of the platforms are available on both Android and iOS.

We tested the XM App on an iPhone 11:

We were pleased to find that we could trade directly on the XM mobile app and that it could be linked to our MT4 and MT5 accounts.

We found that the XM app was very easy to set up and use. It was also easy to search for and monitor our assets and trades:

MT4/MT5 Mobile Trading

XM’s MT4 and MT5 mobile trading apps offer similar functionality to the desktop and web trader versions of the platforms. Traders can access all instruments available at XM (except that share CFD trading is only available on MT5), and access all the same charts. Additionally, all the trading order types are available. The only difference is that the number of indicators is reduced for both the MT4 and MT5 mobile applications.

XM’s Trading Platforms

We found that XM offers an average range of trading platforms, including the web trader and desktop versions of MT4 and MT5.

Both MT4 and MT5 are available on Mac and PC.

For the purposes of this review, we tested XM’s web trader platforms.

MetaTrader 4 (MT4) and Metatrader 5 (MT5)

The benefit of XM offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, thousands of plugins and tools are available for both the MetaTrader platforms.

As you can see, the MT4 Webtrader looks slightly outdated, but it is highly customisable. There are three chart types, including Line, Bar, and Candlestick charts, and you can access a wide selection of indicators in multiple timeframes. See below:

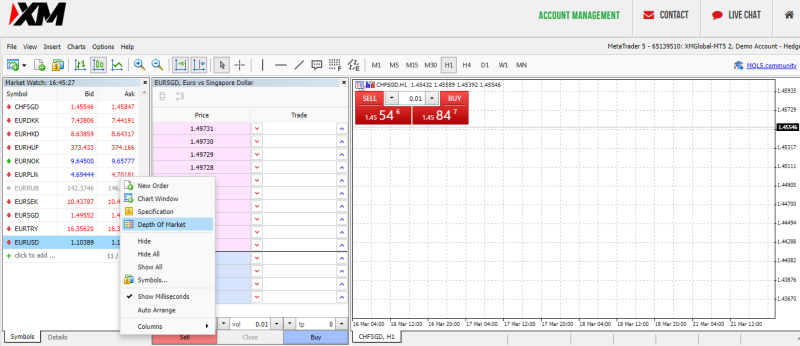

In our review of MT5 web trader, we noted that it has a great depth of market display:

One other benefit of trading with XM is that it offers MT4 Multiterminal, which is not often available at other brokers. It allows traders to open and manage multiple MT4 accounts from a single terminal with one login and password.

Platform Comparison:

![]()

![]()

Promotions

We noted that XM offers a variety of promotional bonuses to new traders, which can be accessed upon sign-up. Traders can follow this link to find out more about its current bonuses and promotions.

Opening an Account at XM

We found XM’s account opening process fast and simple. Our account was open in less than a day and XM’s customer support was readily available for our technical and account queries.

It took us about 5 minutes to open an account at XM and once our documentation had been submitted, our accounts were ready for trading on the same day. XM’s customer support agents were very helpful and provided relevant and immediate responses.

As a Nigerian trader, you are eligible to open an account at XM as long as you meet the minimum deposit requirement of 5 USD (the equivalent of 22 MYR).

How to open an account at XM:

- We clicked on the “Open an Account” button at the top of the page.

- We then filled in our personal details and chose our preferred trading platform (MT4/MT5), base currency, and level of leverage.

- We were then required to fill in our financial information and answer questions about our trading knowledge.

- In order to verify our account, we were required to submit a copy of our ID or Passport with the signature page, as well as a copy of a recent utility bill or bank statement. Our documents were scanned as high-quality digital camera pictures.

Once all our documents had been received, the account was ready for trading on the same day.

XM’s Research and Trading Tools

We found that XM offers excellent technical analysis tools and that its in-house curation of research data far surpasses that of other brokers. It also offers several in-house trading tools that are compatible with MT4 and MT5.

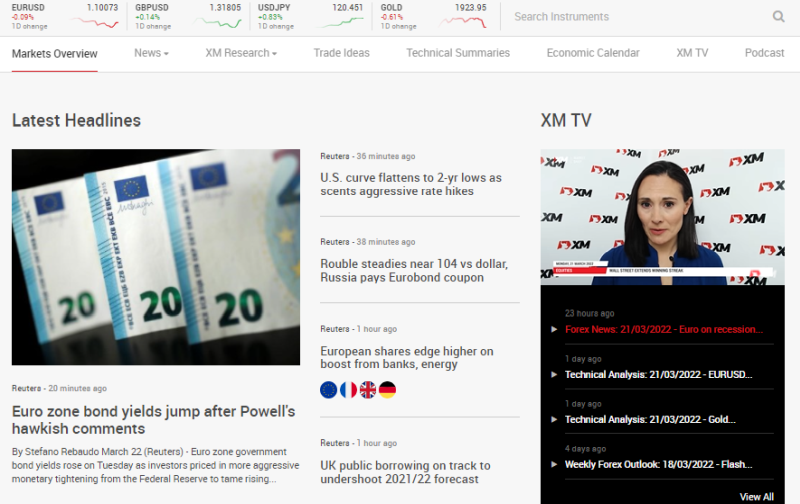

Our review noted that XM’s market analysis section consists of a market overview, News, XM Research, Trade Ideas, Technical Summaries, an Economic Calendar, XM TV, and a Podcast. See below for more details:

- Markets Overview: Frequent articles by a third-party provider, Reuters, are available in this section and cover all the latest market news.

- News: All the latest market news, also provided by Reuters, is updated a few times an hour.

- XM Research: The XM Research team provides frequent articles covering technical analysis, Forex previews, market comments, financial markets, special reports, and stock market news.

- Trade-Ideas: Provided by a third party, namely Analyzzer, this section covers how the various instruments fare against one another.

- Technical Summaries: This section covers the various trends among the XM’s instruments.

- XM TV: Provided daily by XM’s in-house team of analysts, XM TV covers Forex News, Technical Analysis, and a Weekly Forex Outlook.

- Podcast: XM’s trading podcast, Global Market Insights, provides traders with meaningful and informative content encompassing up-to-date information needed for online investing and updates on economic events across the globe.

- Economic Calendar: XM offers a good economic calendar. It has a filter function where you can filter for countries, data type, and importance.

XM also offers several technical indicator tools to help guide traders in their trading decisions, including the following:

- Ribbon Indicator

- River Indicator

- Ichimoku Indicator

- Bollinger Bands

- ADX and PSAR Indicator

- Analyser Indicator

- MQL5

Unfortunately, XM doesn’t offer the popular third-party tools such as Autochartist or Trading Central, that are commonly available at other brokers.

Copy Trading

XM recently added copy trading to its repertoire. We really like XM’s copy trading service – there are a huge number of strategy providers to choose from, and traders can filter providers by performance, risk appetite, trading instrument, win-ratio, drawdown, and trading frequency, among others. see the video below for more details:

Overall, we found XM’s trading tools useful in making trading decisions, but it could add a variety of third-party tools to help with fundamental analysis.

Trading Tools Comparison:

![]()

![]()

Education

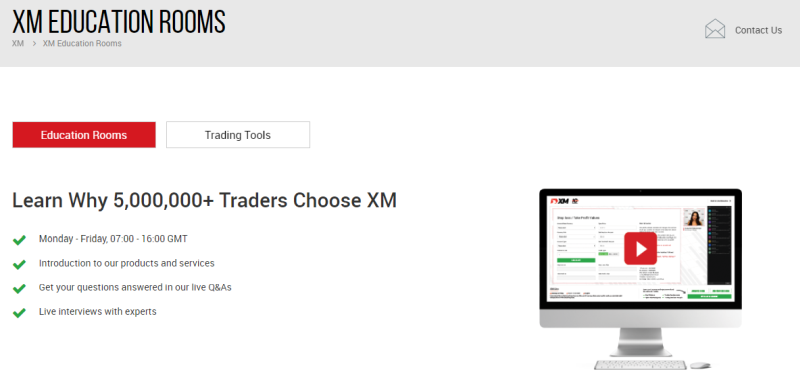

Our review noted that XM provides an excellent selection of educational materials suitable for both beginners and more experienced traders. It also offers a demo account that does not expire.

We found that XM’s library of educational materials is world-class and on par with some of the best brokers in the world. Education comprises XM Live, Live Education, Educational Videos, Forex Webinars, Platform Tutorials, and Forex Seminars. These materials are in-depth and well-structured, and available in Malay. We were pleased to note that educational materials are accessible to all XM website visitors, although some sections require registration. See below for more details:

- XM Live: Available from Monday to Friday 05:00 – 15:00 GMT, visitors can learn about the products and services offered by XM, and trading fundamentals and have all their questions answered by its hosts.

- Live Education: XM offers the Basic Room for beginner traders and the Advanced Room for more experienced traders. Live Education is essentially a series of live webinars that run from Monday to Friday from 07:00 – 16:00 GMT. These webinars cover trading fundamentals and trading session analysis. The Advanced Room also covers topics such as How to Prepare for a Trade, Follow Real-Time Trading, and Live Debates.

- Educational Videos: XM provides an extensive library of videos that cover topics such as:

- Intro to the Markets

- Trading Essentials

- Fundamental Analysis

- Technical Analysis

- Money Management

- Trading Psychology

- Trading strategies

- More on Forex Trading

- Forex Webinars: XM offers free webinars presented by 67 highly skilled forex professionals in 19 languages, including Malay, seven days a week.

- Platform Tutorials: XM’s team has developed a vast array of video tutorials that explain the ins and outs of the MT4 and MT5 platforms in addition to the XM trading tools.

- Forex Seminars: XM runs frequent seminars across the globe to educate online investors and help them develop their trading knowledge with the guidance of professional instructors.

- Demo Account: Ideal for trading practice, as well as for testing trading strategies, XM’s Demo Account does not expire and allows you to trade on live markets, risk-free. However, demo accounts that have been inactive for longer than 90 days from the last login will be closed, but you can open a new demo account at any time. Please note that a maximum of 5 active demo accounts are allowed.

Education Comparison:

![]()

![]()

Customer Support

Available 24/5, we found XM’s customer support agents are responsive and well-trained.

XM’s customer support is available 24/5 in over 30 languages, via email, phone, and live chat.

For the purposes of the review, we tested the live chat service and email. Our email was answered within a day and the answer was relevant and to the point. The live chat agents were able to answer all our questions quickly and to our satisfaction. They also provided links and extra reading material where appropriate.

After logging into the live chat we were connected to an agent who replied to our message within a matter of seconds, as shown below:

Safety and Industry Recognition

Regulation: Founded in 2009 and headquartered in Cyprus, XM Group has grown into a large and well-established international investment firm with over 3,500,000 clients worldwide. XM is a brand name of Trading Point Group and is regulated by the following authorities:

- Trading Point of Financial Instruments Ltd was established in 2009 and is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10)

- Trading Point of Financial Instruments Pty Ltd was established in 2015 in Australia and is regulated by the Australian Securities and Investments Commission (ASIC 443670)

- Trading Point MENA Limited has been approved and regulated by the Dubai Financial Services Board (Reference No. F003484).

- The Belize FSC licenses XM Global Limited under license number 000261/397.

Awards

XM has won numerous awards for its services and offerings over the years, including:

- Silver for the COVID-19 HR Action Plan – Business as Usual, in an Unusual 2020 (Cyprus HR Awards 2020)

- Global Forex Broker of the Year (Global Forex Awards 2020)

- Best Forex Affiliate Broker Programme – Europe (Global Forex Awards 2020)

- Most Reliable Broker – Global 2020 (Capital Finance International Magazine)

- Most Transparent Broker – Global 2020 (Capital Finance International Magazine)

- Best Online CFD & FC Trading Broker – Global 2020 (The European Magazine).

Overall, because of the long history of responsible behaviour, strong international regulation, and wide industry acclaim, we consider XM a trustworthy and safe broker.

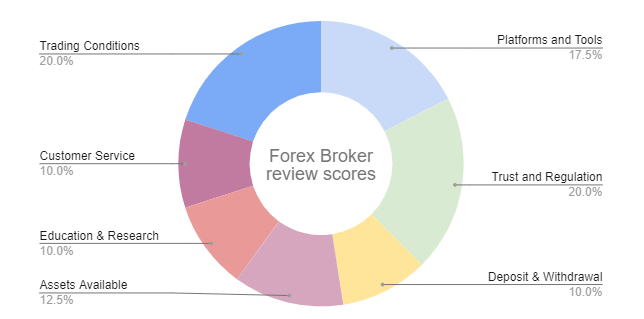

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, which are summarised in this review.

Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

XM Group Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. XM Group would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.33% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please consider our Risk Disclosure.

Overview

A well-regulated market maker broker, XM offers trading on over 1000 instruments, including over 57 Forex pairs. We found XM’s trading conditions are low, with spreads of 1 pip (EUR/USD) on its Standard Account and 0.6 pips (EUR/USD) on its Ultra-Low Account. Its minimum deposit requirements are low, at 5 USD across all account options, making it good for beginner traders. We also really liked its copy trading service.

XM also offers trading on the most popular platforms – MT4 and MT5 and allows all trading strategies alongside a world-class repository of educational and market analysis materials and excellent customer service available in Malay.

FAQ

Is XM Safe?

Yes, it is a trusted international broker. XM is regulated by ASIC in Australia and by CySEC in Europe. They have won multiple international awards.

What assets can I trade at XM?

Forex, stocks, commodities, indices, metals, and energies.

What is the minimum deposit at XM?

Trading accounts can be opened for 5 USD.

Is XM good for beginners?

XM has some of the industry’s best beginner and advanced learning material, with additional daily market analysis for free to all clients.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how XM stacks up against other brokers.