For over a decade, FxScouts Nigeria has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and African markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

- Octa - Lowest Trading Fees

- AvaTrade - Best Risk Management Tools

- HFM - MT4/MT5 + Premium Trader Tools

- Pepperstone - Best Range of Trading Platforms

- IC Markets - Best Customer Support

- IG - Largest Range of Trading Instruments

- FP Markets - Best Trading Tools

- FxPro - Fastest Trade Execution

- markets.com - Lowest Trading Fees

Best Trading Platforms 2024

What is Forex Trading?

Forex trading involves exchanging one currency for another to profit from fluctuations in the exchange rate. Unlike stock markets, the forex market is a decentralised global marketplace, and currencies can be traded around the clock. Forex trading is a popular investment option due to its potential for high returns and liquidity, and low transaction costs.

Learn more about how Forex trading works here.

What is the difference between a Forex trading platform and a Forex broker?

Forex trading platforms and Forex brokers are two different things, but they are closely related.

Forex trading platforms are applications – either on a phone or a computer – that traders use to place trades, while Forex brokers are companies that find buyers and sellers for your trades. Forex brokers also provide leverage and other services such as education, analysis tools and customer support. Forex brokers charge a fee for these services; this is usually in the form of a markup called the “spread”.

How did we select the trading platforms in this guide?

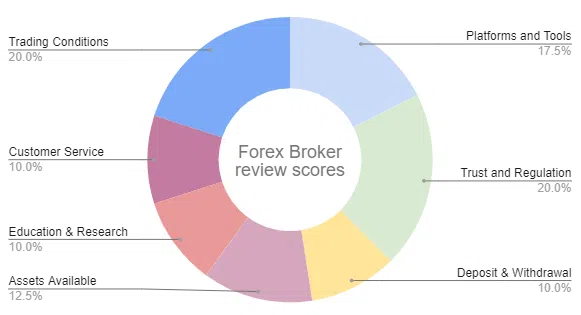

We have an experienced review team that evaluates Forex brokers and their trading platforms. Our team of experts examines each broker in 7 different areas using over 200 metrics. We invest hundreds of hours annually researching and scrutinising brokers and their platforms to ensure we only recommend the best in the Forex industry.

Of these seven areas, we always prioritise regulation and costs. These are our priorities because traders want to know that their broker is trustworthy and isn’t overcharging them. Brokers constantly alter their products, and we keep our reviews updated with the latest data. You can find out more about our in-depth review process here.

Octa – Lowest Trading Fees

Octa is regulated by CySEC of Cyprus and is a reliable broker for Nigerian traders. It offers a great range of trading tools on MT4 and MT5 and its user-friendly OctaTrader Web Platform.

Trading Platform Features: All trading platforms offer one-click trading, a range of analytics tools, a profit calculator, and built-in real-time market news features. Octa also offers an Account Monitoring tool that allows traders to monitor their accounts and sort by balance, gain, trades, and account type. Autochartist, the industry-standard signals provider, is available with a 500 USD minimum deposit.

Execution: Octa offers market execution on its available accounts, with orders fulfilled in less than 0.1s, which is fast for the industry.

Trading Costs: Octa offers three standard accounts, each with a minimum deposit of 25 USD. Spreads start at 0.6 pips (EUR/USD), which is extremely tight compared to other brokers, and there are no commissions for Forex trading. Additionally, it does not charge swap (overnight) fees on any of its accounts.

AvaTrade – Best Risk Management Tools

Regulated by eight international authorities, AvaTrade offers a range of trading platforms, including MT4, MT5, AvaOptions, AvaSocial, and its award-winning AvatradeGO mobile trading app.

Trading Platform Features: Its user-friendly proprietary AvatradeGO app is available for both Android and iOS and has an excellent dashboard with easy trade management tools, clear charts, and a Market Trends feature to monitor trading trends within the AvaTrade community. It also features AvaTrade’s AvaProtect tool, which provides loss protection for a limited time. Other app highlights include a market trends monitor, zoom function and seamless synchronisation with AvaTrade’s webtrader.

MT4 and MT5 have a range of indicators and EAs and provide free access to the integrated Trading Central dashboard for both platforms.

Execution: Avatrade’s execution policy states that it takes all factors into account, including account price, costs, speed, the likelihood of execution and settlement, to ensure fast execution of trades across all its platforms.

Trading Costs: Avatrade’s single account features some of the tightest spreads for a commission-free account with a 100 USD minimum deposit – as low as 0.9 pips on the EUR/USD.

HFM – MT4/MT5 + Premium Trader Tools

HFM is well-regulated and has a long history as a reliable broker for Nigerians.HFM also offers premium trading tools on MT4 and MT5 and its new mobile trading app, which integrates with the MT5 desktop platform and has an easy-to-use interface.

Trading Platform Features: HFM has recently upgraded its mobile trading app, which is now highly customisable and easy to use. It also offers MT4 and MT5 mobile apps on Android and iOS. HFM’s MT4 and MT4 platforms also benefit from HFM’s suite of Premium Trader Tools. These include customisable news and data feeds, live sentiment and correlation tracking, sophisticated alarms and messaging and advanced trade management.

Execution: All HFM trading platforms feature one-click trading, even on the HFM mobile app. HFM also offers an Execution Desk service, where trades can be opened and closed over the phone with their trading desk based in London.

Trading Costs: HFM’s trading costs depend on which account you open. It offers three standard accounts and two specialised copy trading accounts, but beginners will be drawn to the Micro Account, with a 5 USD minimum deposit and reasonable trading fees with the spread starting at 1 pip on the EUR/USD.

Pepperstone – Best Range of Trading Platforms

Established in 2010 and well-regulated, Pepperstone is one of our highest-rated brokers, globally renowned for its choice of trading platforms, including MT4, MT5, cTrader, and TradingView.

Trading Platform Features: All of Pepperstone’s platforms offer automated trading, strategy backtesting, customisable charting, and a range of indicators, and integrate with Autochartist, one of Pepperstone’s free trading tools. TradingView, a relatively new platform, offers even more advanced charting abilities, including custom timeframes, over 100,000 custom-built indicators, and integrated financial analysis.

Execution: Pepperstone offers market execution on all its accounts, with orders fulfilled in less than 0.1s, which is fast for the industry.

Trading Costs: Pepperstone offers some of the lowest trading fees in the industry, and there is no required minimum deposit to open an account. The commission-free Standard Account offers spreads from 1.00 pips (EUR/USD), while the Razor Account has an average spread of 0.10 pips (EUR/USD) in exchange for a low commission of 7 USD per lot.

IC Markets – Best Customer Support

An excellent all-round broker with a very high trust rating and exceptional customer service, IC Markets was founded in 2007 in Australia and holds licences from some of the strictest regulators in the world. IC Markets is well-known for its choice of trading platforms, including MT4, MT5, and cTrader, and wide range of trading tools. It also offers 24/7 customer support – a huge benefit to traders who may want to set up on the weekend.

Trading Platform Features: IC Markets supports all three major trading platforms – MetaTrader 4, MetaTrader 5, and cTrader – providing traders with a broad choice of environments to suit their needs. Alongside these, the broker also provides an array of trading tools for each platform, including VPS services, Trading Central, and various copy trading services. These tools aid traders in making informed decisions, enhancing the trading experience.

Execution: IC Markets’ average execution speed is under 40ms once the order is received, which ensures traders can effectively capitalise on market movements.

Trading Costs: IC Markets stands out for its competitive pricing structure, offering lower trading costs than most other brokers. The Raw Spread Account is particularly cost-effective, featuring average spreads of 0.10 pips (EUR/USD) for a low commission of 6 USD (round turn) per lot.

IG – Largest Range of Trading Instruments

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | ASIC, BaFin, DFSA, CFTC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

An exceptional all-round broker with a long-standing reputation, IG was founded in 1974 and is regulated by eight national authorities. IG is renowned for its safe and secure trading environment, competitive trading fees, and an extensive array of trading instruments and platforms.

Trading Platform Features: IG provides access to its award-winning web trader platform and mobile app, which collectively host over 17,000 instruments. It also offers the L2 Dealer platform and MT4. This diverse offering accommodates a wide variety of trading preferences and strategies. The platforms are supplemented with an array of trading tools that can assist traders in formulating and executing their strategies more effectively.

Execution: As one of the largest CFD brokers globally, IG is known for its reliable and strict order execution, ensuring that traders get the best prices possible.

Trading Costs: IG offers two low-cost trading accounts with no minimum deposit requirements, making it accessible for traders at all levels. You can choose to trade on either the MT4 platform, in which case spreads will average at 0.75 pips on the EUR/USD, or on the IG platform, where spreads average at 0.86 pips on the EUR/USD.

FP Markets – Best Trading Tools

A well-regulated Forex broker with an excellent reputation, FP Markets offers support for MT4, MT5, and the cTrader platforms alongside a vast range of trading tools, including Autochartist, a Trader’s Toolbox, VPS services, and copy trading services.

Trading Platform Features: FP Markets recently added cTrader to its trading platform offering, a great addition considering its ease of use and great range of in-built trading tools. Although FP Markets offers the standard versions of MT4 and MT5, they are transformed into state-of-the-art trading platforms with its Trader’s Toolbox. The Toolbox includes customisable news and data feeds, live sentiment and correlation tracking, tick charts, session maps, sophisticated alarms and messaging and advanced risk management tools.

Execution: FP Markets offers fast execution on its MT4, MT5, and cTrader platforms, with an average execution speed of less than 40ms.

Trading Costs: FP Markets offers a Standard and Raw account on the MetaTrader platforms both with a minimum deposit of 100 USD. Spreads start at 1 pip (EUR/USD) on the Standard Account, which is average for the industry, and 0.1 pips (EUR/USD) on the Raw Account in exchange for a commission of 6 USD, which is very competitive.

FxPro – Fastest Trade Execution

FxPro is well-regulated, with oversight from several top financial authorities, including the FCA in the UK and the Cyprus Securities and Exchange Commission (CySEC). Traders can choose between four different trading platforms, including MT4, MT5, cTrader, and its own in-house platform, FxPro Edge.

Trading Platform Features: FxPro offers an impressive selection of trading platforms, ensuring that all types of traders can find a platform that suits their needs. Furthermore, the FxPro mobile trading app has been lauded for its user-friendly interface and accessibility, making it easy for traders to monitor and execute trades on the go. However, it is worth noting that the educational resources and market analysis tools provided by FxPro are somewhat limited when compared to other brokers.

Execution: FxPro is recognized for its superior order execution, with most client orders being filled in under 13 milliseconds. This swift execution ensures that traders can capitalise on market movements promptly and efficiently, making FxPro an attractive choice for those who value speed and accuracy in their trading activities.

Trading Costs: FxPro offers a wide range of account types with reasonable minimum deposits, making it a suitable option for a variety of traders. Both the MT4 and MT5 accounts offer commission-free trading, while the cTrader account has a commission but tighter spreads – down to 0.3 pips on the EUR/USD.

Markets.com – Lowest Trading Fees

With regulation from some of the world’s best authorities, including Australia’s ASIC and the FCA of the UK, Markets.com is considered a trustworthy broker for Nigerian traders. It is also listed on the London Stock Exchange, further adding to its credibility. Markets.com provides support for various trading platforms, including MT4, MT5, and its proprietary Markets.com platform.

Trading Platform Features: Markets.com’s proprietary platform is known for its user-friendly interface and advanced analytical tools. It also has other features, such as live market data, sentiment analysis, advanced charting tools, and educational resources available from within the platform.

Execution: Markets.com ensures efficient and swift execution on its platforms, delivering a smooth trading experience. It has numerous processes and procedures in place to ensure traders obtain the best possible execution.

Trading Costs: Markets.com offers a simple account structure with competitive trading costs. Its account is commission-free, with spreads that start at 0.6 pips (EUR/USD) on the lowest tier in exchange for a minimum deposit requirement of 100 USD and lower still on its Platinum Account tier, but this requires an initial deposit of 50,000 USD.

Guide to the Best Trading Platforms

The most popular trading platforms are MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and TradingView. Many brokers also have their own proprietary trading platforms. Almost all trading platforms are also available as mobile trading apps. The best Forex trading platform for you will depend on your trading experience and personal taste.

What is MetaTrader4 (MT4)?

Available at over 90% of Forex brokers, MT4 can run on any system, regardless of age, has extremely fast execution, and has the largest number of Expert Advisors.

Developed in 2005 by MetaQuotes, MT4 is the world’s most popular Forex trading platform. MT4 gives traders real-time access to the Forex market, enabling them to trade currencies, commodities, indices, and cryptocurrencies. However, it does not natively allow trading on stock CFDs, ETFs, and bonds, which are available on MT5, cTrader, and TradingView.

The platform also has advanced charting tools and customisable trading layouts, but its interface is outdated, and other platforms, such as MT5, cTrader, and TradingView, have a much broader range of platform tools and more advanced functionality.

Because MT4 has such low resource requirements, it can run on both new and old devices and has been developed to initiate trades as quickly as a Forex broker can process them.

One of the main benefits of MT4 is automated trading with trading robots called Expert Advisors (EAs). Traders can build or purchase EAs, which will trade within the parameters of a pre-set algorithm. Before MT4, automated trading was only available to banks and hedge funds. There are also many more EAs available for MT4 than any other platform in the world.

Watch our MT4 tutorial video

Learn more about MT4.

Find out more about our favourite MT4 brokers.

What is MetaTrader5 (MT5)?

A feature-rich and modern trading platform compared to MT4, MT5 is more powerful and efficient and offers trading on a broad range of tradable assets, including stocks, ETFs, and bonds.

Released in 2010, MT5 is considered a more advanced and versatile platform than MT4. One of the key differences is that MT5 has a built-in economic calendar and more advanced charting tools. MT5 also supports more order types than MT4 and, unlike MT4, allows native trading of assets like stocks, ETFs and bonds.

Another feature that sets MT5 apart from MT4 is its Depth of Market DOM feature. DOM measures the liquidity of an asset based on its supply and demand. It displays the number of open buy and sell orders for a given asset.

MT5 also has an improved programming language called MetaQuotes Language 5 (MQL5) that allows traders to create more complex EAs than is possible with MQL4, but there are far fewer pre-programmed EAs available for download on MT5.

Although MT5 has slowly gained popularity and is available at many more Forex brokers than cTrader and TradingView, it is not as user-friendly or easy to set up.

Watch our MT5 Tutorial Video

Learn more about MT5.

Find out more about our favourite MT5 brokers.

What is cTrader?

cTrader is a modern-looking and user-friendly platform with more advanced functionality than MT4 and MT5. cTrader users are also more profitable than their MetaTrader counterparts.

Developed by Spotware and released in 2011, cTrader is a trading platform popular among forex traders for its advanced features and user-friendly interface. cTrader advanced charting capabilities include 70+ technical indicators, 26 time frames, a range of chart types, and Depth of Market functionality. cTrader also has a built-in economic calendar and a wide range of advanced order types.

Like MT4 and MT5, cTrader supports automated trading through cTrader Automate, a feature for developing and backtesting trading robots called cBots. cTrader also has an integrated copy trading function called cTrader Copy, allowing traders to copy the trades of other traders.

Unfortunately, cTrader is not as widely available as MetaTrader software programs, but according to Spotware’s internal calculations, 35% more cTrader users are profitable compared to the industry average. This amazing statistic highlights why cTrader has become MetaTrader’s main competitor.

Watch out cTrader Tutorial Video

Learn more about cTrader

Find out more about our favourite cTrader brokers

What is TradingView?

TradingView has the most advanced charting functionality of all third-party trading platforms and is the most customisable. However, because it is fairly new, it is the least widely available platform.

TradingView is a charting platform and social network used by 50 million traders and investors worldwide to spot opportunities across global markets. TradingView also works with select brokers, allowing traders to trade directly from TradingView’s charting platform.

The TradingView platform offers a fully customisable experience, with 12 chart types, custom time intervals, 100,000+ community-built indicators, integrated financial analysis, and its own programming language, called PineScript, which allows traders to share their automated trading strategies.

Overall, TradingView is the most advanced, customisable, and feature-rich third-party platform available, but traders will have few brokers to choose from that offer its services.

What are Proprietary Trading Platforms?

Proprietary trading platforms are trading platforms that belong to a single broker. Most of the larger brokers have proprietary platforms. They generally work in a web browser and are designed to be intuitive and easy for beginners to learn. However, they tend to be less advanced; many do not have automated trading, for example. Some of our favourite broker platforms are AvaTrade, XTB, Skilling and IG.

Be aware that by choosing a broker’s proprietary platform rather than MT4, MT5, cTrader or TradingView, you will not be able to take the platform with you if you decide to switch brokers. So, you will lose all your specific platform knowledge and will have to start all over again with your new broker.

Learn more about Proprietary trading platforms here

What are Mobile Trading Apps?

Mobile trading apps are trading platforms that work on mobile devices, like mobile phones and tablets. Most trading platforms are available on Android and iOS devices, though they lose some functionality in the switch to the smaller screen size and emphasis on touch-screen controls.

Key Factors to Consider When Choosing a Forex Trading Platform

Regulation: Because traders generally have to use a broker to trade on a platform, choosing a broker regulated by a reputable financial authority is essential to protect your funds and ensure that you are treated fairly. Brokers regulated by authorities such as the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) of the UK tend to be reliable and trustworthy brokers.

User interface and functionality: The platform should have an easy-to-use interface with straightforward navigation, advanced charting tools, customisable indicators, and other features that suit your trading style and preferences. For example, TradingView and cTrader are more user-friendly and feature-rich than their MetaTrader counterparts, but these two platforms are only available at select brokers.

Reliability and speed: The platform should have fast order execution, low latency, and minimal downtime to ensure you can place trades quickly and efficiently. For example, a trading platform that can execute trades in under 100ms is considered a low-latency platform, but this will also depend on the broker’s ability to process trades.

Trading tools: The platform should offer a range of trading tools, including risk management tools, economic calendars, market analysis, and educational resources. More advanced trading platforms, such as cTrader, have integrated economic calendars and a trailing stop order function that operates from the server side rather than on the terminal side like MT4 and MT5. This functionality means the trailing stop will stay in place even if the terminal goes offline. Find out more about the various order types between the trading platforms here.

Security: The platform should have robust security features, including two-factor authentication, encryption, and firewalls, to protect your personal and financial information. Most trading platforms have robust security features, but this will largely depend on your broker.

Costs and fees: Consider the trading fees, spreads, and commissions associated with your broker to ensure they are reasonable and competitive. Brokers with a minimum deposit of 200 USD or less, an average commission-free spread of around 0.9 pips (EUR/USD), or a commission of 7 – 10 USD with a spread of 0.1 – 0.3 pips (EUR/USD) are considered brokers with low trading costs.

Trading Goals: When choosing a trading platform, ensure it has compatible functionality with your trading goals and style. For example, if you use Expert Advisors or automated trading, you may consider using a platform like MT4, MT5, cTrader or TradingView. However, traders who trade on stock CFDs would not choose MT4 because it does not natively offer stock CFD trading. In contrast, beginner traders may consider a user-friendly platform or one that offers copy trading functionality.

Trading Platform FAQs

What trading platform is best for Forex trading?

Our team has reviewed over 180 brokers to find those with the best Forex trading platforms. Traders with different priorities and experience levels prefer different trading platforms. These are our favourite brokers with the best trading platforms.

- AvaTrade – Best Platform Risk Management

- FXTM – Best Copy Trading Platform

- HFM – MT4/MT5 Platforms + Premium Trader Tools

Which Currency Pairs can I trade on a trading platform?

Some Forex trading platforms have more currency pairs to trade than others, and this depends on which Forex broker your trading platform is connected to. Beginners should start with the major currency pairs, like the EUR/USD or the USD/JPY, as they are less volatile and are less expensive to trade than minor currency pairs and exotic currency pairs.

Learn more about currency pairs and how to trade them

What other assets can I trade on a Trading Platform?

Other assets you can trade are stocks, commodities, cryptocurrencies, indices and government bonds. Which assets are available on your trading platform will depend on your broker, and some brokers offer many more types of assets. Some of the rare assets include interest rates, ETFs and futures.

What are technical indicators?

Technical indicators are used to identify trends, measure market volatility, and assess the strength and direction of current market conditions. Technical indicators can be divided into two categories: trend-following and oscillators. Trend-following indicators are used to identify the direction of a trend, while oscillators identify reversals in the trend.

Common types of technical indicators include moving averages, momentum indicators, relative strength index (RSI), Bollinger Bands, MACD (moving average convergence divergence), stochastics, Ichimoku clouds, Fibonacci retracements and more. Technical traders use indicators to determine potential entry and exit points for trades.

What are trading tools?

Trading tools are any technology or application traders use to help them make trading decisions, track trades, and manage their portfolios. These tools can range from basic charting software to complex AI-driven algorithms for high-frequency trading. Trading tools typically provide access to market data, news feeds, and real-time risk management tools.

Many trading tools also come with specialized features such as portfolio analysis, order execution, backtesting of strategies, portfolio optimisation, and access to multiple exchanges in one place. In addition to these more practical applications, they may include educational resources such as videos and tutorials that help traders gain insight into the markets they trade.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our State of the Market Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.