-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

In the world of Forex trading and other types of investment, brokers typically earn money in one of two ways: through spreads and commissions. In this video, Alison discusses what spreads are and how they affect profitability, and the benefits of trading with a broker with low spreads.

Transcript

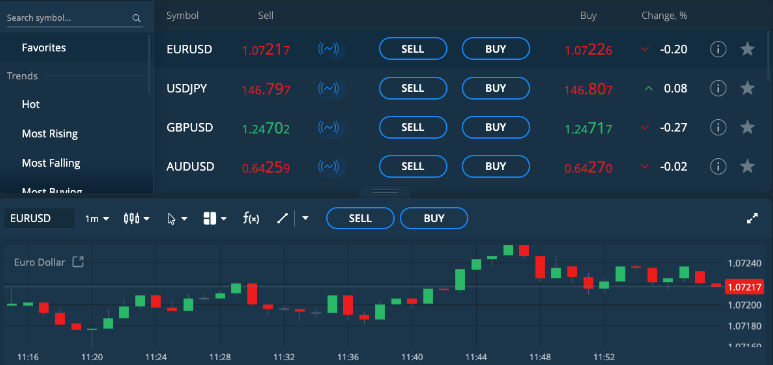

A spread is the difference between the buying price and the selling price of a financial instrument. For example, as you can see below: The bid or sell price is 1.07217, while the ask or buy price is 1.07226. So this means if you bought the EUR/USD for the quoted bid price, and immediately closed your position, (which is effectively selling the asset), you would pay the spread, which in this case is 0.9 pips. So you would make a loss of 0.9 pips because you will have to pay the broker to open that position. So, the spread is essentially the broker’s profit on each trade a trader makes.

In order to understand the spread, you will have to understand pips, which you can learn more about here.

What is a commission?

A commission is a fee that a broker charges for its services. This is generally a flat fee per trade or a percentage of the total volume of the trade.

So, brokers who offer low spreads essentially offer to execute trades at prices very close to the market price. And this means that the bid and ask prices are very similar. This is very often attractive to traders because it reduces their trading costs.

The spread charged by brokers tends to be very small on the surface of things, often amounting to just a few pips or a fraction of a percentage of the value of the currency unit. However, spreads can quickly add up to significant operating costs for traders, especially if they are trading on margin or if they open up large forex trading positions.

Example:

Here you can see the EUR/USD has a spread of 0.8 pips – if you subtract the sell price from the buy price. And if I trade a volume or open a position size of 0.01 lots – which is a contract value of 1000 Euro, then I will pay a commission of 0.07 EUR or around 0.075 USD. This seems like a very small amount, and it is, depending on how many times you open an close your trades.

If you open a position with the same broker and the same spread of 1 lot, which is equivalent to 100,000 EUR, you will pay a much higher spread. This means that to open and close a position, no matter how much profit you make or how much you lose, you will pay the broker around 100 x that amount, because you have opened a position size 100 x bigger. As you can see, the spread increased from 0.8 pips to 0.9 pips between the two times the positions were opened.

How are spreads determined?

Spreads, however, are not only determined by how much a broker charges for trading a particular instrument, but also by the available liquidity in the market.

During normal market conditions, the difference between a particular instrument’s bid and the ask price remains generally stable, with the most popular, heavily traded currency pairs usually having the lowest spreads.

These include pairs such as the EUR/USD, GBP/USD and USD/JPY, while an emerging-market currency paired with the USD, such as the USD/ZAR, will have a much wider spread. In other words, the more liquid the market, the narrower the spread. That’s because the high volumes traded generate lots of profit for brokers, even though the profit margins might be narrow.

If, however, there is a significant imbalance between supply and demand, spreads may widen considerably. The same is also observed during illiquidity or when a major market event occurs, such as a change in interest rates.

Example:

In this dollar-yen chart, you’ll notice a gap of around 80 pips from the market close on Friday until the market open on Monday. This was in the wake of comments from Bank of Japan (BOJ) Governor that increased expectations the central bank could shift away from its negative interest rate policy. It was also a result of the fact that US inflation data due to be released at the end of the week. To cope with the huge sell-off of the USD/JPY, the broker increases the spread or the difference between the bid and ask price to cope with the huge volatility and possible illiquidity.

As a trader, you’d be right to look for a broker that offers low spreads. After all, spreads play a significant part in the profitability of your trades and if you’re like every other trader out there, the smallest difference in price matters a lot to you.

Example:

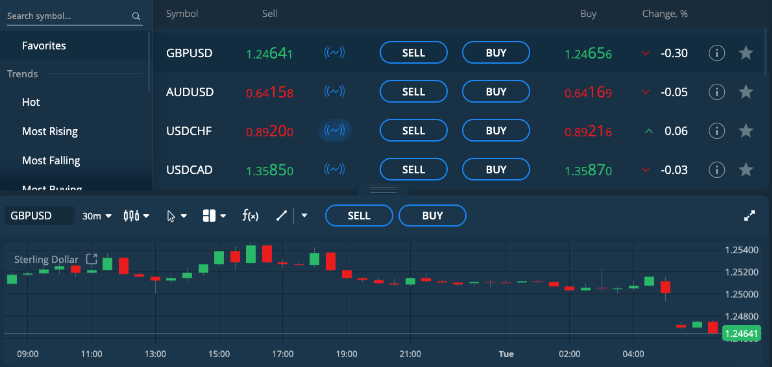

Let’s say you wish to trade GBP/USD. Your broker is offering a bid price of 1.24641 and an ask price of 1.24656.The spread here is therefore 1,5 pips.

If you were to buy GBP/USD and attempt to sell it straight back to the broker, you would immediately be in the red, due to this 1.5-pip difference. You would, therefore need GBP/USD to appreciate by at least 2 pips before you could sell and make any profit. Low pips mean lower barriers to profitability.

If you are concerned about shoring up your bottom line and ensuring that you pay a fair market price for all of your forex trades, you need low-spread brokers. If you are looking for low-spread brokers, we have a list of trustworthy brokers with some of the lowest spreads in the industry.