-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

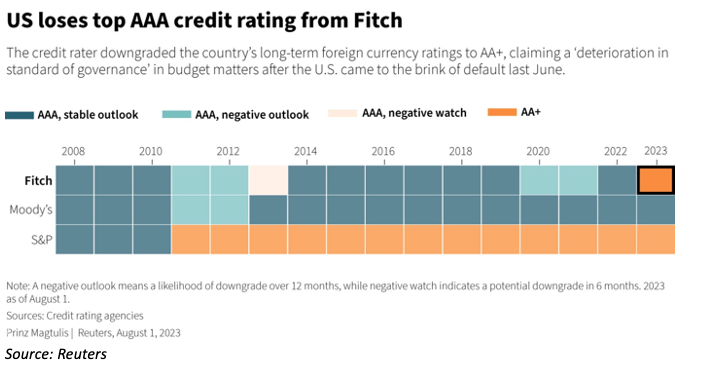

In a surprise aftermarket move on Tuesday, August 1st 2023, Fitch – one of the major debt rating agencies – downgraded US government debt to AA+ from AAA. There is precedent here, with S&P downgrading US debt to AA+ in 2011, a rating that has remained unchanged ever since.

In notes accompanying the downgrade decision, Fitch cited “expected fiscal deterioration over the next three years” and “a high and growing general government debt burden”. Fitch also pointed to an “erosion of governance… that has manifested in repeated debt limit stand-offs and last-minute resolutions”.

In the immediate aftermath of the downgrade, the EUR/USD climbed sharply, before pulling back to hold on to gains around the 1.1000 mark. Global stock markets also slipped. The Stoxx Europe 600 index fell 1.3 per cent on 2nd August, extending losses from the previous session. Futures contracts tracking the US S&P 500 fell 0.8 per cent, following a small decline on Wall Street on Tuesday, while the Nasdaq 100 was down 1.1 per cent ahead of the New York open.

The broader DXY index, which tracks the USD against a basket of currencies, held firm on Wednesday morning, falling only 0.1%.

Impact on the debt market will be limited, with most investors mandated to hold AAA government debt also specifically required to maintain US government debt holdings regardless of its rating.

Unsurprisingly, US Treasury Secretary Janet Yellen disagreed with Fitch’s reasons for the downgrade, calling the decision “arbitrary and based on outdated data”. However, apart from the political concerns, Fitch also cited the growing US debt burden. Fitch expects the US deficit to rise to 6.3 per cent of GDP in 2023, up from 3.7 per cent in 2022. Fitch also projected a recession in the fourth quarter of 2023 and first quarter of 2024.

Following the release of the mixed US Jobless Claims and Unit Labor cost data, the US dollar holds the renewed upside ahead of the ISM Services PMI later. The US Employment Change for July, measuring the change in the number of people that are employed in the US, came in at 324k, significantly higher than the predicted 189k. This data may influence the Fed to consider an additional interest rate hike before the end of the year. This data, in addition to safe-haven buying of the greenback following the downgrade by Fitch, has lent significant support to the dollar.

However, concerns over the wider health of the US economy have been mounting for some time. Credit card borrowing is now at all-time highs and a high percentage of the workforce is living paycheck-to-paycheck. While not a concern for day traders, positional traders and those with a longer view may want to keep Fitch’s wider concerns in mind.

EUR/USD Technical Analysis

The bears have been gaining significant ground over the last 2 weeks, with a sharp downturn yesterday, fuelled by robust labour market data and safe-haven buying following the downgrade to AA+ status.

According to the daily chart below, the Relative Strength Index (RSI) is sloping below the midline, putting it in negative territory. The MACD (Moving Average Convergence Divergence) confirms the bearish trend, with a long line of strong red bars. However, the EUR/USD is still trading in the 1.0940 price zone, having remained relatively unchanged since its opening this morning.

The 100 SMA (yellow) remains a firm dynamic support at the 1.09300 level, which if not broken, could see a retracement up to the psychological 1.1000 handle. But, looking at the longer view, a positive move for the EUR/USD remains likely while above the 200-day SMA (pink).

After a busy week, the NFP tomorrow will likely create some more decisive moves for the pair.

Source: XTB xStation5