-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

The European Central Bank (ECB) held interest rates at 4.5% today, in a widely expected decision. While there was no expectation for a cut in rates, markets were hopeful for more dovish forward guidance from the ECB and its President, Christine Lagarde.

But in her comments after the decision, Christine Lagarde reiterated the ECB’s stance – laid out on the sidelines of the World Economic Forum earlier this month – that it was too soon to start talking about rate cuts: “Consensus at the table was that it was premature to talk about rate cuts.”

Almost simultaneously, the fourth-quarter GDP numbers for the US were released, coming in at 3.3% – much higher than the 2% forecast.

But a raft of other US economic data released at the same time were more mixed. Initial and continuing jobless claims both increased, and inflation for final prices of goods and services came in much lower than expected.

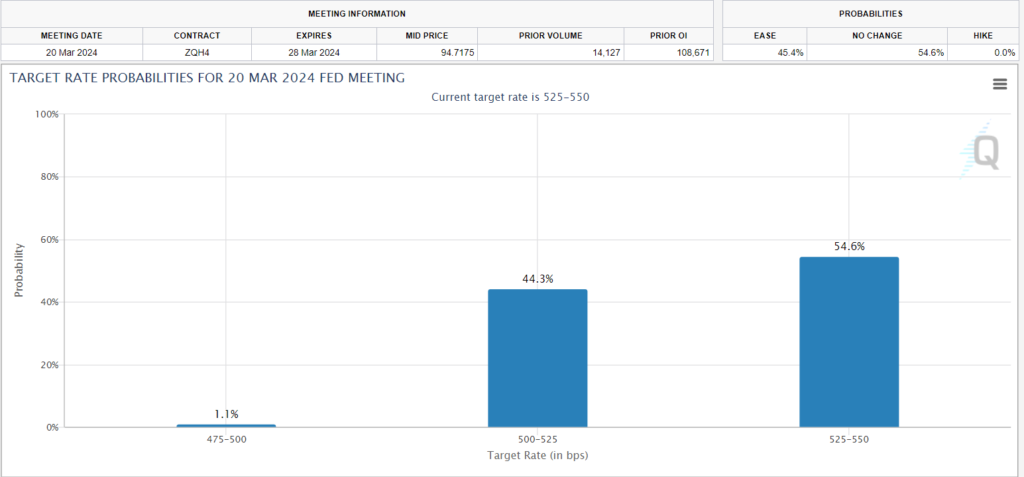

While high GDP growth would be expected to support the USD, given that it increases the likelihood of the Federal Reserve keeping rates elevated, higher unemployment and lower inflation present an argument for cutting rates sooner. The tension and uncertainty can be seen in the latest probabilities for a March rate cut according to the CME FedWatch tool.

The probability has been hovering around 70% over the last few weeks but has now fallen to 44% as the US economy continues to grow despite elevated borrowing costs. Hawkish commentary from policymakers has not helped either, as it has become increasingly clear that the Fed is concerned about the inflationary implications of the recent corporate debt binge.

Markets barely responded to the barrage of trans-Atlantic news, reflecting the uncertain picture the data presented. The EUR/USD and the DXY remained relatively flat, though the EUR/USD slipped later in the trading day as Lagarde spoke.

So, we have two contrasting pictures on either side of the Atlantic:

The eurozone economy will continue to drift for much of 2024, with the ECB expecting GDP growth of 0.8% in 2024, a tepid upgrade on the 2023´s 0.6%. Inflation will continue to fall, but the ECB is fully expected to keep interest rates tight enough to subdue economic growth for much of the year.

The picture for the US looks very different. With the US economy continuing to outperform expectations, corporations and markets are becoming increasingly frustrated with the Fed’s hawkish stance – which they see as an artificial damper on a strong recovery. Their argument would have been bolstered today following the poor employment data, and I fully anticipate more pressure on the FOMC to lower interest rates. The Fed is unlikely to cave though – their concerns are very real, and inflation remains a threat – so expect DXY and major pair volatility to continue as long as the conflict between reality and market expectations remains.

Technical Analysis

Having faced strong resistance in the 1.0920 – 1.0930 area, where the 26-period EMA (blue), the 50-period EMA (pink), and the 50% Fibonacci Retracement level (from the July – September 2023 downtrend) are located on the daily chart, the price continued to range. Since the price broke through the upward channel (green) on the 16th of January 2024 after Christopher Waller warned against rushing to cut rates, it has not yet recovered.

For traders, the mixed data out of the US and the ECB’s expected rate holds have been largely unhelpful. With the lack of fundamental data to support any strong moves, traders will be carefully monitoring the technicals.

Any acceleration to the upside past the resistance of the 1.0920/1.0935 levels could see the price rally to the 1.100 psychological level. Downside moves past the 200-day SMA (orange) at the 1.0831 level could see a move towards 1.0770, followed by 1.0710.