-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Over the last few months, traders’ attention has been on the EUR/USD and the DXY more generally as the ECB and the Fed have battled to control inflation via tightening monetary policy.

But, the UK, through the Bank of England (BoE), has been waging its own war against inflation – though with different results than the EU and the USA. While inflation is now cooling rapidly in both the US and the EU, it has remained stubbornly sticky in the UK. The GBP/USD has been particularly volatile compared to other major pairs, with the hawkish tone and monetary response from the Bank of England pushing the GBP higher.

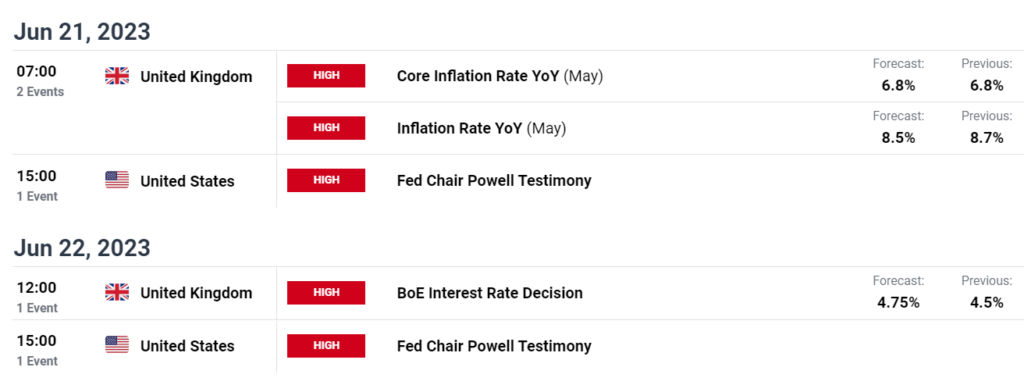

This week, we have a few important dates for the pair, starting on Wednesday, 21st June, when we get the UK’s inflation data released. This is followed up on Thursday, 22nd June, when the BoE will release its interest rate decision. Inflation is expected to remain high, diverging from the Eurozone and USA, where inflation is falling rapidly. The market has priced in a BoE 25bps rate rise, regardless of the inflation data.

More interestingly, markets expect a 1.25% rise in UK interest rates over the rest of 2023 – a very different story than we are seeing in the USA and the EU. This will support the GBP in the medium term, though with recessionary fears still very much on the table, such an extreme rise in interest rates may prove optimistic.

Robust job data and surprising economic resilience in the UK have also helped support the GBP, and if the BoE can avoid a recession while continuing to raise interest rates, we can expect the current trend of GBP strength to continue.

Also this week, but on the other side of the Atlantic, Jay Powell, Chairman of the Federal Reserve, will be testifying to the Senate Banking Committee. There is a noticeable difference between his tone and current market expectations for monetary policy, and we can expect some market volatility surrounding his testimony, especially if he doubles down on his hawkish rhetoric from last week.