-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

The bullish momentum supporting the EUR/USD has faded, along with the extreme volatility we have seen in the pair over the last few months. The trigger for the pause seems to have been the raft of data from the US showing that the Fed’s year-long assault on inflation finally seems to be working, crucially without tipping the US economy into recession.

With inflation falling and the US economy cooling without collapsing, the impetus has been on Eurozone data to drive the pair. But there has been little movement on the European side, either. Eurozone inflation data, released on Wednesday, 19th July, came in around market expectations, and the market has already priced in another 25bps rate hike by the ECB next week. It looks like the EU may fall into recession, but any downturn is unlikely to be deep or long-lasting.

With no fundamental support for the bulls or the bears and the pair already trading at 16-month highs, the EUR/USD has been moving sideways for the best part of a week.

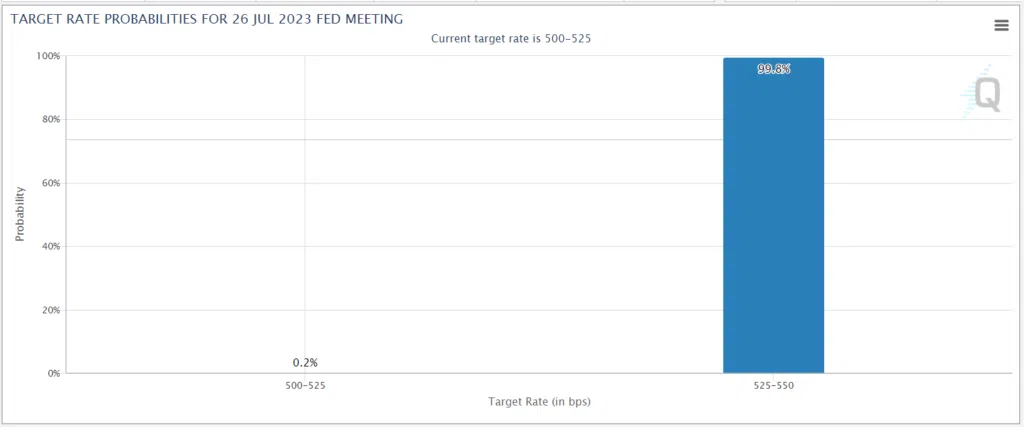

The next major fundamental shift could be the Fed’s interest rate decision next week. But with a 25bps rise almost a certainty, I wouldn’t hold your breath.

The danger here for traders is unpredictable events. The EUR/USD´s current stability is fragile, and the pair is especially vulnerable to any major geopolitical change. But, for now, things are quiet. But as with all ranging currency pairs, things look more interesting from a technical standpoint.

EUR/USD Technical Overview

The last two weeks saw a huge upswing of the EUR/USD largely due to the weakness of the USD following lower-than-expected headline and core inflation data. However, over the last five days, the EUR/USD has consolidated and hovered around the 61.8% Fibonacci retracement (the 1.2750 resistance level) of the longer-term decline that started in January 2021 until September 2022. The current support level is around 1.1175, which has not been breached since the steep incline in the first half of the month.

There was a squeeze of the Bollinger Bands a week before US inflation data was released, indicating a breakout, and the bands are still wide, indicating possible future volatility. The RSI (red) indicates that the pair is in oversold territory, but the price remains firmly above all three moving averages (orange – 50 EMA, pink – 100 SMA and yellow 200 SMA).

Overall, it’s not clear which direction the price may go – but if support is breached at the 1.1175 level, it could see a bullish move towards the psychological support of 1.1000 at the 50% Fibonacci retracement. Alternatively, a topside breakout could see a breach of the 1.1300 level, heading towards 1.1500, the highest the EUR/USD has been since February 2022.