-

Best Forex Brokers

Our top-rated Forex brokers

-

NGN Trading Accounts

Save on conversion fees

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ECN Brokers

Trade with Direct Market Access

-

No-Deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Lowest Spreads Brokers

Tight spreads and low commissions

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Nigeria

-

MetaTrader 5 Brokers

The top MT5 brokers in Nigeria

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Nigeria

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Last Updated On Nov 28, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Exness

Exness is a popular global broker with nine different trading accounts and one of the lowest-cost Cent Accounts in the industry. Nigerians are onboarded through its company in Seychelles. This means that your money will be held overseas, and any disputes you have with Exness won’t be governed by Nigerian laws.

Exness offers support for MT4, MT5, and its user-friendly proprietary platform, Exness Terminal, available as a desktop and mobile app. In addition to fundamental and technical market analysis tools, including FXStreet News and Trading Central, Exness also hosts expert-led educational seminars in various regions as well as live webinars.

| 🏦 Min. Deposit | USD 3 |

| 🛡️ Regulated By | FSCA, CMA, B.V.I FSC, FSC |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | Unlimited:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, Exness Terminal |

| 💱 Instruments | Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Highly competitive spreads and low trading costs (7 USD per lot).

- Extensive selection of trading instruments and over 100 Forex pairs

- User-friendly trading platforms: MT4 MT5 and Exness Terminal.

- Minimum deposit requirement of only 3 USD

- Offers copy trading options

Cons

- Extreme leverage

- Limited range of share CFDs

Is Exness Safe?

Exness’ exit from the UK/EU retail market following the regulators’ restrictions intended to safeguard traders does not speak highly of the group. However, Exness is regulated by multiple second-tier authorities, including the Kenyan CMA, the South African FSCA and the Seychelles FSA.

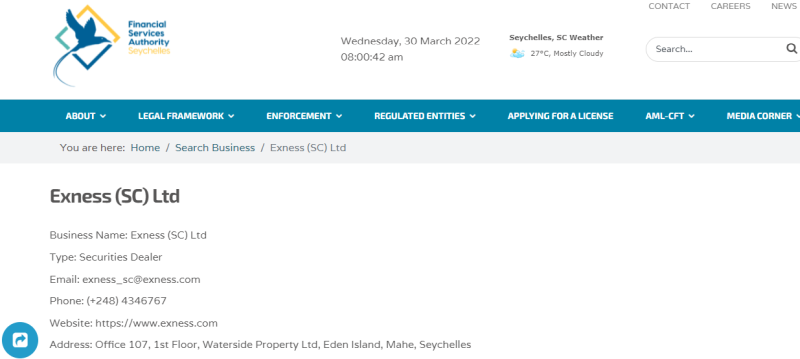

FSA Regulation: Nigerian traders will be trading with Exness (SC) Ltd, authorised and regulated by the FSA in Seychelles.

Safety Features: Although Nigerians will be onboarded through the FSA Seychelles – traditionally a weaker regulator – we still consider Exness a safe broker to trade with. Firstly, it holds licences from several regulators worldwide. Secondly, it provides all clients with negative balance protection, meaning traders cannot lose more than their initial deposit. Finally, it is regularly audited by Deloitte, one of the world’s most reputable audit firms.

We confirmed each of the licences and regulations on the regulator’s online register:

Exness’s Trading Instruments

We were impressed by the large number of Forex pairs available at Exness. It also offers a decent crypto lineup and 2000:1 maximum leverage. However, the maximum number of stock CFDs available to trade is 97, which is disappointing. This number will vary according to the account the trader is using.

A large number of Forex pairs: With over 100 Forex pairs on its books, Exness offers one of the largest sets in the industry, including majors, minors, and exotics.

High Leverage: Exness has 34 cryptocurrencies to trade at 400:1 leverage. This isn’t the largest selection in the world, but it is a higher level of leverage for crypto trading than any other broker. The high leverage on the crypto CFDs is potentially risky given the volatility of these assets, and traders are advised to use lower levels than the maximum offered.

![]()

![]()

Forex pairs: Exness offers a much larger range of Forex pairs and much higher leverage than other brokers.

Cryptocurrencies: Exness offers a good range of crypto crosses, mostly Bitcoin, including BTC/ZAR and BTC/XAU. Also available are Ethereum, Litecoin, Ripple, and other less popular cryptocurrencies. The maximum leverage is 400:1, which is much higher than other brokers. Traders should know that trading with high leverage on such volatile assets is risky. It can lead to increased profits but also to big losses.

Metals: Exness offers silver and gold crosses with the AUD, EUR, GBP, and USD, as well as palladium and platinum futures. Maximum leverage is 1:2000 on gold but falls to 1:100 on platinum and palladium futures.

Energies: Exness offers spot contracts on both Brent and WTI oil. This is a slightly limited range compared to other brokers.

Indices: Exness offers CFDs on various international indices, including the NASDAQ, S&P500, FTSE100, DAX30, and the Nikkei. This is a common range of indices compared to other brokers.

Shares: Exness offers a smaller range of share CFDs than other brokers. When trading stocks, leverage is fixed at 1:20 except when a stock company’s financial reports are announced, where there is a decrease in leverage to 1:5, to protect traders from possible market price gaps.

Exness’ Accounts and Trading Costs

Exness offers 9 accounts, which is many more than other brokers. Some accounts are suitable for beginners, while others may appeal to more experienced traders.

Trading Fees: We opened and tested all of Exness’s accounts and found that its trading costs are slightly higher than average on its Standard accounts but significantly lower than average on its Pro accounts.

![]()

![]()

As you can see from the table above, trading costs are lower than average across all three of the Standard Accounts – most good brokers’ entry-level accounts have a trading cost of 9 USD per lot of EUR/USD traded. However, with no real minimum deposit requirements to speak of, these are very good accounts for beginner traders. The fees are particularly low on the six Pro accounts, with trading costs of only 6 – 7 USD per lot of EUR/USD traded.

MT4 support is available on all account types, but MT5/Exness web trader support is slightly restricted – see below for details:

Standard Cent Account (MT4 only) – With a variable minimum deposit (depending on the payment system), micro-lots unlocked and a spread as low as 0.3 pips, this is a great account for new Forex traders who want to learn without too much risk. However, as you can see below, spreads are closer to 1 pip on this account.

You will only be able to trade Forex and metals with this account and the MT5/Exness web trader trading platforms are not supported.

Standard Account (MT4/MT5/Exness web trader) – This account also comes with a variable minimum deposit (depending on the payment system) and trading conditions are broadly similar to the Cent Account, but you will have access to MT5/Exness web trader and more assets, including cryptocurrencies and indices.

Raw Spread Account (MT4/MT5/Exness web trader) – This account has a minimum deposit of 500 USD, a 3.50 USD (7 USD round turn) commission, and spreads that start at 0 pips on the EUR/USD. It is available on MT5/Exness web trader.

Pro Account (MT4/MT5/Exness web trader) – The single instant execution account offered by Exness, this account has a minimum deposit of 500 USD and spreads that start at 0.1 pips (EUR/USD) but guarantees no slippage. It is available on MT5/Exness web trader.

Zero Account (MT4 or MT5) – This account has a minimum deposit of 500 USD and commission starting at 0.2 USD, but traders are guaranteed 0 pip (EUR/USD) spreads for 95% of the trading day on 30 pairs. It is also available on MT5/Exness web trader.

All accounts feature market execution except the Pro Account, which provides instant execution for all CFDs except cryptocurrencies. All accounts are available as swap-free Islamic accounts for Muslim traders.

Exness’s Deposits and Withdrawals

We were impressed by Exness’s wide range of deposit and withdrawal methods. Additionally, we were pleased that deposits and withdrawals are instant and have no fees, making funding your account (and withdrawing profits) much cheaper and easier than most other brokers.

In line with Anti-Money Laundering policies, deposits and withdrawals at Exness cannot be made to/from third-party accounts, and all non-profit funds are returned to the original deposit source.

Accepted Currencies: When we opened our account at Exness, we were given the choice of more than 40 base currencies, including NGN. Most other brokers only offer 5 – 10 base currencies, so Exness really shines on this front. This is a huge advantage for Nigerians, who will likely have bank accounts denominated in NGN and will have the option of avoiding conversion fees.

Funds can be deposited in several ways, including credit cards, bank wire transfers, Neteller, Skrill, and a few other online payment systems, through Exness’s payment portal.

We tested deposits and withdrawals in NGN via a Visa credit card and found that our deposit was processed almost instantly, and it took 24 hours for our withdrawal to arrive in our account. This withdrawal time is faster than the industry average.

Opening an Account with Exness

We found the account-opening and verification process at Exness easy. Our account was verified within 48 hours, which is longer than average, but we were able to make a deposit and start trading while we waited.

It took us about 5 minutes to open an account at Exness. We could immediately deposit funds into our accounts and start trading, but our accounts were only ready for trading after two days.

From the Exness homepage, we clicked on the New Account tab where we were directed to register an account.

- Exness’ registration form required us to fill in our country of residence and email address and choose a password. This allowed us access to Exness Personal Area.

- By default, a real trading account and a demo trading account (both for MT5) are created in the new Personal Area; but it is possible to open new trading accounts.

- From our new Personal Area, we clicked on the Open New Account in the ‘My Accounts’ area.

- We chose from the available trading account types, and whether we wanted to open a real or demo account. We then chose between the MT4 and MT5 platforms, set our max leverage, and chose our account currency (note that this cannot be changed for this trading account once set): Finally, we created a nickname for this trading account, set the trading account password and clicked Create an Account.

- Our new trading account appeared in the ‘My Accounts’ tab.

- While you can deposit up to 2000 USD and trade for 30 days without account verification, it is recommended that you verify your identity as soon as possible. Note that deposits with cryptocurrency or bank cards require a fully verified profile.

Exness will also need: - Your Economic Profile – this is a short questionnaire detailing your economic knowledge and financial background.

- Proof of Identification – Exness accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

- Once verification is complete, traders will be able to deposit up to 50,000 USD. If your Exness account is not verified within 30 days of account registration, deposits, transfers, and trading functions will no longer be available.

Our documents were checked by the verifications department and were approved in around 40 hours, which is longer than the industry average.

Exness’s Research and Trading Tools

Exness offers comprehensive research in both video and written formats, but we were disappointed that Exness offers no trading tools, apart from a standard VPS service and Trading Central’s indicator service. Most other brokers offer a range of tools to assist traders with finding opportunities and making analyses.

Research

Most of the research content is presented in the analysis blog, which is updated every few days with thoughtful insight on recent and future events across a range of CFD markets. Dow Jones news is also available to clients with MT4 accounts, while FXStreet is available on Exness’ web trader platform.

Of course, a standard economic calendar is available, but Exness also presents a daily video of upcoming market events to watch out for with a brief technical analysis. This is provided by Trading Central and is quite useful for new traders.

Trading Central (TC) Indicator

One of our favourite indicators, the TC Indicator is a multilingual and customizable plugin that superimposes Trading Central’s technical analysis strategies, forecast, commentary, and key levels (support/resistance/targets/stop pivots) onto MT4 live charts for most tradable instruments.

VPS Service

Exness offers a free VPS service for all traders who deposit at least 500 USD. A Virtual Private Server (VPS) is a remote terminal solution that benefits from reduced latency and downtime, as it is unaffected by power cuts or computer crashes. Even when the trading terminal is closed, the Exness VPS will keep trading.

![]()

![]()

Exness Educational Content

We found that Exness’s education is adequate for new traders but not as good as the best brokers in this space.

Exness Academy: The majority of Exness’ educational assistance for new traders can be found in the Exness Academy. Trading education is split into two different experience levels, which is perfect for a new trader wishing to improve their understanding of the Forex market gradually.

Video Tutorials: Video education is available in five languages, including English, Arabic, Thai, Indonesian and Vietnamese. These bite-sized videos are great explainers of important concepts that all Forex traders need to understand.

![]()

![]()

Exness’s Customer Support

Exness customer service is available in English 24 hours a day and over the weekend. However, they couldn’t assist us with some of our queries.

Exness’ dedicated support specialists speak 16 languages. Support is available 24 hours a day, 7 days a week in English, Chinese, Thai, Vietnamese and Swahili. Most brokers only offer 24/5 customer service, which is a bonus for many traders.

Other contact forms include live chat, call-back service, phone, and emails. Support is also provided through the Exness help centre, frequently updated with detailed articles covering everything from trading guides to funding FAQs.

For the purposes of the review, we tested the live chat service and email. Our email is yet to be answered. We found the live chat agents were polite and responsive but unable to answer some of our questions:

Safety and Industry Recognition

Regulation: Founded in 2008, Exness Group is a relatively new Forex and CFD broker. It has grown rapidly since its inception, has over 500,000 clients worldwide, and is regulated by eight national authorities. In 2012, Exness obtained a licence from the Cyprus Securities and Exchange Commission (CySEC) and moved its headquarters to Cyprus. In 2018, Exness shut down its retail business in the EU and UK in response to tighter restrictions on retail CFD brokers – though it does retain a business-to-business (B2B) service in both regions. See below for more details:

- Exness (SC) Ltd is a Securities Dealer authorised and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025.

- Exness ZA (PTY) Ltd is authorised by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Exness B.V. is a Securities Intermediary authorised and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Exness (VG) Ltd is authorised by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business licence number SIBA/L/20/1133.

- Exness (MU) Ltd is authorised by the Financial Services Commission (FSC) in Mauritius with registration number 176967 and Investment Dealer (Full Service Dealer, Excluding Underwriting) licence number GB20025294.

- Tadenex Limited is authorised by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

- B2B Only: Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12.

- B2B Only: Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729.

Awards

Exness regularly receives industry awards and recently won:

- 2023 Global Broker of the Year – Forex Traders Summit Dubai 2023

- 2023 Most Innovative Broker of the Year – Forex Traders Summit Dubai 2023

- 2023 Best & Most Trusted Multi-Asset Broker – Smart Vision Investment Expo 2023

- 2023 Broker of the Year – Jordan Financial Expo and Awards

We consider Exness a safe broker to trade with, though with some misgivings. Its retreat from the EU/UK market after tougher regulation is a concern, but Exness is still regulated in multiple regions.

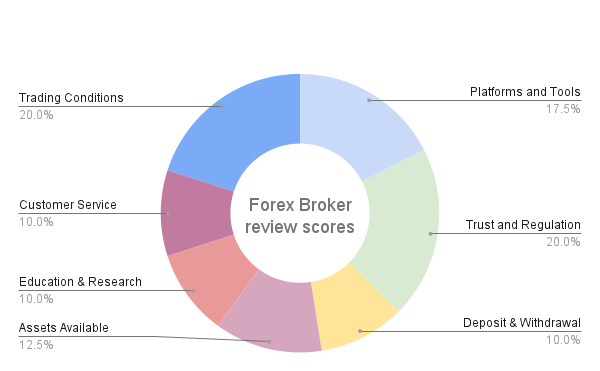

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

Exness Disclaimer and Risk Warning

Trading Forex is risky, and Exness would like you to know that: “Our services relate to complex derivative products which are traded outside an exchange. These products come with a high risk of losing money rapidly due to leverage and thus are not appropriate for all investors.”

Final Word

Exness is a decent all-round broker for most traders, whether beginner or more experienced. It offers support for MT4, MT5, and its own proprietary platform, 24/7 customer service, low-cost entry-level accounts, and good trading conditions on the Pro Accounts. However, Exness offers high levels of leverage to traders, which in combination with low minimum deposits, could increase their risk of an account wipeout.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Exness stacks up against other brokers.